Question: Instructions Note: This problem is for the 2 0 2 2 tax year. On November 1 , 2 0 1 1 , Janet Morton and

Instructions

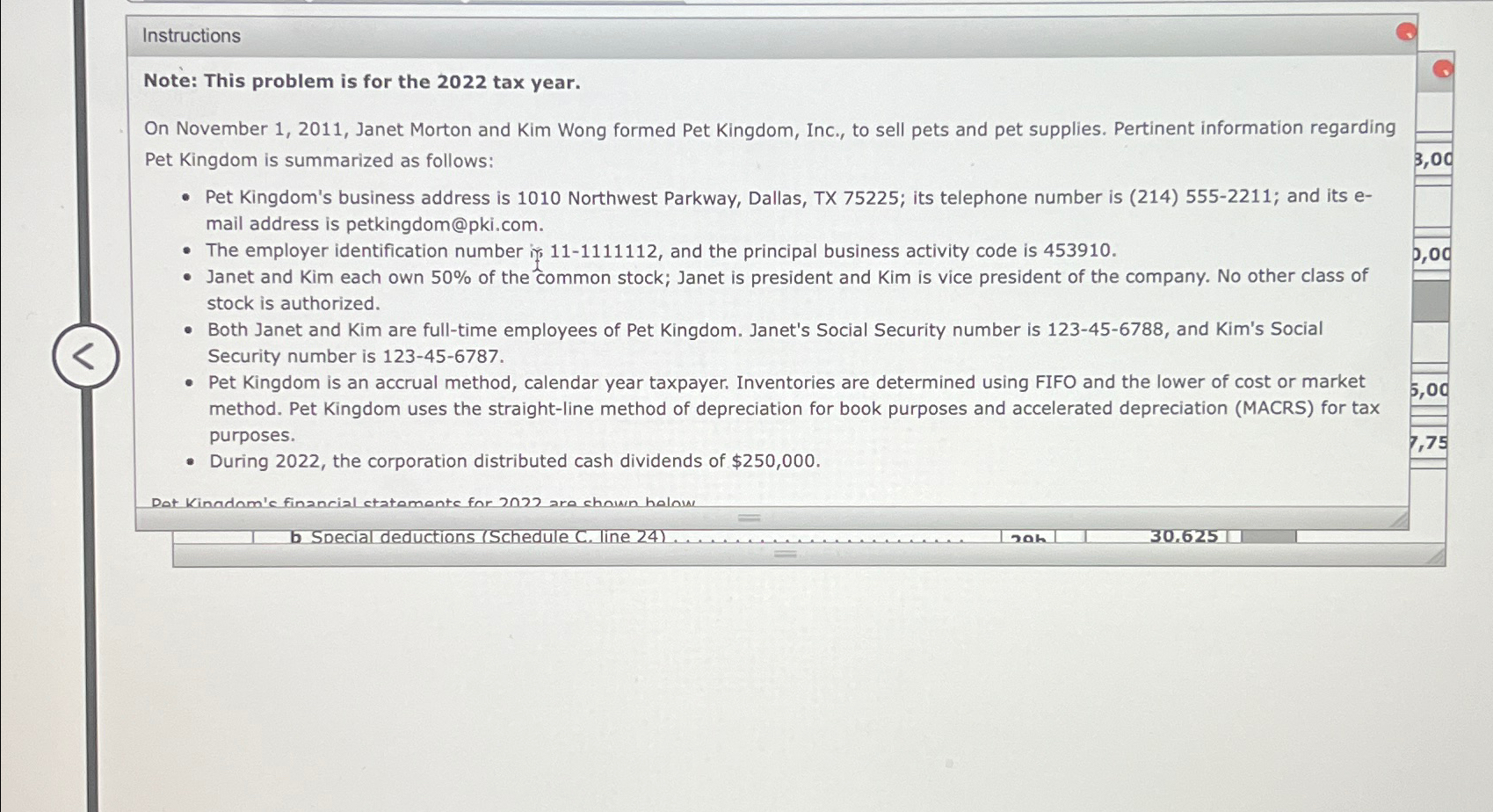

Note: This problem is for the tax year.

On November Janet Morton and Kim Wong formed Pet Kingdom, Inc., to sell pets and pet supplies. Pertinent information regarding Pet Kingdom is summarized as follows:

Pet Kingdom's business address is Northwest Parkway, Dallas, TX ; its telephone number is ; and its email address is

petkingdom@pki.com.

The employer identification number if and the principal business activity code is

Janet and Kim each own of the common stock; Janet is president and Kim is vice president of the company. No other class of stock is authorized.

Both Janet and Kim are fulltime employees of Pet Kingdom. Janet's Social Security number is and Kim's Social Security number is

Pet Kingdom is an accrual method, calendar year taxpayer. Inventories are determined using FIFO and the lower of cost or market method. Pet Kingdom uses the straightline method of depreciation for book purposes and accelerated depreciation MACRS for tax purposes.

During the corporation distributed cash dividends of $

Dot Kinadom'c financial ctatomonte for aro chowin holow

b Special deductions Schedule C line

rah

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock