Question: Instructions Note: This problem is for the 2020 tax year. David R. and Ella M. Cole (ages 39 and 38, respectively) are husband and wife

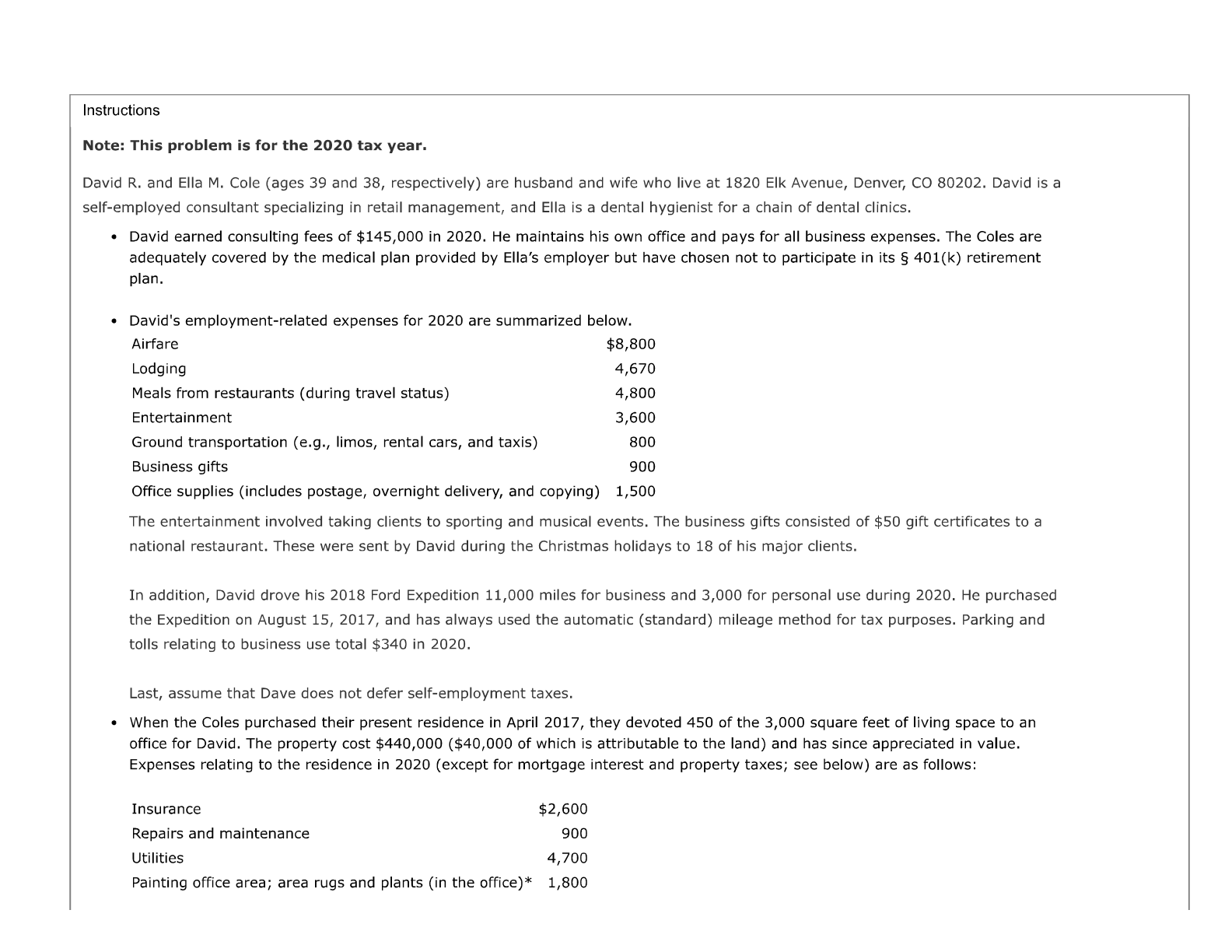

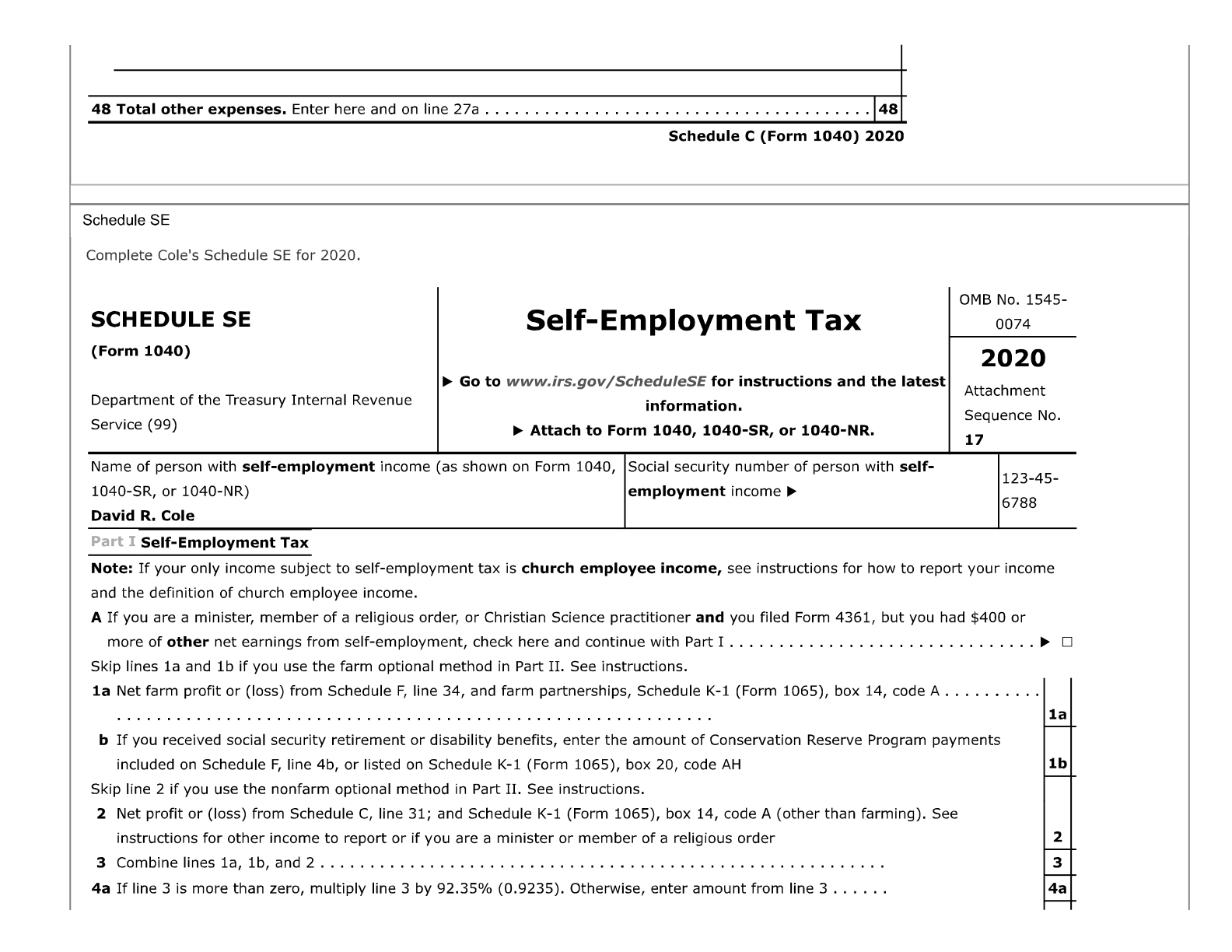

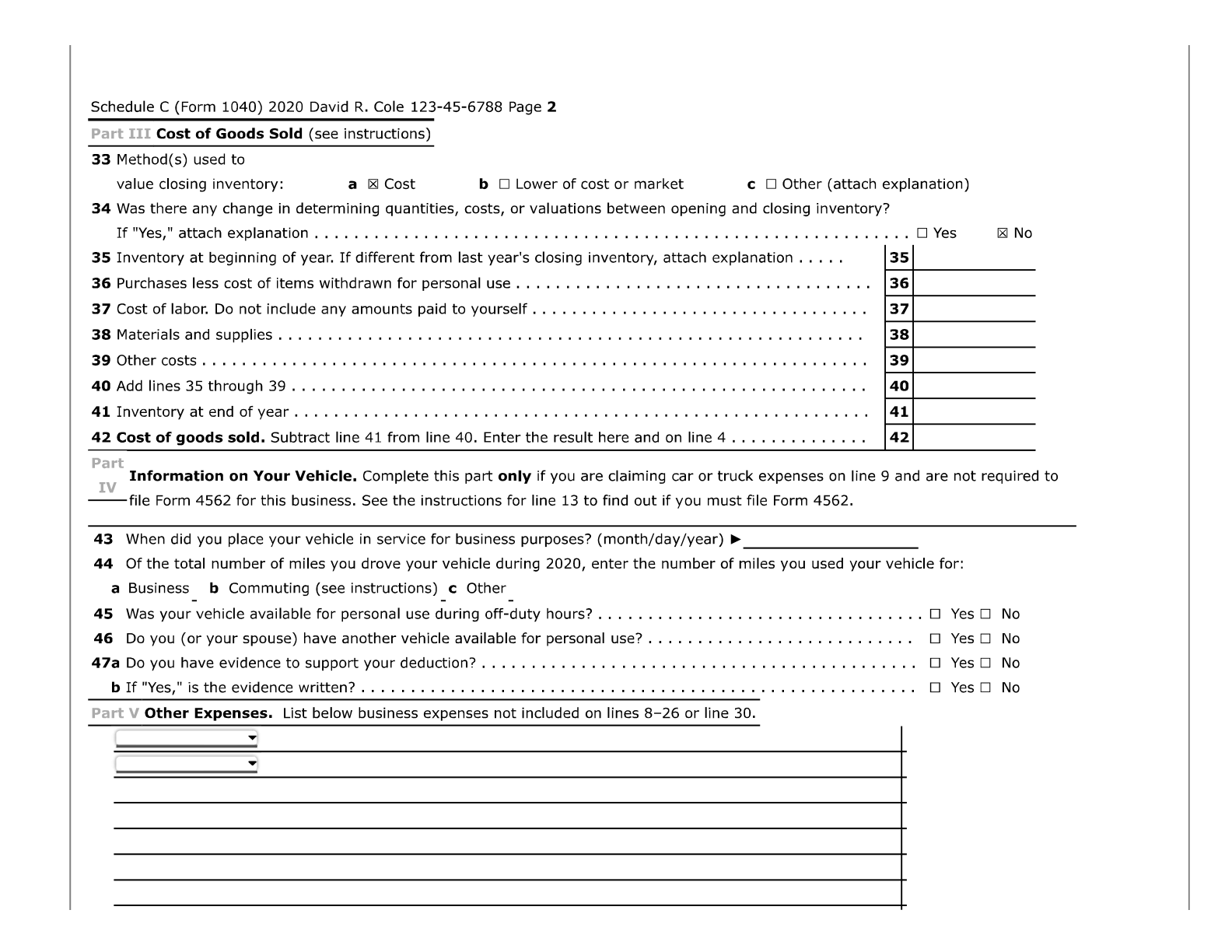

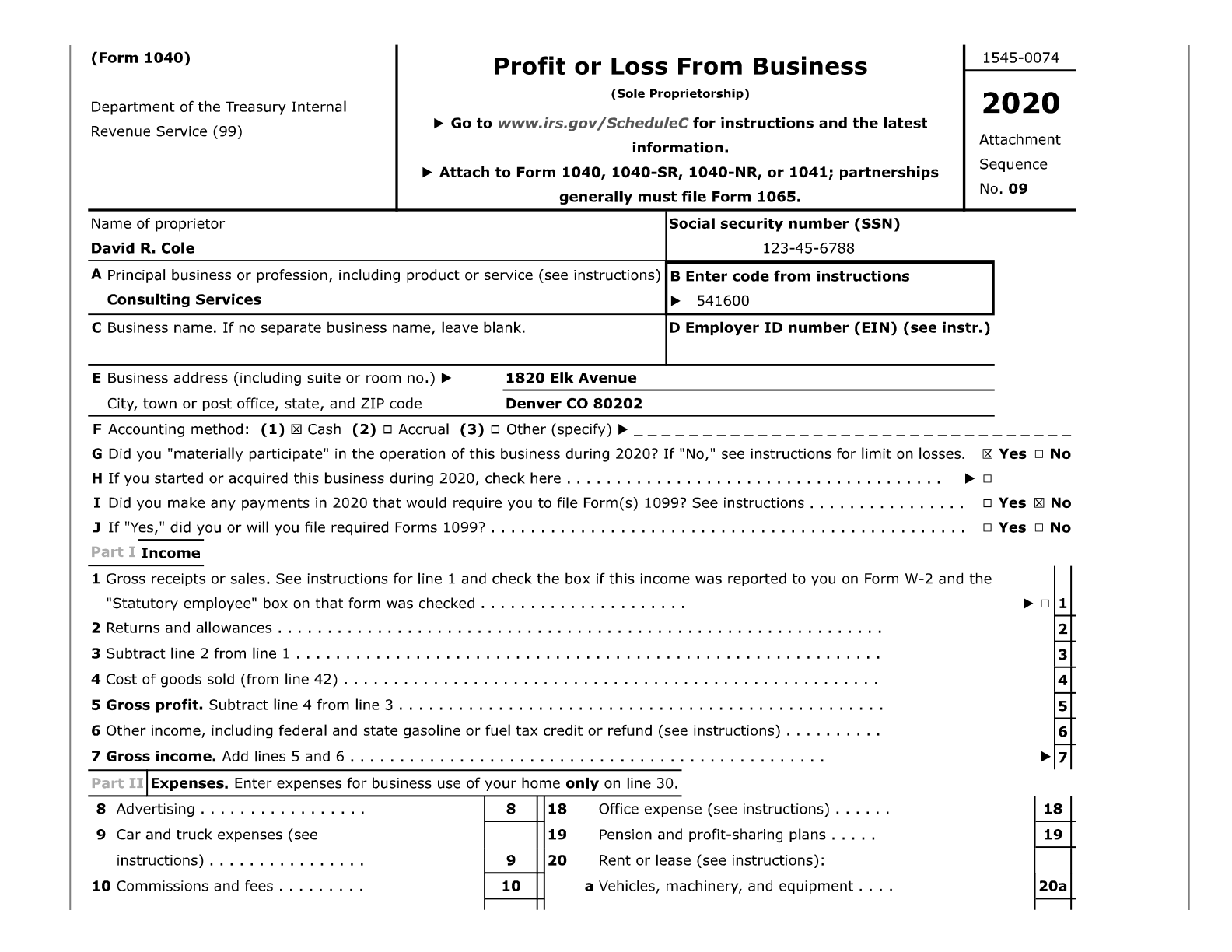

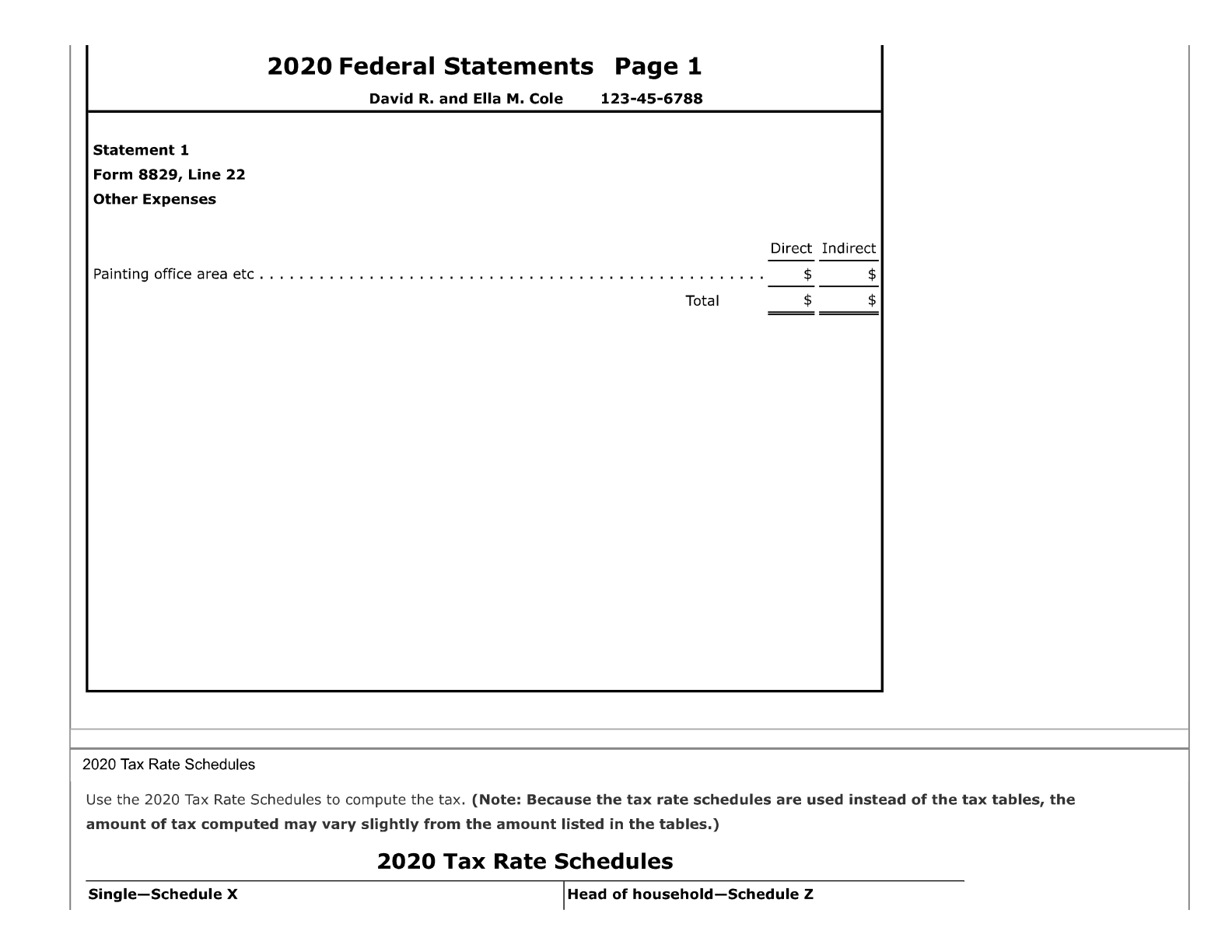

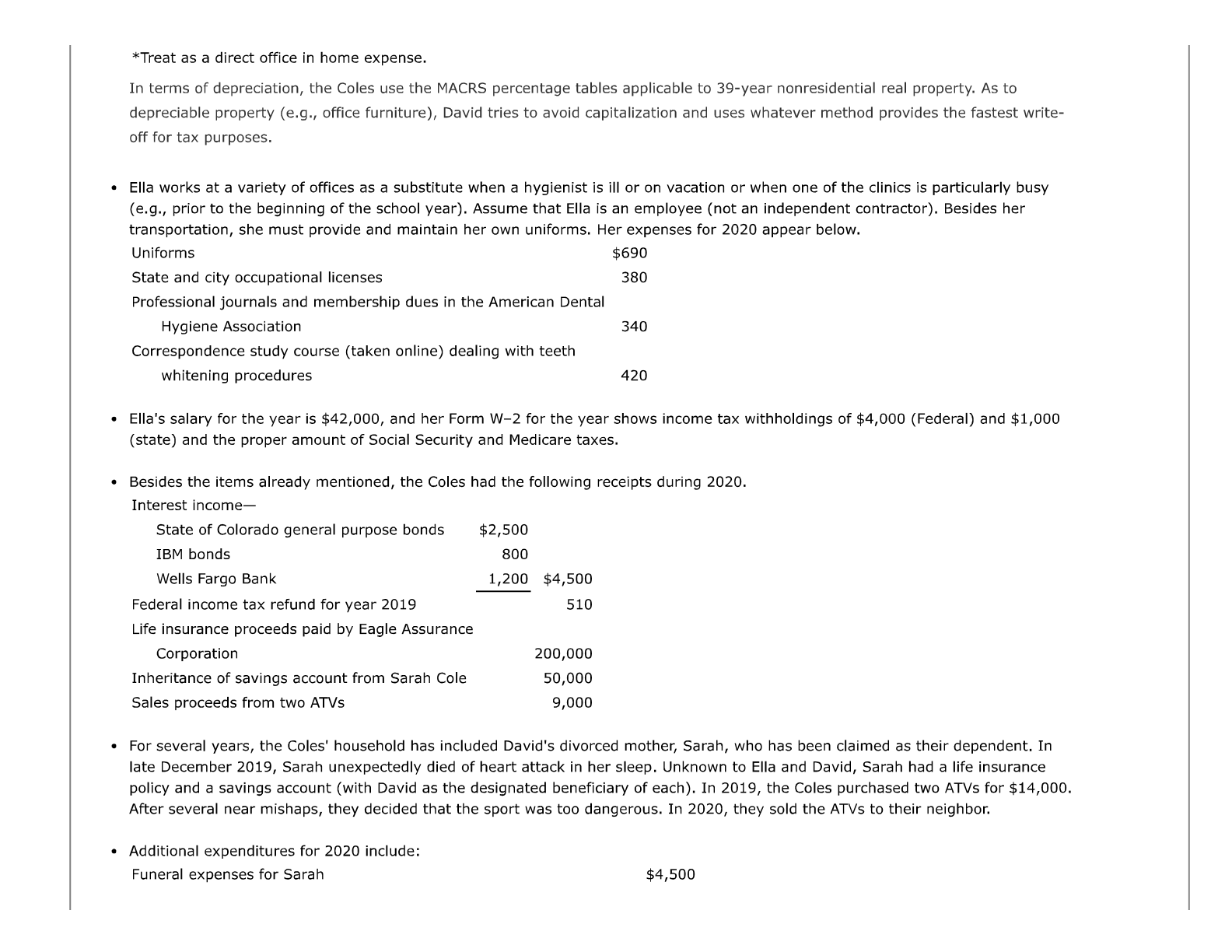

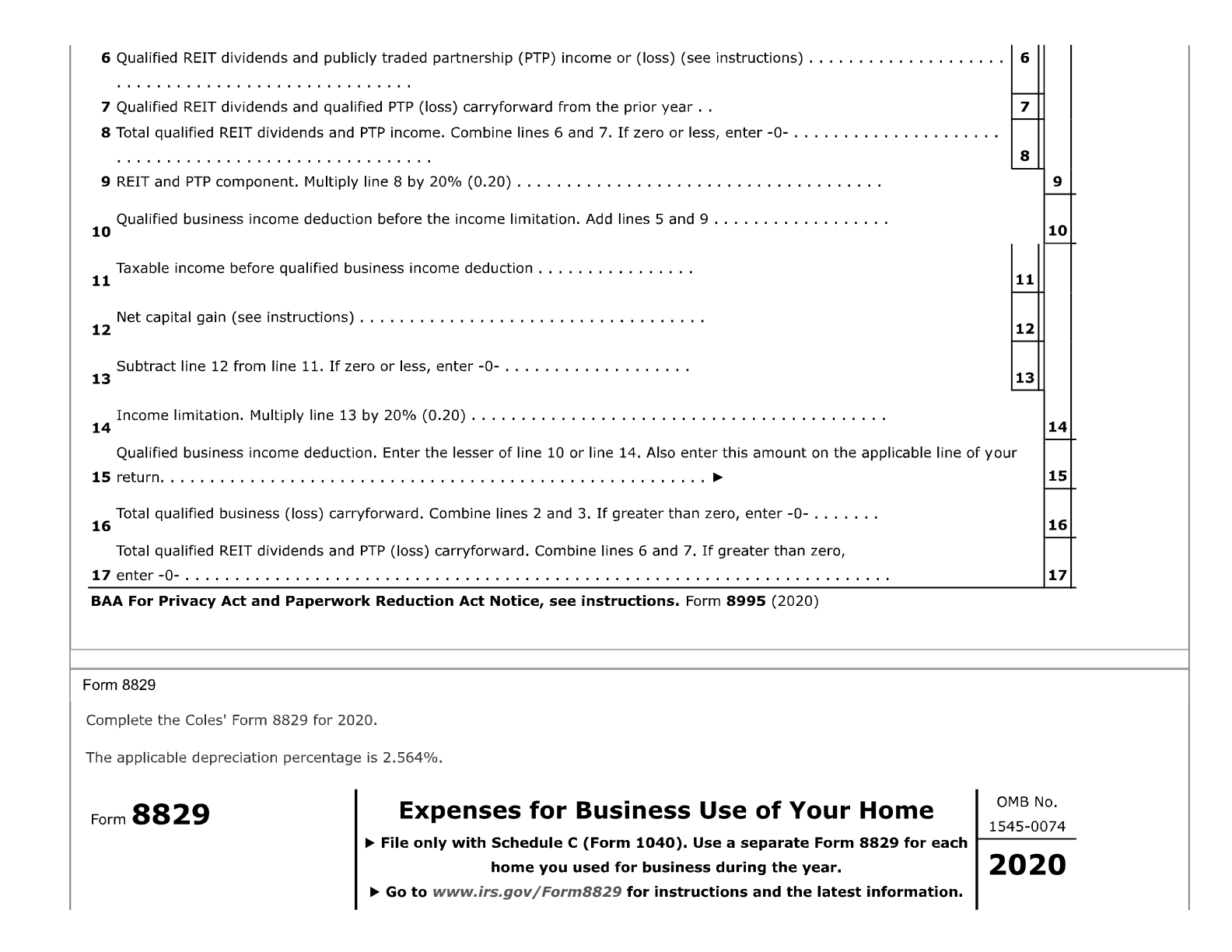

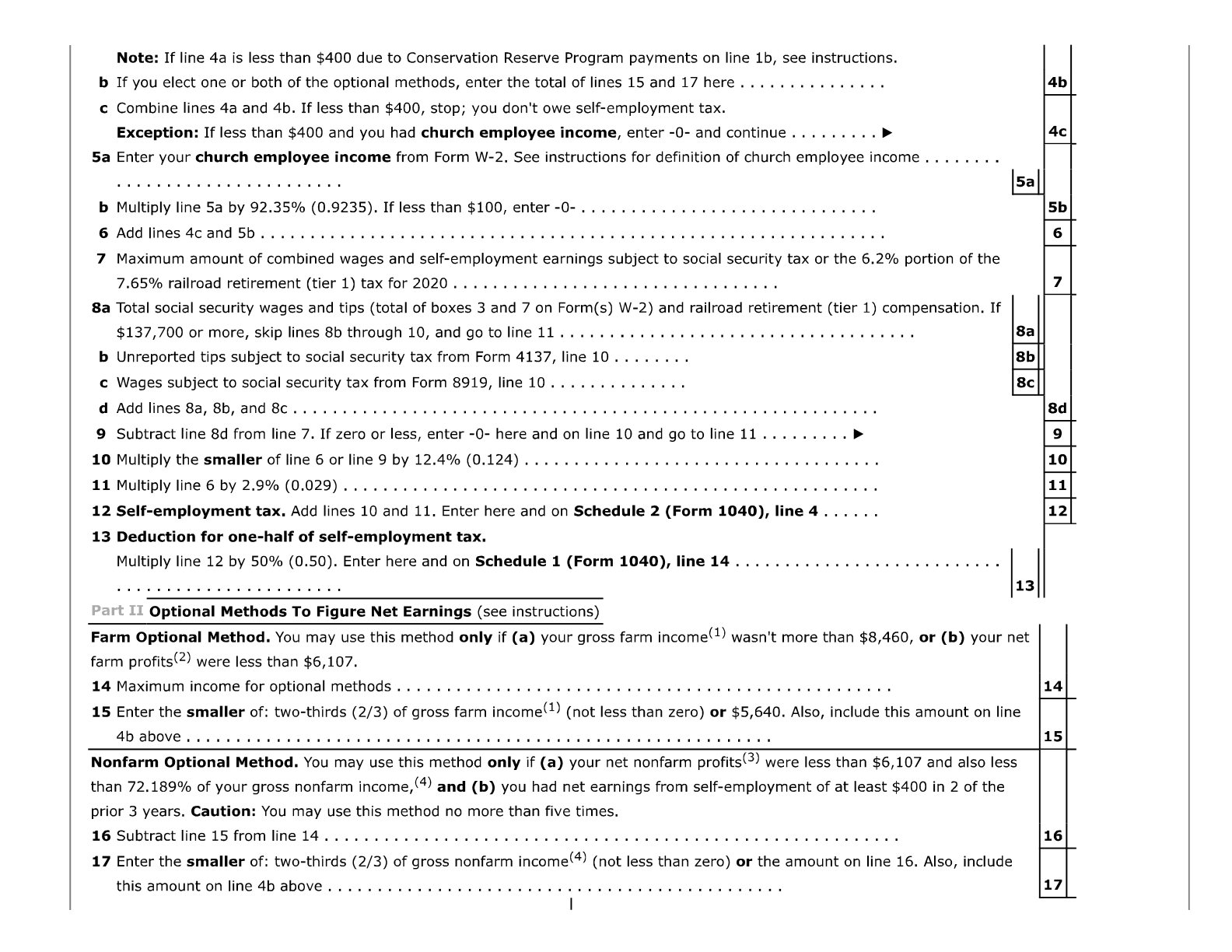

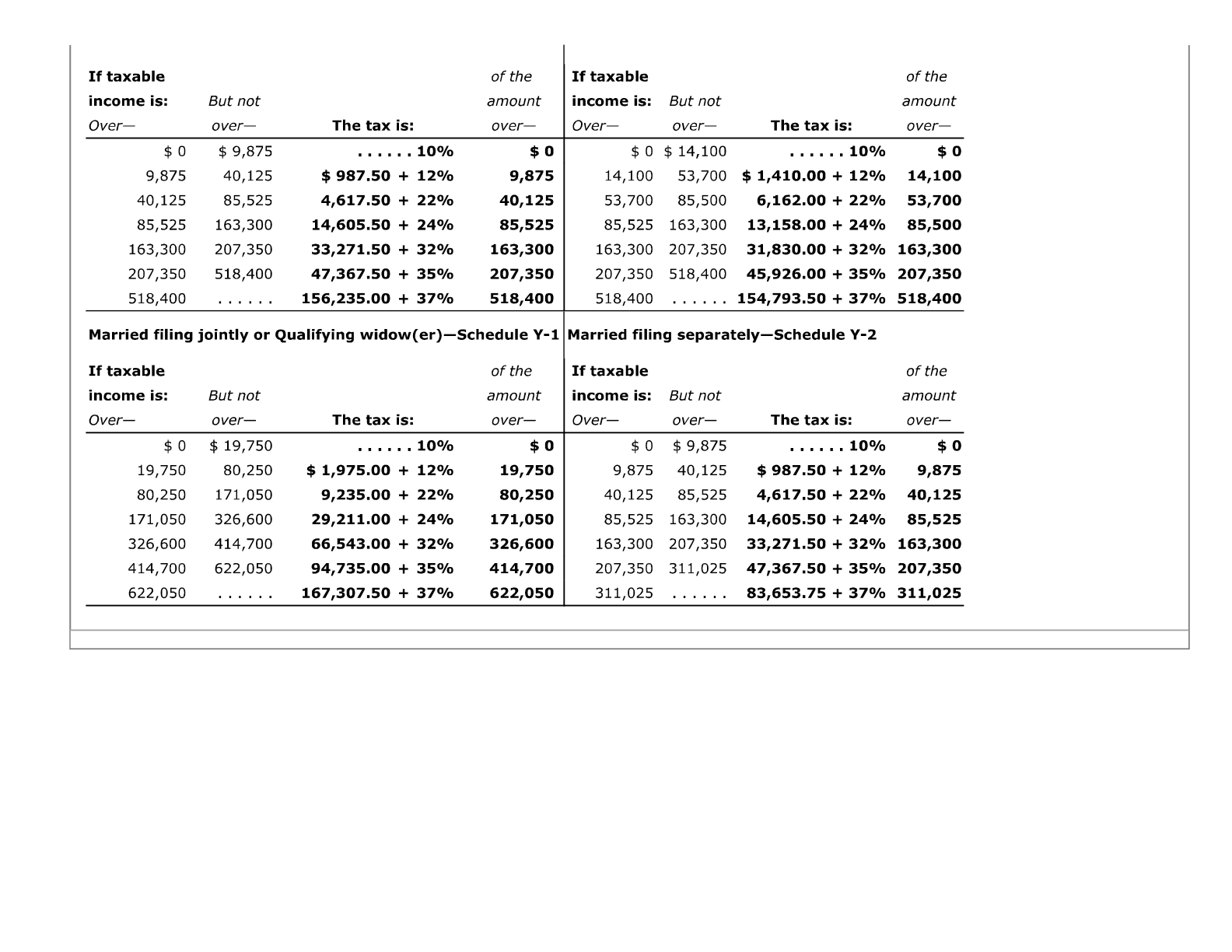

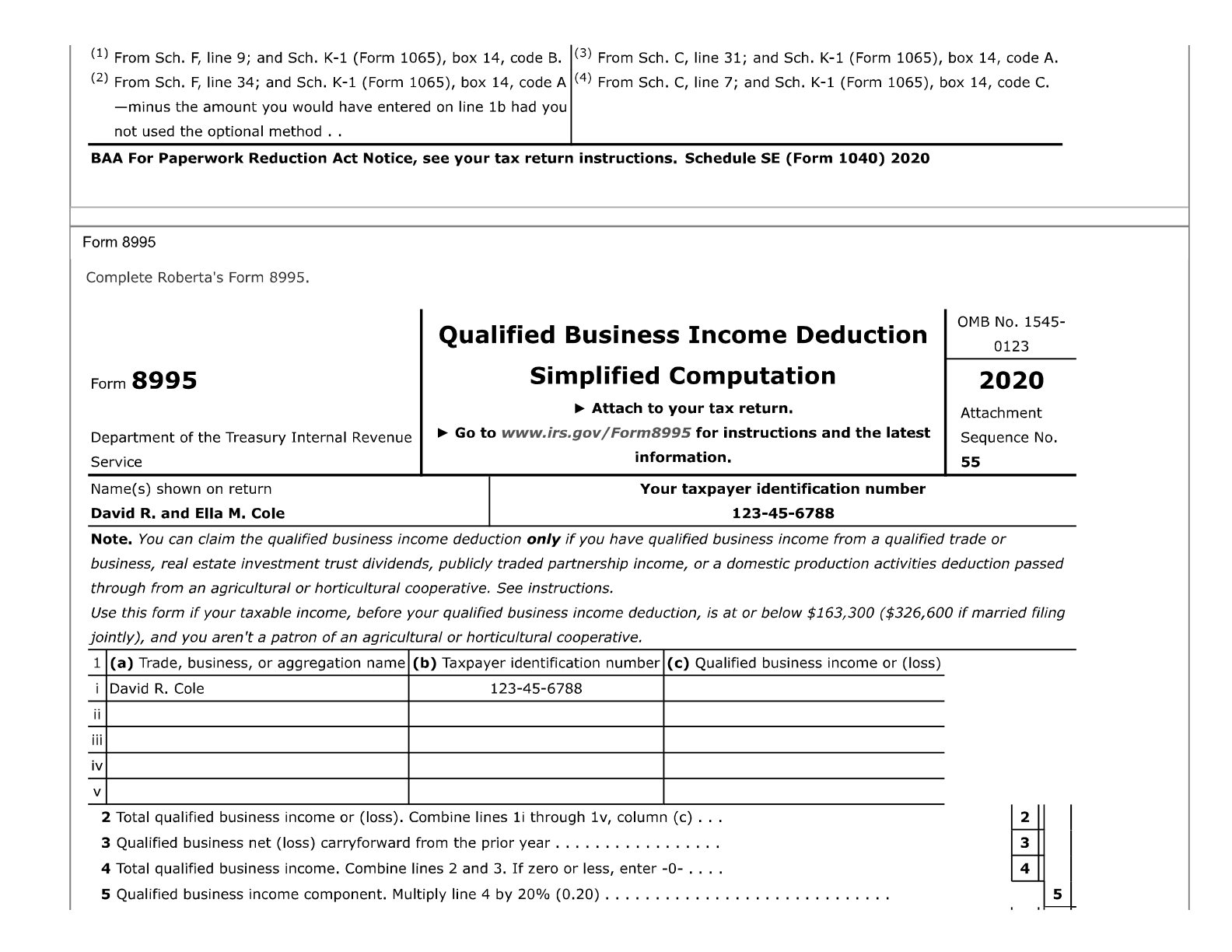

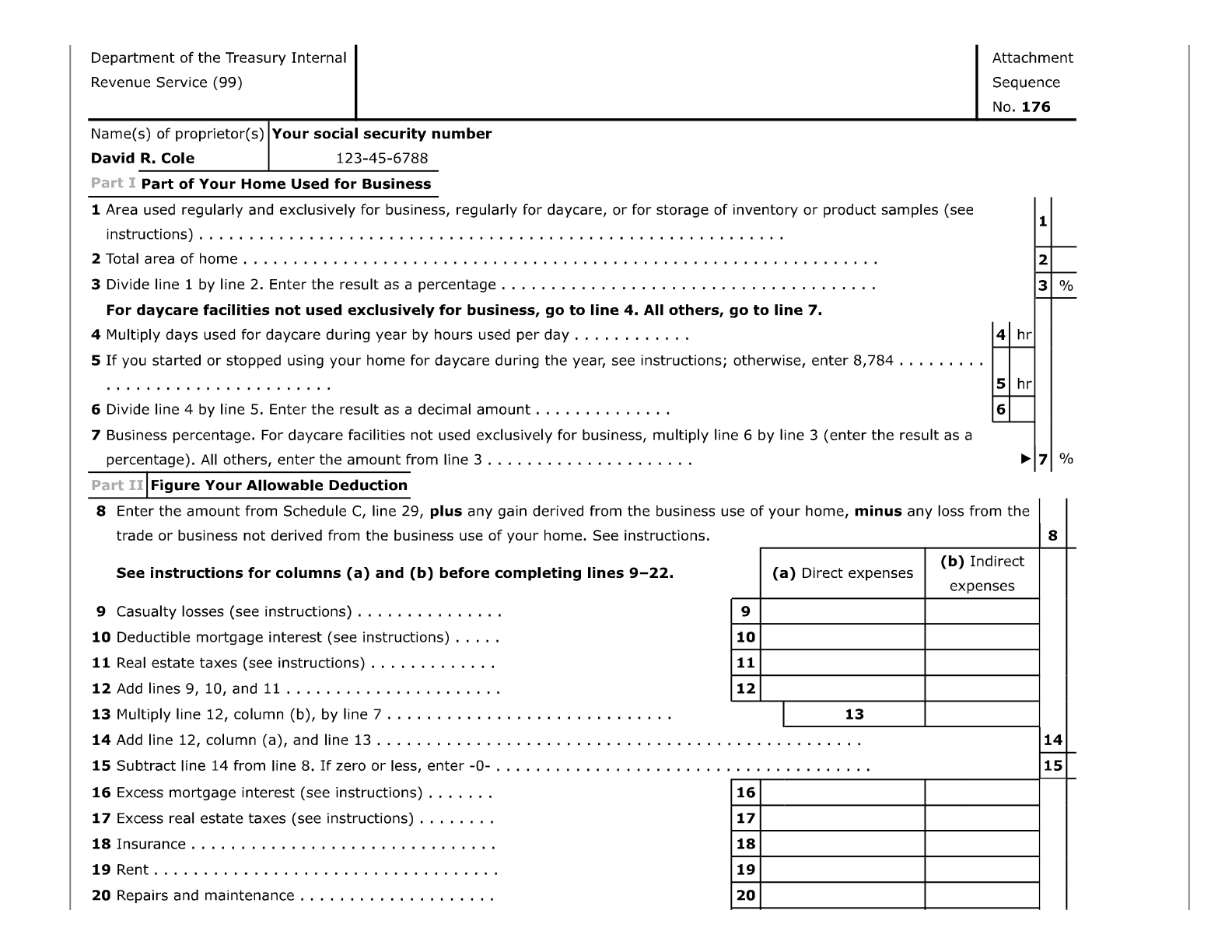

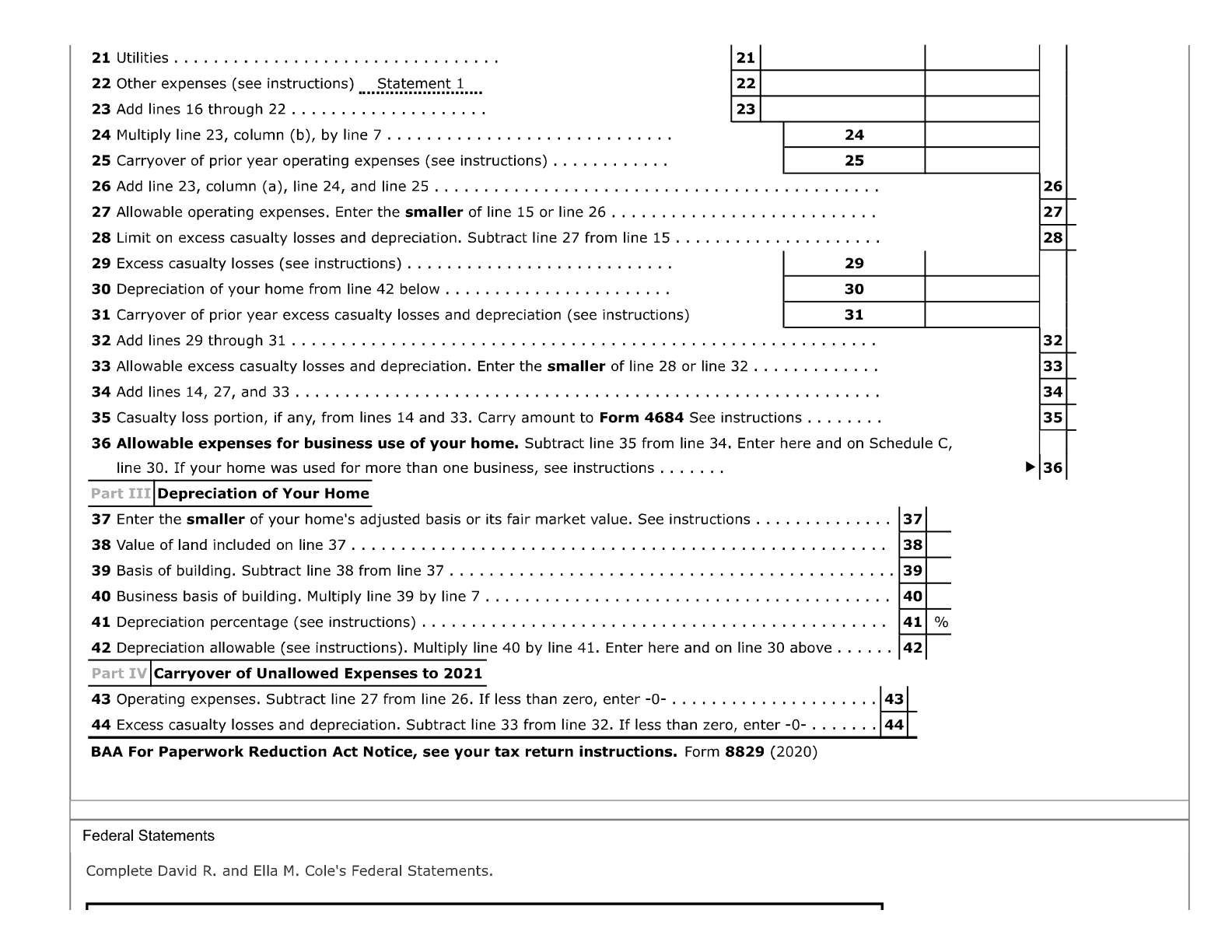

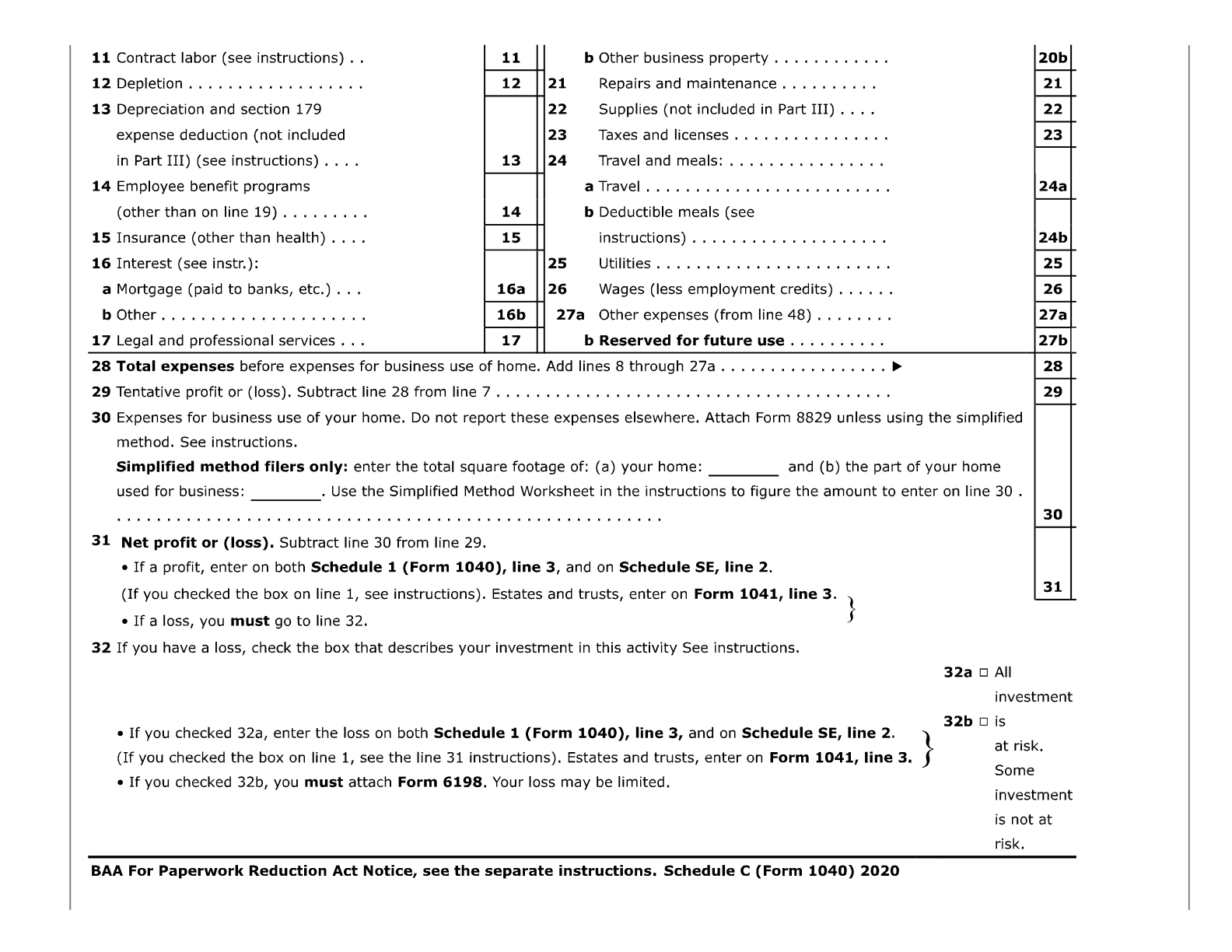

Instructions Note: This problem is for the 2020 tax year. David R. and Ella M. Cole (ages 39 and 38, respectively) are husband and wife who live at 1820 Elk Avenue, Denver, CO 80202. David is a self-employed consultant specializing in retail management, and Ella is a dental hygienist for a chain of dental clinics. . David earned consulting fees of $145,000 in 2020. He maintains his own office and pays for all business expenses. The Coles are adequately covered by the medical plan provided by Ella's employer but have chosen not to participate in its 401(k) retirement plan. . David's employment-related expenses for 2020 are summarized below. Airfare $8,800 Lodging 4,670 Meals from restaurants (during travel status) 4,800 Entertainment 3,600 Ground transportation (e.g., limos, rental cars, and taxis) 800 Business gifts 900 Ofce supplies (includes postage, overnight delivery, and copying) 1,500 The entertainment involved taking clients to sporting and musical events. The business gifts con5isted of $50 gift certificates to a national restaurant. These were sent by David during the Christmas holidays to 18 of his major clients. In addition, David drove his 2018 Ford Expedition 11,000 miles for business and 3,000 for personal use during 2020. He purchased the Expedition on August 15, 2017, and has always used the automatic (standard) mileage method for tax purposes. Parking and tolls relating to business use total $340 in 2020. Last, assume that Dave does not defer self-employment taxes. 0 when the Coles purchased their present residence in April 2017, they devoted 450 of the 3,000 square feet of living space to an office for David. The property cost $440,000 ($40,000 of which is attributable to the land) and has since appreciated in value. Expenses relating to the residence in 2020 (except for mortgage interest and property taxes; see below) are as follows: Insurance $2,600 Repairs and maintenance 900 Utilities 4,700 Painting office area; area rugs and plants (in the office)* 1,800 48 Total other expenses. Enter here and on line 27a ....................................... Schedule C (Form 1040) 2020 Schedule SE Complete Cole's Schedule SE for 2020. OMB No. 1545- SCHEDULE SE Self-Employment Tax 0074 (Form 1040) 2020 I Go to www.irs.gov/Schedule$ for instructions and the latest Attachment Department of the Treasury Internal Revenue information. 5 . 99 Sequence No. mm\" ) > Attach to Form 1040, mac-SR, or 1o4o-NR. 17 Name of person with self-employment income (as shown on Form 1040, Social security number of person with self- 1040SR, or 1040NR) employment income > David R. Cole Part I Self-Employment Tax 123-45- 6788 Note: If your only income subject to self-employment tax is church employee income, see instructions for how to report your income and the denition of church employee income. A If you are a minister, member of a religious order, or Christian Science practitioner and you filed Form 4361, but you had $400 or more of other net earnings from self-employment, check here and continue with Part I ............................... I El Skip lines 1a and 1b if you use the farm optional method in Part 11. See instructions. 1a Net farm prot or (loss) from Schedule F, line 34, and farm partnerships, Schedule K-1 (Form 1065), box 14, code A .......... la b If you received social security retirement or disability benefits, enter the amount of Conservation Reserva Program payments included on Schedule F, line 4b, or listed on Schedule K-1 (Form 1065), box 20, code AH E Skip line 2 if you use the nonfarrn optional method in Part 11. See instructions. 2 Net prot or (loss) from Schedule C, line 31; and Schedule K-1 (Form 1065), box 14, code A (other than farming). See instructions for other income to report or if you are a minister or member of a religious order 3 Combinelinesla,1b,and2......................................................... 5 4a If Iine3 is more than zero, multiply line 3 by 92.35% (0.9235).Otherwise, enter amount from |ine3 . . . . . . a Schedule C (Form 1040) 2020 David R. Cole 123-45-6788 Page 2 Part III Cost of Goods Sold (see instructions) 33 Method(s) used to value closing inventory: a X Cost b O Lower of cost or market c Other (attach explanation) 34 Was there any change in determining quantities, costs, or valuations between opening and closing inventory? If "Yes," attach explanation . . . . . . . . Yes X NO 35 Inventory at beginning of year. If different from last year's closing inventory, attach explanation . . . . . 35 36 Purchases less cost of items withdrawn for personal use . . 36 37 Cost of labor. Do not include any amounts paid to yourself 37 38 Materials and supplies . 38 39 Other costs . . 39 40 Add lines 35 through 39 . 40 41 Inventory at end of year . . . . 41 42 Cost of goods sold. Subtract line 41 from line 40. Enter the result here and on line 4 . . 42 Part IV Information on Your Vehicle. Complete this part only if you are claiming car or truck expenses on line 9 and are not required to file Form 4562 for this business. See the instructions for line 13 to find out if you must file Form 4562. 43 When did you place your vehicle in service for business purposes? (month/day/year) 44 Of the total number of miles you drove your vehicle during 2020, enter the number of miles you used your vehicle for: a Business b Commuting (see instructions) c Other 45 Was your vehicle available for personal use during off-duty hours? . . . . . . . . . . Yes No 46 Do you (or your spouse) have another vehicle available for personal use? . . . . . . . Yes O No 47a Do you have evidence to support your deduction? . . . . . . . . . . Yes O No b If "Yes," is the evidence written? . . . . . . . . Yes No Part V Other Expenses. List below business expenses not included on lines 8-26 or line 30.(Form 1040) 1545-0074 Profit or Loss From Business (Sole Proprietorship) Department of the Treasury Internal _ 2020 Revenue Service (99) D Go to www.1rs.gov/Schedulec for instructions and the latest Attachment information. _ Sequence b Attach to Form 1040, 1040-SR, HMO-NR, or 1041, partnerships No. 09 generally must le Form 1065. Name of proprietor David R. Cole Social security number (SSN) 123-45-6788 B Enter code from instructions > 541600 D Employer ID number (EIN) (see Instr.) A Principal business or profession, including product or service (see instructions) Consulting Services C Business name. If no separate business name, leave blank. E Business address (including suite or room no.) > 1820 Elk Avenue City, town or post ofce, state, and ZIP code Denver CO 80202 F Accounting method: (1) IZI Cash (2) El Accrual (3) a other (specify) b ________________________________ G Did you "materially participate" in the operation of this business during 2020? If "No," see instructions for limit on losses. 8 Yes D No H If you started or acquired this business during 2020, check here ...................................... > El I Did you make any payments in 2020 that would require you to file Form(s) 1099? See instructions ................ D Yes No J If "Yes," did you or will you le required Forms 1099? ................................................ El Yes El No Part I Income 1 Gross receipts or sales. See instructions for line 1 and check the box if this income was reported to you on Form W2 and the "Statutory employee" box on that form was checked ..................... I El 2 Returns and allowances ............................................................. 3 Subtract line 2 from line 1 ........................................................... 4 Cost of goods sold (from line 42) ...................................................... 5 Gross profit. Subtract line 4 from line 3 ................................................. 6 Other income, including federal and state gasoline or fuel tax credit or refund (see Instructions) .......... *1 EIEIIJEIEI H 7 Gross income. Add lines 5 and 6 ................................................ b Part II Expenses. Enter expenses for business use of your home only on line 30. 8 Advertising ................. Office expense (see instructions) ...... 18 9 Car and truck expenses (see Pension and prot-sharing plans ..... m instructions) ................ Rent or lease (see instructions): 10 Commissions and fees ......... a Vehicles, machinery, and equipment . . . . a Taxes Real property taxes on personal residence $6,400 Colorado state income tax due (paid in April 2020 for tax year 2019) 310 6,710 Mortgage interest on personal residence (Rocky Mountain Bank) 6,600 Contributions to traditional IRAs for Ella and David ($6,000 + $5,000) 12,000 0 In 2020, the Coles made quarterly estimated tax payments of $6,000 (Federal) and $500 (state) for a total of $24,000 (Federal) and $2,000 (state). . Relevant Social Security numbers are: David Cole 123-45-6788 Ella Cole 123-45-6787 . The Coles have neVer owned or used any virtual currency. The Coles receIVed the appropriate coronavirus recovery rebates (economic Impact payments); related questions In ProConnect Tax should be ignored. They do not want to contribute to the Presidential Election Campaign Fund. David is not eligible for any qualied sick or family leave credit for 2020 and does not want to defer payment of any of his self-employment taxes for 2020. Also, the Coles want any overpayment of tax refunded to them and not applied toward next year's tax liability. Required: Using the appropriate forms and schedules, compute the Coles' Federal income tax for 2020. Disregard the alternative minimum tax (AMT) and the various education credits - Make realistic assumptions about any missing data. - Enter all amounts as positive numbers. - If an amount box does not require an entry or the answer is zero, enter "0". - If required, round all dollar amounts to the nearest dollar. - It may be necessary to complete the tax schedules before completing Form 1040. 0 Use the included tax rates schedules to compute the tax. when computing the tax liability, do not round your immediate calculations. If required, round your nal answers to the nearest dollar. Schedule 0 Complete Coles' Schedule C for 2020. SCHEDULE C OMB No. 2020 Federal Statements Page 1 David R. and Ella M. Cole 123-45-6788 Statement 1 Form 8829, Line 22 other Expenses Direct Indirect Painting ofce area etc ................................................... $ Tota I 2020 Tax Rate Schedules Use the 2020 Tax Rate Schedules to compute the tax. (Note: Because the tax rate schedules are used instead of the tax tables, the amount of tax computed may vary slightly from the amount listed in the tables.) 2020 Tax Rate Schedules SingleSchedule x lHead of householdSchedule z *Treat as a direct office in home expense. In terms of depreciation, the Coles use the MACRS percentage tables applicable to 39-year nonresidential real property. As to depreciable property (e.g., office furniture), David tries to avoid capitalization and uses whatever method provides the fastest write- off for tax purposes. - Ella works at a variety of ofces as a substitute when a hygienist is ill or on vacation or when one of the clinics is particularly busy (e.g., prior to the beginning of the school year). Assume that Ella is an employee (not an independent contractor). Besides her transportation, she must provide and maintain her own uniforms. Her expenses for 2020 appear below. Uniforms $690 State and city occupational licenses 380 Professional journals and membership dues in the American Dental Hygiene Association 340 Correspondence study course (taken online) dealing with teeth whitening procedures 420 - Ella's salary for the year is $42,000, and her Form W2 for the year shows income tax withholdings of $4,000 (Federal) and $1,000 (state) and the proper amount of Social Security and Medicare taxes. - Besides the items already mentioned, the Coles had the following receipts during 2020. Interest income State of Colorado general purpose bonds $2,500 IBM bonds 800 Wells Fargo Bank 1,200 $4,500 Federal income tax refund for year 2019 510 Life insurance proceeds paid by Eagle Assurance Corporation 200,000 Inheritance of savings account from Sarah Cole 50,000 Sales proceeds from two ATVs 9,000 - For several years, the Coles' household has included David's divorced mother, Sarah, who has been claimed as their dependent. In late December 2019, Sarah unexpectedly died of heart attack in her sleep. Unknown to Ella and David, Sarah had a life insurance policy and a savings account (with David as the designated beneciary of each). in 2019, the Coles purchased two ATVs for $14,000. After several near mishaps, they decided that the sport was too dangerous. In 2020, they sold the ATVs to their neighbor. - Additional expenditures for 2020 include: Funeral expenses for Sarah $4,500 6 Qualified REIT dividends and publicly traded partnership (PTP) income or (loss) (see instructions) . . . . . . . . . . 6 7 Qualified REIT dividends and qualified PTP (loss) carryforward from the prior year . . 7 8 Total qualified REIT dividends and PTP income. Combine lines 6 and 7. If zero or less, enter -0- . . . . . 8 9 REIT and PTP component. Multiply line 8 by 20% (0.20) . . . 9 Qualified business income deduction before the income limitation. Add lines 5 and 9 . . 10 11 Taxable income before qualified business income deduction . . . . . 11 Net capital gain (see instructions) . . . . . . . . . . . 12 12 13 Subtract line 12 from line 11. If zero or less, enter -0- . .. 13 Income limitation. Multiply line 13 by 20% (0.20) . . . . . 14 14 Qualified business income deduction. Enter the lesser of line 10 or line 14. Also enter this amount on the applicable line of your 15 return. . . . 15 Total qualified business (loss) carryforward. Combine lines 2 and 3. If greater than zero, enter -0- . . . . . . . 16 16 Total qualified REIT dividends and PTP (loss) carryforward. Combine lines 6 and 7. If greater than zero, 17 enter -0- . . . ..... .... 17 BAA For Privacy Act and Paperwork Reduction Act Notice, see instructions. Form 8995 (2020) Form 8829 Complete the Coles' Form 8829 for 2020. The applicable depreciation percentage is 2.564%. OMB No. Form 8829 Expenses for Business Use of Your Home 1545-0074 File only with Schedule C (Form 1040). Use a separate Form 8829 for each home you used for business during the year. 2020 Go to www.irs.gov/Form8829 for instructions and the latest information.Note: If line 4a is less than $400 due to Conservation Reserve Program payments on line 1b, see instructions. 5' b If you elect one or both of the optional methods, enter the total of lines 15 and 17 here ............... c Combine lines 4a and 4b. if less than $400, stop; you don't owe self-employment tax. Exception: If less than $400 and you had church employee income, enter -0- and continue ......... 5 5a Enter your church employee income from Form W-2. See instructions for denition of church employee income ........ b Multiply line Sa by 92.35% (0.9235). If less than $100, enter -0- .............................. 6 Add lines 4c and 5b ............................................................... 7 Maximum amount of combined wages and self-employment earnings subject to social security tax or the 6.2% portion of the 7.65% railroad retirement (tier 1) tax for 2020 ................................. 83 Total social security wages and tips (total of boxes 3 and 7 on Form(s) w-2) and railroad retirement (tier 1) compensation. If $137,700 or more, skip lines 3b through 10, and go to line 11 .................................... b Unreported tips subject to social security tax from Form 4137, line 10 ........ c Wages subject to social security tax from Form 8919, line 10 .............. d Add lines 83, 8b, and 8c ........................................................... 9 Subtract line ad from line 7. If zero or less, enter -0- here and on line 10 and go to line 11 ......... b 10 Multiply the smaller of line 6 or line 9 by 12.4% (0.124) .................................... 11 Multiply line 6 by 2.9% (0.029) ...................................................... 12 Self-employment tax. Add lines 10 and 11. Enter here and on Schedule 2 (Form 1040), line 4 ...... 13 Deduction for one-half of self-employment tax. Multiply line 12 by 50% (0.50). Enter here and on Schedule 1 (Form 1040), line 14 ........................... 13 Part II Optional Methods To Figure Net Earnings (see instructions) Farm Optional Method. You may use this method only if (a) your gross farm income\") wasn't more than $8,460, or 0:) your net farm prots(2) were less than $6,107. 14 Maximum income for optional methods .................................................. 14 15 Enter the smaller of: two-thirds (2/3) of gross farm lncomem (not less than zero) or $5,640. Also, Include thls amount on line I 4b above ........................................................... 15 than 72.189% of your gross nonfarm income\") and (b) you had net earnings from self-employment of at least $400 in 2 of the prior 3 years. Caution: You may use this method no more than ve times. 16 Subtract line 15 from line 14 .......................................................... 17 Enter the smaller of: two-thirds (2/3) of gross nonfarm income\") (not less than zero) or the amount on line 16. Also, include I 17' Nonfarrn Optional Method. You may use this method only if (a) your net nonfarm profits\") were less than $6,107 and also less ! this amount on line 4b above .............................................. | If taxable of the If taxable income is: But not amount income is: But not Over over The tax ls: over Over over The tax is: $ 0 $ 9,375 ...... 10% 5 0 $ 0 $ 14,100 ...... 10% 9,875 40,125 $ 987.50 + 1210 9,875 14,100 53,700 $ 1,410.00 + 12% 40,125 85,525 4,617.50 + 22% 40,125 53,700 85,500 6,162.00 + 22% 85,525 163,300 14,605.50 + 2475 85,525 85,525 163,300 13,158.00 + 24% 163,300 207,350 33,271.50 + 3210 163,300 207,350 518,400 47,367.50 + 35% 207,350 518,400 ...... 156,235.00 + 37"!0 518,400 163,300 207,350 31,830.00 4- 32% 207,350 518,400 45,926.00 + 35% 518,400 ...... 154,793.50 + 37% Married filing jointly or Qualifying widow(er)Schedule v-1 Married filing separatelySchedule v-2 If taxable of the If taxable income is: But not amount income is: But not Over over The tax is: over Over over The tax is: $ 0 $ 19,750 ...... 10% $ 0 $ 0 $ 9,875 ...... 10% 19,750 80,250 $ 1,975.00 + 12% 19,750 9,875 40,125 $ 987.50 + 12% 80,250 171,050 9,235.00 + 22% 80,250 40,125 85,525 4,617.50 + 22% 171,050 326,600 29,211.00 + 24% 171,050 326,600 414,700 66,543.00 + 32% 326,600 414,700 622,050 94,735.00 + 35% 414,700 622,050 ...... 167,307.50 + 37% 622,050 85,525 163,300 14,605.50 4- 2415 163,300 207,350 33,271.50 4- 32% 207,350 311,025 47,367.50 4- 35%: 311,025 ...... 83,653.75 + 3710 of the amount over 5 0 14,100 53,700 85,500 163,300 207,350 518,400 of the amount over $ 0 9,875 40,125 05,525 163,300 207,350 311,025 (1) From Sch. F, line 9; and Sch. K-1 (Form 1065), box 14, code B. () From Sch. C, line 31; and Sch. K-1 (Form 1065), box 14, code A. (2) From Sch. F, line 34; and Sch. K-1 (Form 1065), box 14, code A (4) From Sch. C, line 7; and Sch. K-1 (Form 1065), box 14, code C. -minus the amount you would have entered on line 1b had you not used the optional method . BAA For Paperwork Reduction Act Notice, see your tax return instructions. Schedule SE (Form 1040) 2020 Form 8995 Complete Roberta's Form 8995. Qualified Business Income Deduction OMB No. 1545- 123 Form 8995 Simplified Computation 2020 Attach to your tax return. Attachment Department of the Treasury Internal Revenue Go to www.irs.gov/Form8995 for instructions and the latest Sequence No. Service information. 55 Name(s) shown on return Your taxpayer identification number David R. and Ella M. Cole 123-45-6788 Note. You can claim the qualified business income deduction only if you have qualified business income from a qualified trade or business, real estate investment trust dividends, publicly traded partnership income, or a domestic production activities deduction passed through from an agricultural or horticultural cooperative. See instructions. Use this form if your taxable income, before your qualified business income deduction, is at or below $163,300 ($326,600 if married filing jointly), and you aren't a patron of an agricultural or horticultural cooperative. 1 (a) Trade, business, or aggregation name (b) Taxpayer identification number (c) Qualified business income or (loss) i David R. Cole 123-45-6788 2 Total qualified business income or (loss). Combine lines li through 1v, column (c) . . . 2 3 Qualified business net (loss) carryforward from the prior year . .. . . . . . . . 3 4 Total qualified business income. Combine lines 2 and 3. If zero or less, enter -0- . . . . 4 5 Qualified business income component. Multiply line 4 by 20% (0.20) . 5Department of the Treasury Internal Attachment Revenue Service (99) Sequence No. 176 Name(s) of proprietor(s) Your social security number David R. Cole 123-45-6788 Part I Part of Your Home Used for Business 1 Area used regulany and exclusively for business, regularly for daycare, or for storage of inventory or product samples {see Instructions) 2 Total area of home ................................................................ 3 Divide line 1 by line 2. Enter the result as a percentage ...................................... For daycare facilities not used exclusively for business, 90 to line 4. All others, go to line 7. 4 Multiply days used for daycare during year by hours used per day ............ 5 If you started or stopped using your home for daycare during the year, see instructions; otherwise, enter 8,784 ......... 6 Divide line 4 by line 5. Enter the result as a decimal amount .............. 7 Business percentage. For daycare facilities not used exclusively for business, multiply line 6 by line 3 (enter the result as a percentage). All others, enter the amount from line 3 . . . . . . . . . . . . . . . . . . . . . l Part II Figure Your Allowable Deduction 8 Enter the amount from Schedule C, line 29, plus any gain derived from the business use of your home, minus any loss from the trade or business not derived from the business use of your home. See instructions. (b) Indirect EXPENSES See instructions for columns (a) and (h) before completing lines 922. 9 Casualty losses (see instructions) . . . . . . . . . . . . . . . 10 Deductible mortgage interest (see instructions) ..... 11 Real estate taxes (see instructions) ............. 12 Add lines 9, 10, and 11 ...................... 13Multiplyline12,column(b),byline7............................. 14 Add line 12, column (a), and line 13 ................................................. 15$ubtractline14fromIineB.Ifzeroorless,enter-D-...................................... 16 Excess mortgage interest (see instructions) ....... 17 Excess real estate taxes (see instructions)........ 18Insurance............................... 19Rent 20 Repairs and maintenance .................... 21 Utilities . . . . . . . 21 22 Other expenses (see instructions) . Statement 1 22 23 Add lines 16 through 22 . . . . . . . . . . 23 24 Multiply line 23, column (b), by line 7 . . . . . . . . 24 25 Carryover of prior year operating expenses (see instructions ) . . . . . . . . . . . . 25 26 Add line 23, column (a), line 24, and line 25 . . . . . . . . . . . 26 27 Allowable operating expenses. Enter the smaller of line 15 or line 26 . . . . . . . . . . . 27 28 Limit on excess casualty losses and depreciation. Subtract line 27 from line 15 . . . . . . . . . . . . . . . . 1 28 29 Excess casualty losses (see instructions) . . . 29 30 Depreciation of your home from line 42 below . . . . . . 30 31 Carryover of prior year excess casualty losses and depreciation (see instructions) 31 32 Add lines 29 through 31 . 32 33 Allowable excess casualty losses and depreciation. Enter the smaller of line 28 or line 32 . . . . . . . . . . . . . 33 34 Add lines 14, 27, and 33 . . . . . . . . 34 35 Casualty loss portion, if any, from lines 14 and 33. Carry amount to Form 4684 See instructions . . . 35 36 Allowable expenses for business use of your home. Subtract line 35 from line 34. Enter here and on Schedule C, line 30. If your home was used for more than one business, see instructions . . . . . . . 36 Part III Depreciation of Your Home 37 Enter the smaller of your home's adjusted basis or its fair market value. See instructions . . . 37 38 Value of land included on line 37 . . 38 39 Basis of building. Subtract line 38 from line 37 . . .. 39 40 Business basis of building. Multiply line 39 by line 7 . . . . . . 40 41 Depreciation percentage (see instructions) . .. 41 % 42 Depreciation allowable (see instructions). Multiply line 40 by line 41. Enter here and on line 30 above . . . . . 42 Part IV Carryover of Unallowed Expenses to 2021 43 Operating expenses. Subtract line 27 from line 26. If less than zero, enter -0- . . . . . . . . . . . . . . . . . . . .. 43 44 Excess casualty losses and depreciation. Subtract line 33 from line 32. If less than zero, enter -0- . . . . . . . 44 BAA For Paperwork Reduction Act Notice, see your tax return instructions. Form 8829 (2020) Federal Statements Complete David R. and Ella M. Cole's Federal Statements.11 Contract labor (see instructions) . . 11 b Other business property . . . . . . . . . . . . 20b 12 Depletion . . . . . . . . 12 2: Repairs and maintenance . . . . . . . . . . 21 13 Depreciation and section 179 22 Supplies (not included in Part III) . . . . 22 expense deduction (not included 23 Taxes and licenses . . . . . . . ... 23 in Part III) (see instructions) . . . . 13 24 Travel and meals: . 14 Employee benefit programs a Travel . . . . . . . . . . . . . . . ... 24a (other than on line 19) . . . . 14 b Deductible meals (see 15 Insurance (other than health) . . . . 15 instructions) . . . . . . . . . . . . . . . . . . 24b 16 Interest (see instr. ): 25 Utilities . . . . . . . . . 25 a Mortgage (paid to banks, etc. ) . . . 16a 26 Wages (less employment credits) . . . . . . 26 b Other . . . 16b 27a Other expenses (from line 48) . . . . . . . . 27a 17 Legal and professional services . . . 17 b Reserved for future use . . 1. . .. . 27 b 28 Total expenses before expenses for business use of home. Add lines 8 through 27a . . . . . . . . . . . . 28 29 Tentative profit or (loss). Subtract line 28 from line 7 . . . 29 30 Expenses for business use of your home. Do not report these expenses elsewhere. Attach Form 8829 unless using the simplified method. See instructions. Simplified method filers only: enter the total square footage of: (a) your home: and (b) the part of your home used for business: . Use the Simplified Method Worksheet in the instructions to figure the amount to enter on line 30 . 30 31 Net profit or (loss). Subtract line 30 from line 29. . If a profit, enter on both Schedule 1 (Form 1040), line 3, and on Schedule SE, line 2. 31 (If you checked the box on line 1, see instructions). Estates and trusts, enter on Form 1041, line 3. . If a loss, you must go to line 32. 32 If you have a loss, check the box that describes your investment in this activity See instructions. 32a O All investment 32b O is If you checked 32a, enter the loss on both Schedule 1 (Form 1040), line 3, and on Schedule SE, line 2. at risk. (If you checked the box on line 1, see the line 31 instructions). Estates and trusts, enter on Form 1041, line 3. Some . If you checked 32b, you must attach Form 6198. Your loss may be limited. investment is not at risk. BAA For Paperwork Reduction Act Notice, see the separate instructions. Schedule C (Form 1040) 2020

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts