Question: Instructions On June 1 , 2 0 Y 6 , Hannah Ellis established an interior decorating business, Whitworth Designs. During the month, Hannah completed the

Instructions

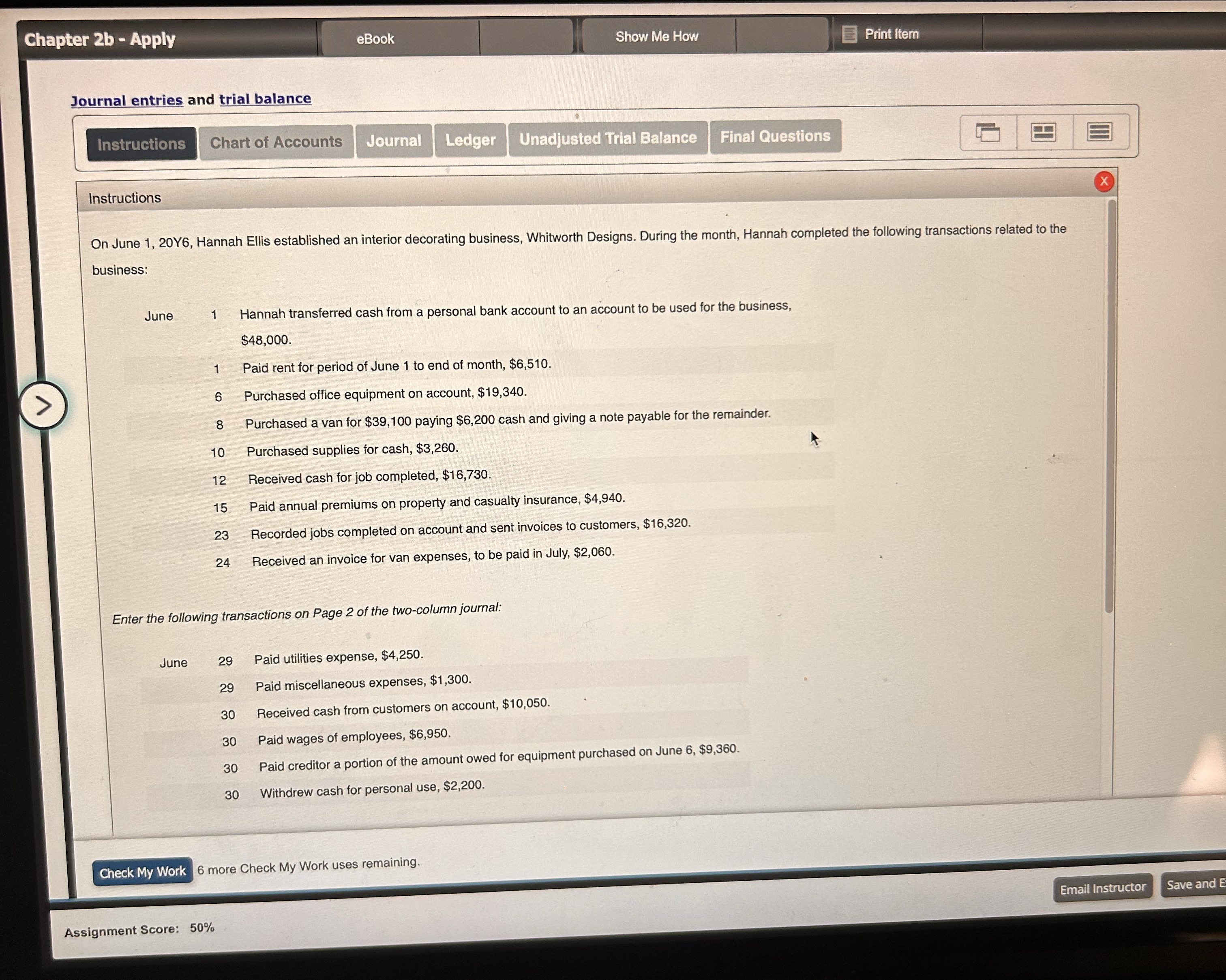

On June Y Hannah Ellis established an interior decorating business, Whitworth Designs. During the month, Hannah completed the following transactions related to the

business:

June

Hannah transferred cash from a personal bank account to an account to be used for the business,

$

Paid rent for period of June to end of month, $

Purchased office equipment on account, $

Purchased a van for $ paying $ cash and giving a note payable for the remainder.

Purchased supplies for cash, $

Received cash for job completed, $

Paid annual premiums on property and casualty insurance, $

Recorded jobs completed on account and sent invoices to customers, $

Received an invoice for van expenses, to be paid in July, $

Enter the following transactions on Page of the twocolumn journal:

June

Paid utilities expense, $

Paid miscellaneous expenses, $

Received cash from customers on account, $

Paid wages of employees, $

Paid creditor a portion of the amount owed for equipment purchased on June $

Withdrew cash for personal use, $

more Check My Work uses remaining.

Instructions

On June Y Hannah Ellis established an interior decorating business, Whitworth Designs. During the month, Hannah completed the following transactions related to the

business:

June

Hannah transferred cash from a personal bank account to an account to be used for the business,

$

Paid rent for period of June to end of month, $

Purchased office equipment on account, $

Purchased a van for $ paying $ cash and giving a note payable for the remainder.

Purchased supplies for cash, $

Received cash for job completed, $

Paid annual premiums on property and casualty insurance, $

Recorded jobs completed on account and sent invoices to customers, $

Received an invoice for van expenses, to be paid in July, $

Enter the following transactions on Page of the twocolumn journal:

June

Paid utilities expense, $

Paid miscellaneous expenses, $

Received cash from customers on account, $

Paid wages of employees, $

Paid creditor a portion of the amount owed for equipment purchased on June $

Withdrew cash for personal use, $

more Check My Work uses remaining.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock