Question: Instructions Outline a story problem and create a functional debt amortization schedule in Excel to accompany the story problem. Your spreadsheet should include the following

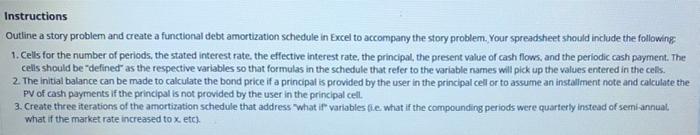

Instructions Outline a story problem and create a functional debt amortization schedule in Excel to accompany the story problem. Your spreadsheet should include the following 1. Cells for the number of periods, the stated interest rate, the effective interest rate, the principal, the present value of cash flows, and the periodic cash payment. The cells should be "defined as the respective variables so that formulas in the schedule that refer to the variable names will pick up the values entered in the cells. 2. The initial balance can be made to calculate the bond price if a principal is provided by the user in the principal cell or to assume an installment note and calculate the PV of cash payments if the principal is not provided by the user in the principal cell. 3. Create three iterations of the amortization schedule that address "what if" variables (.e. what if the compounding periods were quarterly instead of semi-annual what if the market rate increased to x. etc). Instructions Outline a story problem and create a functional debt amortization schedule in Excel to accompany the story problem. Your spreadsheet should include the following 1. Cells for the number of periods, the stated interest rate, the effective interest rate, the principal, the present value of cash flows, and the periodic cash payment. The cells should be "defined as the respective variables so that formulas in the schedule that refer to the variable names will pick up the values entered in the cells. 2. The initial balance can be made to calculate the bond price if a principal is provided by the user in the principal cell or to assume an installment note and calculate the PV of cash payments if the principal is not provided by the user in the principal cell. 3. Create three iterations of the amortization schedule that address "what if" variables (.e. what if the compounding periods were quarterly instead of semi-annual what if the market rate increased to x. etc)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts