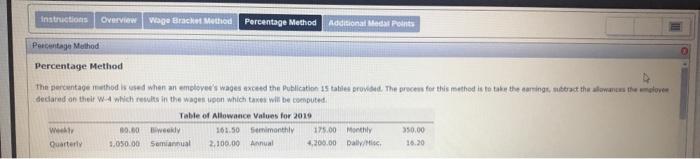

Question: instructions Overview Wage Bracket Method Percentage Method Additional Medal Points Percentage Method Percentage Method The percentage rethod is used when an employee's wages exceed the

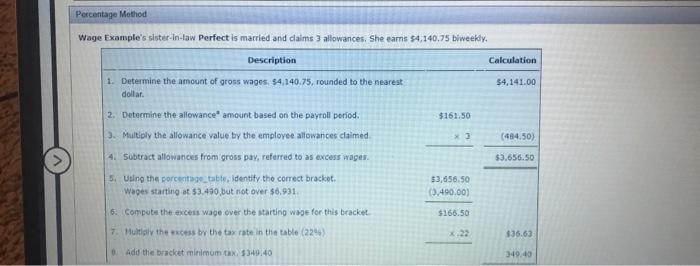

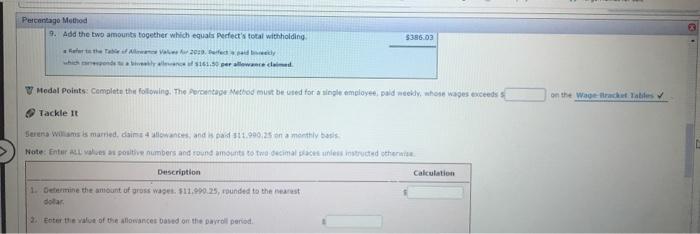

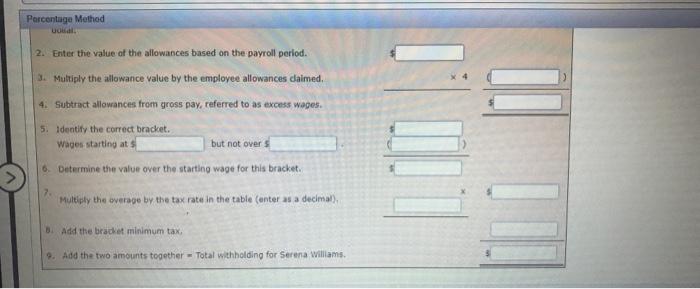

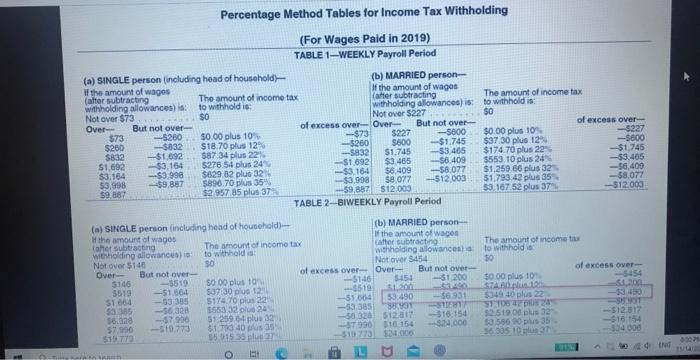

instructions Overview Wage Bracket Method Percentage Method Additional Medal Points Percentage Method Percentage Method The percentage rethod is used when an employee's wages exceed the Publication 15 tables proved. The process for this method is to take the coming bact the aware the love dedared on their which results in the wages on which takes will be computed Table of Allowance Values for 2019 We 30.00 161.50 Seimonthly 175.00 Monthly 350.00 Quarterly 5,050.00 Smanual 2,100.00 Annual 4,200.00 Dall/ 16.30 Percentage Mothod Wage Example's sister-in-law Perfect is married and claims 3 allowances. She earns $4.140.75 biweekly. Calculation $4,141.00 $161.50 x2 (494.50) Description 1. Determine the amount of gross wages, 94140.75, rounded to the nearest dollar 2. Determine the allowance amount based on the payroll period. 3. Multiply the allowance value by the employee allowances claimed 4. Subtract allowances from gross pay, referred to as excess wages. 5. Using the percentagetube, identify the correct bracket Wapes starting at 53.490, but not over $6,931 6. Compute the excess wage over the starting wage for this bracket 7. Mutol the excess by the tax rate in the table (224) $3.656.50 $3,656.50 (1.490.00) $166.50 x 22 $36.63 0 Add the bracket minimum a $349:40 349.40 $36.03 Percentago Method 9. Add the two amounts together which equals Perfect's total withholding the 2013. fed whi161.30 wa V Medal Points: Complete the following: The Percentage Method must be used for a single employee paid whose wages exceeds on the Wage tractables Tackle It Serena Williams is married in 4 towances, and is pas 11.900.25 on a monthly basis Note: Enter ALL vous positive numbers and round amounts to two decimal structed otherwise Calculation Description 1. Determine the amount of gross wages $11.900.25, rounded to the man dolar 2. Enter the value of the Allowances and on the part period Percentage Method Ud 2. Enter the value of the allowances based on the payroll period. 3. Multiply the allowance value by the employee allowances daimed. 4. Subtract allowances from gross pay, referred to as excess wages. 5. identify the correct bracket. Wages starting at but not overs 6. Determine the value over the starting wage for this bracket 7. Multiply the average by the tax rate in the table (anter as a decimal), B. Add the bracket minimum tax 9. Add the two amounts together - Total withholding for Serena Williams Percentage Method Tables for Income Tax Withholding (For Wages Paid in 2019) TABLE 1-WEEKLY Payroll Period (a) SINGLE person (including head of household) (b) MARRIED person if the amount of wages If the amount of wages (after subtracting The amount of income tax (after subtracting The amount of income tax withholding allowances) is: to withhold is withholding allowance is to withholdi Not over $73 30 Not over $227 $0 Over But not over of excess over Over But not over of excess over 573 -5280 $0.00 plus 10% -$73 5227 ---5600 $0.00 plus 10% -$227 $260 $18.70 plus 12 -$260 $800 -$1.745 $37 30 plus 12 -5800 5832 ---$1,692 $87 34 plus 22% -5832 51.745 -53.405 $174.70 plus 22 -$1,745 $1.692 -$3,164 $278 54 plus 24 -$1.092 $3.465 -56.409 5553 10 plus 24 -$3.465 $3,164 -$3 998 $629.12 plus 32 -$3,164 $6.409 -$8.077 $1,259.66 plus 32 -56,409 53,898 --$9,887 $896.70 plus 35% -$3.998 $8,077 -512,003 51.783.42 plus 35 -$8.077 $9 887 $2 957 85 plus 37 -59,887 $12.003 53.167 52 plus 37 -$12.000 TABLE 2-BIWEEKLY Payroll Period (a) SINGLE person (including head of household) (b) MARRIED person the amount of wages If the amount of wages oor subtracting The amount of income tax after subtracting witholding allowances to withholdi withholding allowance Not over $140 30 Not over $454 Over But not over of excess over Over But not over 3146 -5519 S000 plus to -5146 $451 -31 200 3519 -51.064 $37:30 plus 12 5510 1200 ST664 -53305 $174.70 plus 22 --51.004 53.490 -56931 $3385 -5630 555332 plus 24 -53 385 38.991 -S1 5125964 plus 32 -50.32051201 316.154 57.900 -510.773 $1.7334635 -57 990 B10154 2000 515 772 55 155 plus The amount of income to to withholdi 30 of excess over- 50.00 plus 10 -5454 STA SL300 5049 40 plus 22 -33430 51 100 RS -T 90.519.00 plus 32 -512317 353635 -$16.14 36 305 103 304 000 instructions Overview Wage Bracket Method Percentage Method Additional Medal Points Percentage Method Percentage Method The percentage rethod is used when an employee's wages exceed the Publication 15 tables proved. The process for this method is to take the coming bact the aware the love dedared on their which results in the wages on which takes will be computed Table of Allowance Values for 2019 We 30.00 161.50 Seimonthly 175.00 Monthly 350.00 Quarterly 5,050.00 Smanual 2,100.00 Annual 4,200.00 Dall/ 16.30 Percentage Mothod Wage Example's sister-in-law Perfect is married and claims 3 allowances. She earns $4.140.75 biweekly. Calculation $4,141.00 $161.50 x2 (494.50) Description 1. Determine the amount of gross wages, 94140.75, rounded to the nearest dollar 2. Determine the allowance amount based on the payroll period. 3. Multiply the allowance value by the employee allowances claimed 4. Subtract allowances from gross pay, referred to as excess wages. 5. Using the percentagetube, identify the correct bracket Wapes starting at 53.490, but not over $6,931 6. Compute the excess wage over the starting wage for this bracket 7. Mutol the excess by the tax rate in the table (224) $3.656.50 $3,656.50 (1.490.00) $166.50 x 22 $36.63 0 Add the bracket minimum a $349:40 349.40 $36.03 Percentago Method 9. Add the two amounts together which equals Perfect's total withholding the 2013. fed whi161.30 wa V Medal Points: Complete the following: The Percentage Method must be used for a single employee paid whose wages exceeds on the Wage tractables Tackle It Serena Williams is married in 4 towances, and is pas 11.900.25 on a monthly basis Note: Enter ALL vous positive numbers and round amounts to two decimal structed otherwise Calculation Description 1. Determine the amount of gross wages $11.900.25, rounded to the man dolar 2. Enter the value of the Allowances and on the part period Percentage Method Ud 2. Enter the value of the allowances based on the payroll period. 3. Multiply the allowance value by the employee allowances daimed. 4. Subtract allowances from gross pay, referred to as excess wages. 5. identify the correct bracket. Wages starting at but not overs 6. Determine the value over the starting wage for this bracket 7. Multiply the average by the tax rate in the table (anter as a decimal), B. Add the bracket minimum tax 9. Add the two amounts together - Total withholding for Serena Williams Percentage Method Tables for Income Tax Withholding (For Wages Paid in 2019) TABLE 1-WEEKLY Payroll Period (a) SINGLE person (including head of household) (b) MARRIED person if the amount of wages If the amount of wages (after subtracting The amount of income tax (after subtracting The amount of income tax withholding allowances) is: to withhold is withholding allowance is to withholdi Not over $73 30 Not over $227 $0 Over But not over of excess over Over But not over of excess over 573 -5280 $0.00 plus 10% -$73 5227 ---5600 $0.00 plus 10% -$227 $260 $18.70 plus 12 -$260 $800 -$1.745 $37 30 plus 12 -5800 5832 ---$1,692 $87 34 plus 22% -5832 51.745 -53.405 $174.70 plus 22 -$1,745 $1.692 -$3,164 $278 54 plus 24 -$1.092 $3.465 -56.409 5553 10 plus 24 -$3.465 $3,164 -$3 998 $629.12 plus 32 -$3,164 $6.409 -$8.077 $1,259.66 plus 32 -56,409 53,898 --$9,887 $896.70 plus 35% -$3.998 $8,077 -512,003 51.783.42 plus 35 -$8.077 $9 887 $2 957 85 plus 37 -59,887 $12.003 53.167 52 plus 37 -$12.000 TABLE 2-BIWEEKLY Payroll Period (a) SINGLE person (including head of household) (b) MARRIED person the amount of wages If the amount of wages oor subtracting The amount of income tax after subtracting witholding allowances to withholdi withholding allowance Not over $140 30 Not over $454 Over But not over of excess over Over But not over 3146 -5519 S000 plus to -5146 $451 -31 200 3519 -51.064 $37:30 plus 12 5510 1200 ST664 -53305 $174.70 plus 22 --51.004 53.490 -56931 $3385 -5630 555332 plus 24 -53 385 38.991 -S1 5125964 plus 32 -50.32051201 316.154 57.900 -510.773 $1.7334635 -57 990 B10154 2000 515 772 55 155 plus The amount of income to to withholdi 30 of excess over- 50.00 plus 10 -5454 STA SL300 5049 40 plus 22 -33430 51 100 RS -T 90.519.00 plus 32 -512317 353635 -$16.14 36 305 103 304 000