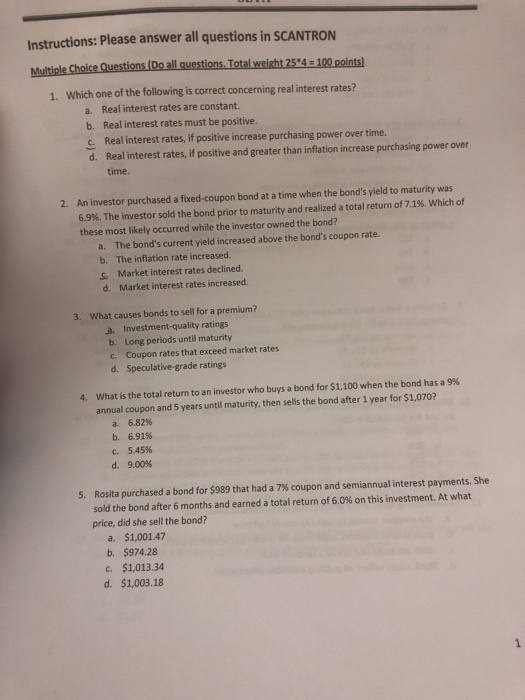

Question: Instructions: Please answer all questions in SCANTRON e Choice Questions (Do all questions Total weight 25'4 Which one of the following is correct concerning real

Instructions: Please answer all questions in SCANTRON e Choice Questions (Do all questions Total weight 25'4 Which one of the following is correct concerning real interest rates? 100 points 1. a. Real interest rates are constant. b. Real interest rates must be positive. C Real interest rates, if positive increase purchasing power over time. d. Real interest rates, if positive and greater than inflation increase purchasing power over time. An investor purchased a fixed-coupon bond at a time when the bond's yield to maturity was 6.9%. The investor sold the bond prior to maturity and realized a total return of 7.1%, which of these most likely occurred while the investor owned the bond? 2. a. The bond's current yield increased above the bond's coupon rate. b. The inflation rate increased. s Market interest rates declined. d. Market interest rates increased. 3. What causes bonds to sell for a premium? a. Investment-quality ratings b. Long periods until maturity c. Coupon rates that exceed market rates d. Speculative-grade ratings what is the total return to an investor who buys a bond for $1,100 when the bond has a 9% annual coupon and 5 years until maturity, then sells the bond after 1 year for $1,070? 4, a. b. . d. 6.82% 6.91% 5.45% 9.00% Rosita purchased a bond for $989 that had a 7% coupon and semiannual interest payments. She sold the bond after 6 months and earned a total return of 6.0% on this investment. At what price, did she sell the bond? 5, a. $1,001.47 b. $974.28 c. $1,013.34 d. $1,003.18

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts