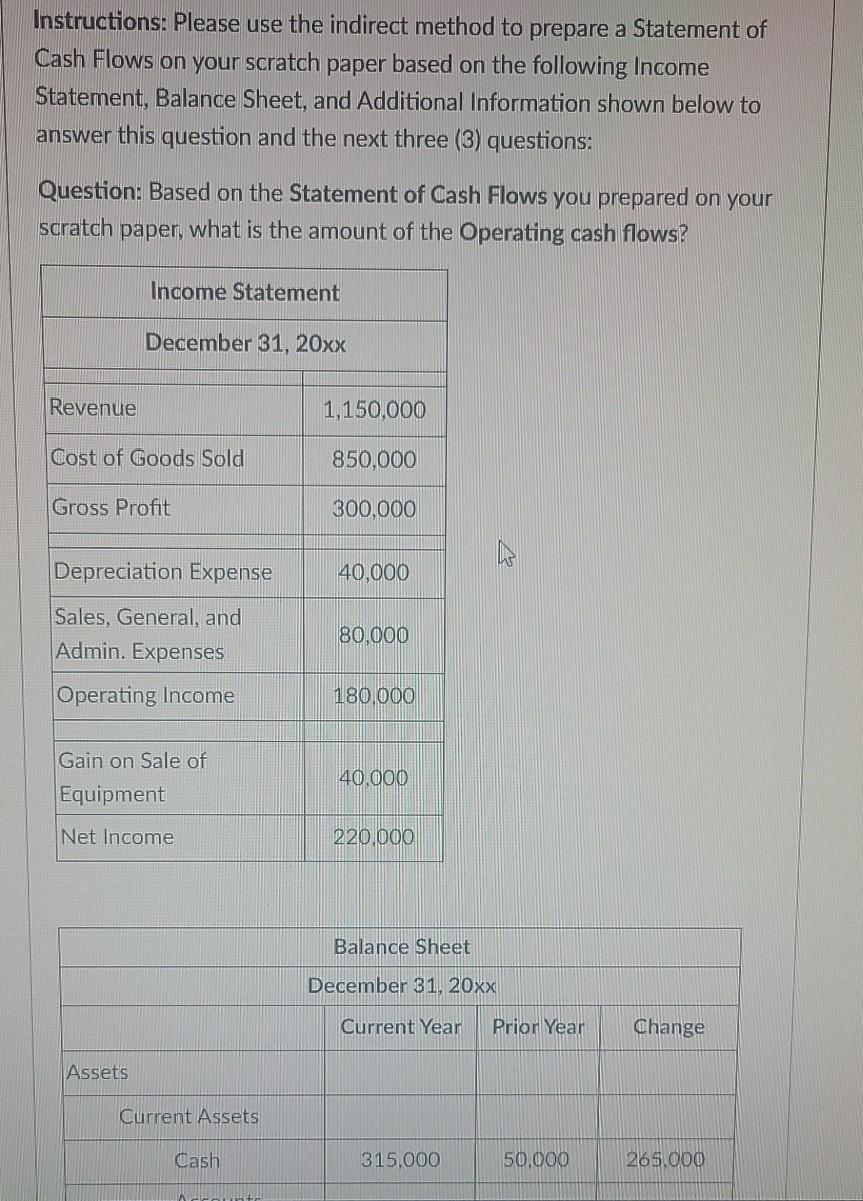

Question: Instructions: Please use the indirect method to prepare a Statement of Cash Flows on your scratch paper based on the following Income Statement, Balance Sheet,

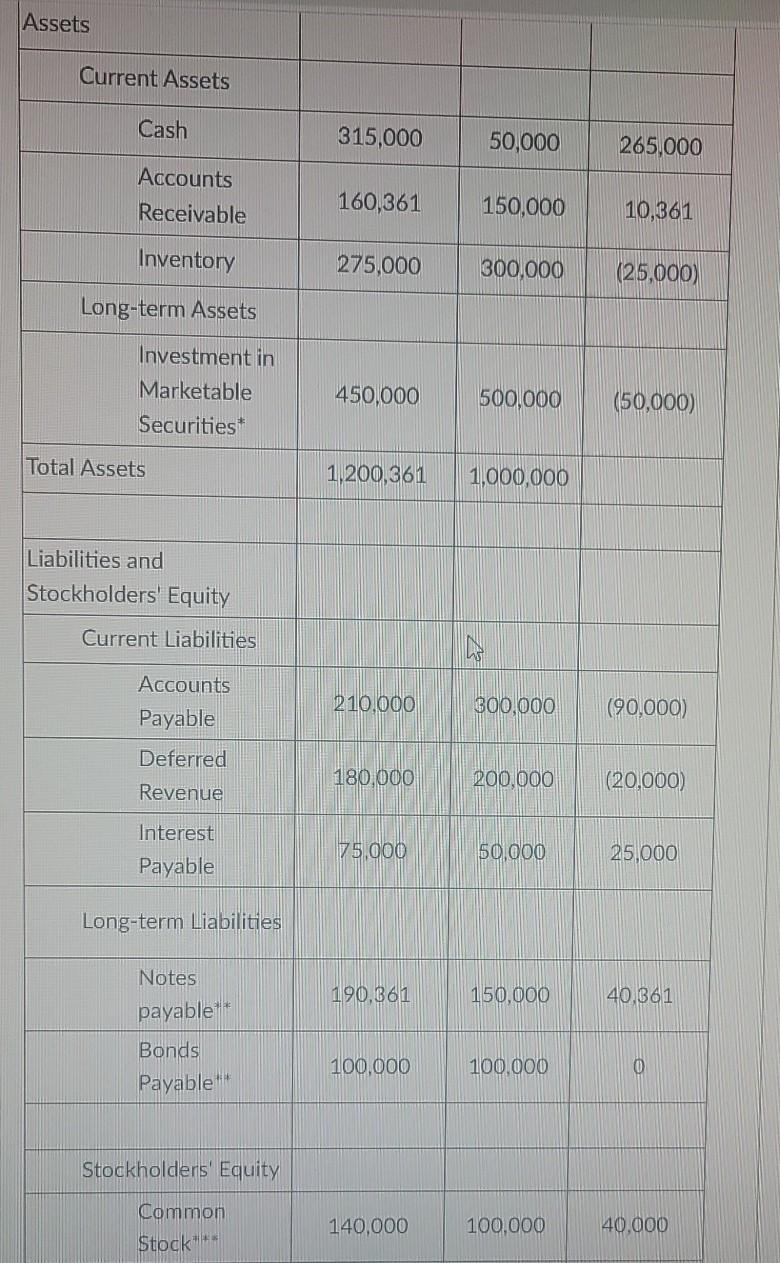

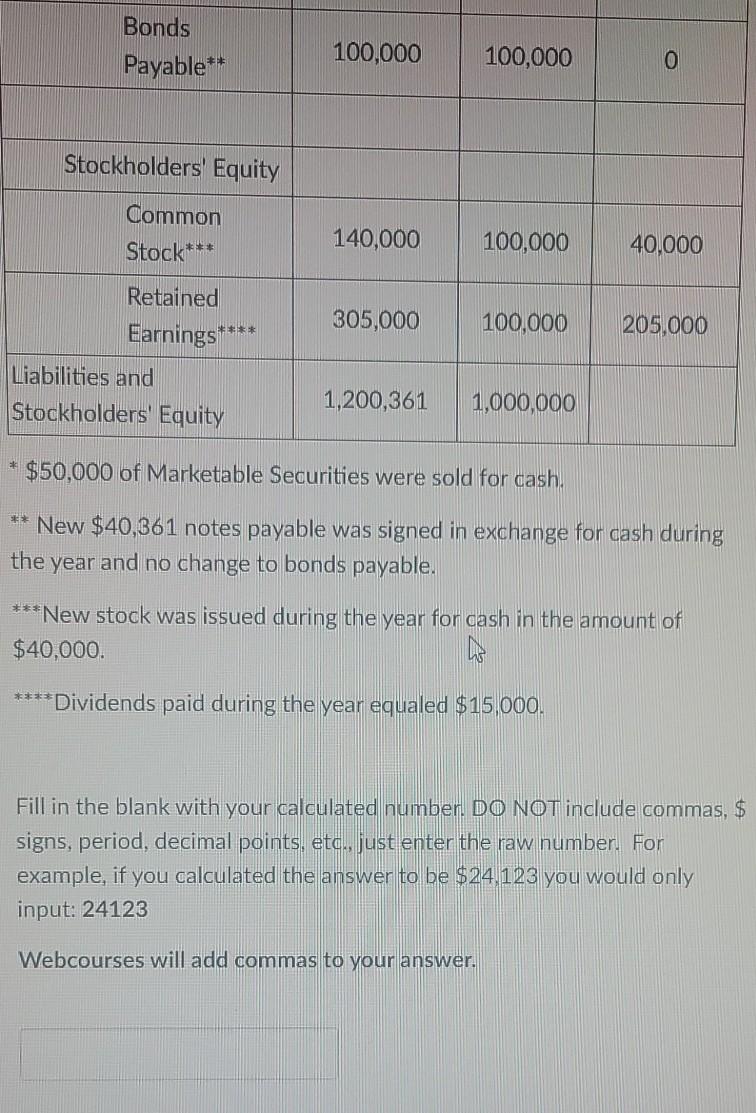

Instructions: Please use the indirect method to prepare a Statement of Cash Flows on your scratch paper based on the following Income Statement, Balance Sheet, and Additional Information shown below to answer this question and the next three (3) questions: Question: Based on the Statement of Cash Flows you prepared on your scratch paper, what is the amount of the Operating cash flows? Income Statement December 31, 20xx Revenue 1,150,000 Cost of Goods Sold 850,000 Gross Profit 300,000 Depreciation Expense 40,000 Sales, General, and Admin. Expenses 80,000 Operating Income 180,000 Gain on Sale of Equipment 40.000 Net Income 220.000 Balance Sheet December 31, 20xx Current Year Prior Year Change Assets Current Assets Cash 315,000 50.000 265.000 Assets Current Assets Cash 315,000 50,000 265,000 Accounts Receivable 160,361 150,000 10,361 Inventory 275,000 300,000 (25,000) Long-term Assets Investment in Marketable Securities 450,000 500,000 (50,000) Total Assets 1,200,361 1,000,000 Liabilities and Stockholders' Equity Current Liabilities IN Accounts Payable 210.000 600.000 (90,000) Deferred 180,000 200.000 (20,000) Revenue Interest Payable 75,000 50.000 25,000 Long-term Liabilities Notes 190,861 150.000 40,361 payable Bonds Payable 100,000 100.000 0 Stockholders' Equity Common Stock 140,000 100.000 40.000 Bonds Payable** 100,000 100,000 0 Stockholders' Equity Common Stock*** 140,000 100,000 40.000 305,000 100,000 205,000 **** Retained Earnings** Liabilities and Stockholders' Equity 1,200,361 1,000,000 $50,000 of Marketable Securities were sold for cash, ** New $40,361 notes payable was signed in exchange for cash during the year and no change to bonds payable. *** New stock was issued during the year for cash in the amount of $40,000. **** Dividends paid during the year equaled $15,000. Fill in the blank with your calculated number. DO NOT include commas, $ signs, period, decimal points, etc., just enter the raw number. For example, if you calculated the answer to be $24.123 you would only input: 24123 Webcourses will add commas to your answer. Statement of Cash Flows Question: Based on the Statement of Cash Flows you prepared on your scratch paper, what is the amount of the Investing cash flow? Fill in the blank with your calculated number. DO NOT include commas, $ signs, period, decimal points, etc., just enter the raw number. For example, if you calculated the answer to be $24,123 you would only input: 24123 Webcourses will add commas to your answer. Statement of Cash Flows Question: Based on the Statement of Cash Flows you prepared on your scratch paper, what is the amount of the Financing cash flows? Fill in the blank with your calculated number. DO NOT include commas, $ signs, period, decimal points, etc., just enter the raw number. For example, if you calculated the answer to be $24,123 you would only input: 24123 Webcourses will add commas to your answer. Based on the Income Statement, Balance Sheet, and Additional Information shown below and the Statement of Cash Flows you prepared on your scratch paper, How much did the actual cash account change over this period? Fill in the blank with your calculated number. DO NOT include commas, $ signs, period, decimal points, etc., just enter the raw number. For example, if you calculated the answer to be $24,123 you would only input: 24123 Webcourses will add commas to your

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts