Question: Instructions: . . Please write all your answers legibly. Please show all the inputs entered in financial calculators. . Please use at least 4 decimal

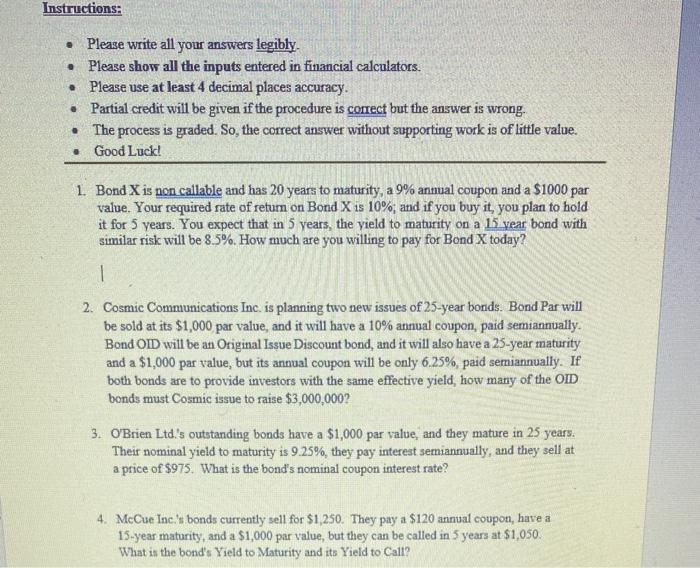

Instructions: . . Please write all your answers legibly. Please show all the inputs entered in financial calculators. . Please use at least 4 decimal places accuracy. Partial credit will be given if the procedure is correct but the answer is wrong. The process is graded. So, the correct answer without supporting work is of little value. Good Luck! 1. Bond X is non callable and has 20 years to maturity, a 9% annual coupon and a $1000 par value. Your required rate of return on Bond X is 10%, and if you buy it, you plan to hold it for 5 years. You expect that in 5 years, the yield to maturity on a 15 year bond with similar risk will be 8.5%. How much are you willing to pay for Bond X today? 1 2. Cosmic Communications Inc. is planning two new issues of 25-year bonds. Bond Par will be sold at its $1,000 par value, and it will have a 10% annual coupon, paid semiannually. Bond OID will be an Original Issue Discount bond, and it will also have a 25-year maturity and a $1,000 par value, but its annual coupon will be only 6.25%, paid semiannually. If both bonds are to provide investors with the same effective yield, how many of the OID bonds must Cosmic issue to raise $3,000,000? 3. O'Brien Ltd.'s outstanding bonds have a $1,000 par value, and they mature in 25 years. Their nominal yield to maturity is 9.25%, they pay interest semiannually, and they sell at a price of $975. What is the bond's nominal coupon interest rate? 4. McCue Inc.'s bonds currently sell for $1,250. They pay a $120 annual coupon, have a 15-year maturity, and a $1,000 par value, but they can be called in 5 years at $1,050. What is the bond's Yield to Maturity and its Yield to Call

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts