Question: Instructions Prepare a condensed income statement for the year on both bases for comparative purposes. E 7 . 1 6 ( LO 3 ) (

Instructions

Prepare a condensed income statement for the year on both bases for comparative purposes.

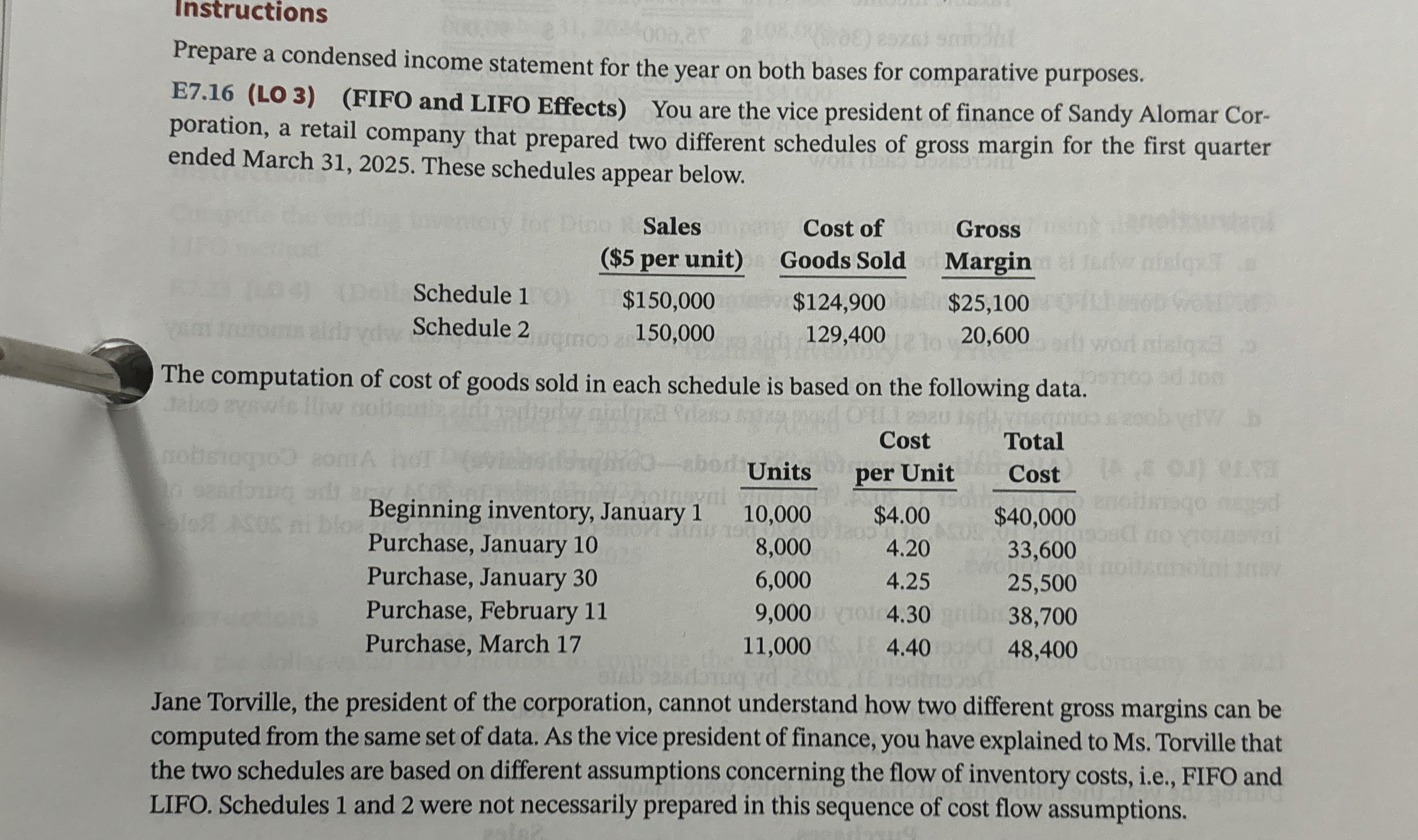

ELO FIFO and LIFO Effects You are the vice president of finance of Sandy Alomar Corporation, a retail company that prepared two different schedules of gross margin for the first quarter ended March These schedules appear below.

tableSales $ per unitCost of Goods Sold,Gross MarginSchedule $$$Schedule

The computation of cost of goods sold in each schedule is based on the following data.

tableUnits,Cost per Unit,Total CostBeginning inventory, January $$Purchase January Purchase January Purchase February Purchase March

Jane Torville, the president of the corporation, cannot understand how two different gross margins can be computed from the same set of data. As the vice president of finance, you have explained to Ms Torville that the two schedules are based on different assumptions concerning the flow of inventory costs, ie FIFO and LIFO. Schedules and were not necessarily prepared in this sequence of cost flow assumptions.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock