Question: Instructions: Problem #1 Everything WACC Everything Corp. has operations in many different businesses, including the manufacturing of toasters. The goal in this problem is to

Instructions:

Problem #1 Everything WACC

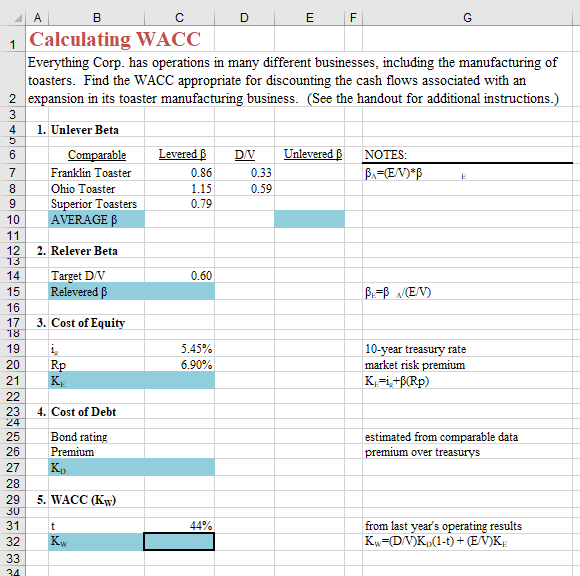

Everything Corp. has operations in many different businesses, including the manufacturing of toasters. The goal in this problem is to find the WACC appropriate for discounting the cash flows associated with an expansion in Everythings toaster manufacturing business. Because Everything Corp. is in multiple lines of business, its overall cost of capital is not appropriate for this purpose. Instead, you will need to find the betas of some comparable firms in order to calculate the WACC. Enter formulas in the appropriate cells in order to complete the five steps outlined.

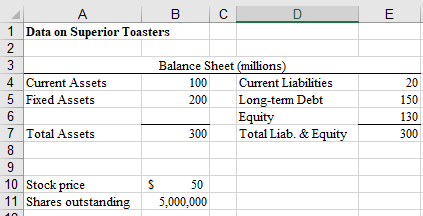

Step 1: Unlever Beta. Equity (levered) betas for three comparable firms are given. Unlever each beta to get the asset beta for each comp. Debt ratios are given for the first two comps, the third can be found using the financial statements for Superior Toasters on the second tab. Average the asset betas to get an estimate of the appropriate asset beta for Everythings investment in toaster manufacturing. Hint: be careful when entering your formulas for levering and unlevering, making sure that you use the right ratios (remember that D/V + E/V = 1 and that V = D + E).

Step 2: Relever Beta. Now relever the asset beta according to the appropriate capital structure for Everything. Note that when available, the target debt ratio is more appropriate than the current debt ratio, because it is more representative of what Everythings capital structure will be over the long run. Here the target debt ratio is given.

Step 3: Cost of Equity. Find the appropriate cost of equity (using the relevered beta) according to the CAPM.

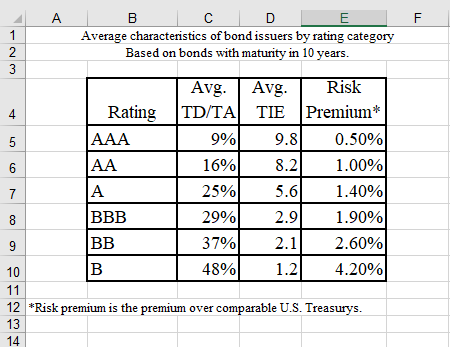

Step 4: Cost of Debt. For the cost of debt, wed like to use the yield to maturity on Everythings outstanding bonds. In this case, we dont know that information, so we need to estimate the cost of debt using data from comparable firms. This data is provided in the worksheet that says Bond data. Estimate Everythings bond rating assuming that Everything has a debt ratio (TD/TA) of 18% and a times-interest-earned ratio (TIE) of 7.7. Observe the premium (over 10-year treasurys) at which bonds of similar risk are trading, and use this premium to estimate Everythings cost of debt if it were to issue bonds to help finance this project.

Step 5: WACC. We now have all the pieces available to put together the appropriate WACC for Everythings investment in toaster manufacturing.

Q1: Under the assumptions given, what is the appropriate WACC for Everythings investment in toaster manufacturing? __________

Q2: Suppose that Everything determined that the appropriate target debt ratio for their toaster division would really be 0.4. What would be the WACC? __________

Problem #2 Nike Cola WACC

In this problem, you will analyze the hypothetical problem of Nike considering investing in the production of Nike Cola, a soft drink for active lifestyles. You will proceed in calculating the WACC as in the first problem, but now you will look up the necessary data on line. Some suggested on-line sources are given, but you may use others if you wish. Hint: it will take a bit of searching around to find the information you need at these sites, but the information is there, and youll get quicker at finding the information as you practice searching around. Note that in this problem your answers will vary depending on when data is retrieved because data (e.g. stock prices, risk-free rates) change in real time.

Step 1: Unlever Beta. The comparable firms will be Coca-Cola Co. (KO) and Pepsico Inc. (PEP). Find betas for these companies on line. Also calculate their debt ratios (D/V) from on-line data. Use their most recent financial statements available. When finding D use book values (we cant figure out market values) and use long-term sources of debt (i.e., total liabilities minus current liabilities.) The table to the right on the spreadsheet might be helpful for keeping track of the information you look up.

Q3: What is the average unlevered beta for Pepsico and Coca-Cola? __________

Step 2: Relever Beta. Now relever the asset beta according to Nikes (NKE) capital structure. You will not find their target debt ratio on line, so focus on their actual debt ratio from their most recent financial statements.

Step 3: Cost of Equity. For the risk-free rate (ig), use the yield currently available on treasury securities. You can find this rate on line. The only question is what maturity of treasurys to use. While opinions differ on this issue, my feeling is that you should use a maturity that is close to the time horizon of the investment considered. Ill suggest using a 10-year rate here.

Step 4: Cost of Debt. To keep this step simple, let me just tell you that Nike's credit rating right now is A. Now you can look up a representative yield for bonds of this rating on line. (For example, on Yahoo finance, try Bonds under the Investing tab, and look up Composite Bond Rates.) Assume Nike would issue 10-year bonds. (Note that in this case you are entering the yield on the bonds, not a premium over treasurys.)

Step 5: WACC. First, calculate Nikes tax rate from its most recent annual financial statements. Then you have all the pieces available to put together the appropriate WACC for Nikes investment in soft drinks.

Q4: What is the appropriate WACC for Nikes investment? __________

Q5: Suppose Nike estimated that the IRR of their soft-drink investment was 5.0%. How low would the market risk premium have to be in order for their investment to be justified? __________ (You can solve this with Goal Seek.)

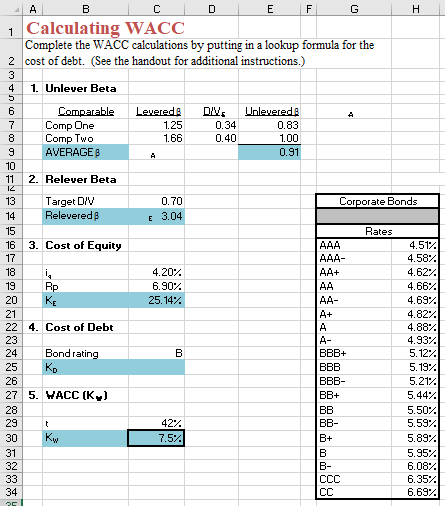

Problem #3 Look up values in a table

In this problem, the calculations are mostly filled in. Your job is to fill in the cost of debt by creating a lookup formula in Excel. To the right in the worksheet is a table of rates applicable to corporate bonds of different credit ratings. The formula in C25 needs to be such that it will adjust automatically when the bond rating is changed in C24. This is done with the VLOOKUP function, which looks up a value in a table and then returns a corresponding value. Find VLOOKUP under Excels list of functions. VLOOKUP is structured like this: VLOOKUP(cell reference of value to be looked up, cell references of complete table to look up value in, number of column in table corresponding to value you want returned, enter FALSE here). When you have entered the function correctly, you should be able to change the bond rating and see the cost of debt adjust automatically.

Q6: What is the WACC assuming a bond rating of AAA-? __________

Q7: What is the WACC assuming a bond rating of B? __________..

1 Calculating WACC Evervthing Corp. has operations in many different businesses, including the manufacturing of toasters. Find the WACC appropriate for discounting the cash flows associated with an 2 expansion in its toaster manufacturing business. (See the handout for additional instructions.) 41. Unlever Beta Comparable Levered Franklin Toaster Ohio Toaster Superior Toasters DUnleveredNOTES 0.86 1.15 0.79 0.33 0.59 10 AVERAGE B 12 2. Relever Beta 13 Target D/w 0.60 15 17 3. Cost of Equity 19 20 21 5.45% 6.90% 10-year treasury rate market risk premium 23 4. Cost of Debt 24 25 Bond rating 26 Premium 27 28 29 5. WACC (Kw) estimated from comparable data premium over treasurys from last year's operating results 32 1 Data on Superior Toasters Balance Sheet (millions) 4 Current Assets 5 Fixed Assets 100 Current Liabilities 200 Long-term Debt 20 150 130 300 Equity Total Liab. & Equity 7 Total Assets 300 10 Stock price 11 5,000,000 s 50 1 A Average characteristics of bond issuers by rating catego Based on bonds with maturity in 10 vears. Risk Avg. Avg TD/TA Rating 9%) 16% 25% 29% 37%) 48% TIE Premium* 9.81 0.50% 1 .00% 1 .40% 1 .90% 2.60% 4.20% 8.2 5.6 2.9 2.11 10 12 Risk premium is the p 13 remiumover comparable U.S. Trea reasurys. 1 Calculating WACC Complete the WACC calculations by putting in a lookup formula for the cost of debt. (See the handout for additional instructions.) 2 4 1. Unlever Beta 7 Comp One Comp Two AVERAGE 1.25 1.66 0.34 0.40 0.83 1.00 11 2. Relever Beta 0.70 3.04 Target DIV Corporate Bonds 14 Releveredp 15 16 3. Cost of Equity Rates 4.51% 4.58; 4.62% 4.66 4.69% 4.82% 4.88% 4.93 5.12% 5.19% 5.21% 5.44% 5.50% 5.59% 5.89% 5.95 6.08% 6.35% 6.69% 18 19 4.20% 6, 90% 25.14% 22 4. Cost of Debt 23 24 Bond rating 27 5.HACC (K,) 28 42. 7.5 32 1 Calculating WACC Evervthing Corp. has operations in many different businesses, including the manufacturing of toasters. Find the WACC appropriate for discounting the cash flows associated with an 2 expansion in its toaster manufacturing business. (See the handout for additional instructions.) 41. Unlever Beta Comparable Levered Franklin Toaster Ohio Toaster Superior Toasters DUnleveredNOTES 0.86 1.15 0.79 0.33 0.59 10 AVERAGE B 12 2. Relever Beta 13 Target D/w 0.60 15 17 3. Cost of Equity 19 20 21 5.45% 6.90% 10-year treasury rate market risk premium 23 4. Cost of Debt 24 25 Bond rating 26 Premium 27 28 29 5. WACC (Kw) estimated from comparable data premium over treasurys from last year's operating results 32 1 Data on Superior Toasters Balance Sheet (millions) 4 Current Assets 5 Fixed Assets 100 Current Liabilities 200 Long-term Debt 20 150 130 300 Equity Total Liab. & Equity 7 Total Assets 300 10 Stock price 11 5,000,000 s 50 1 A Average characteristics of bond issuers by rating catego Based on bonds with maturity in 10 vears. Risk Avg. Avg TD/TA Rating 9%) 16% 25% 29% 37%) 48% TIE Premium* 9.81 0.50% 1 .00% 1 .40% 1 .90% 2.60% 4.20% 8.2 5.6 2.9 2.11 10 12 Risk premium is the p 13 remiumover comparable U.S. Trea reasurys. 1 Calculating WACC Complete the WACC calculations by putting in a lookup formula for the cost of debt. (See the handout for additional instructions.) 2 4 1. Unlever Beta 7 Comp One Comp Two AVERAGE 1.25 1.66 0.34 0.40 0.83 1.00 11 2. Relever Beta 0.70 3.04 Target DIV Corporate Bonds 14 Releveredp 15 16 3. Cost of Equity Rates 4.51% 4.58; 4.62% 4.66 4.69% 4.82% 4.88% 4.93 5.12% 5.19% 5.21% 5.44% 5.50% 5.59% 5.89% 5.95 6.08% 6.35% 6.69% 18 19 4.20% 6, 90% 25.14% 22 4. Cost of Debt 23 24 Bond rating 27 5.HACC (K,) 28 42. 7.5 32

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts