Question: Instructions Required: 1. Prepare an income statement for the year ended December 31. Be sure to complete the statement heading. Refer to the Chart of

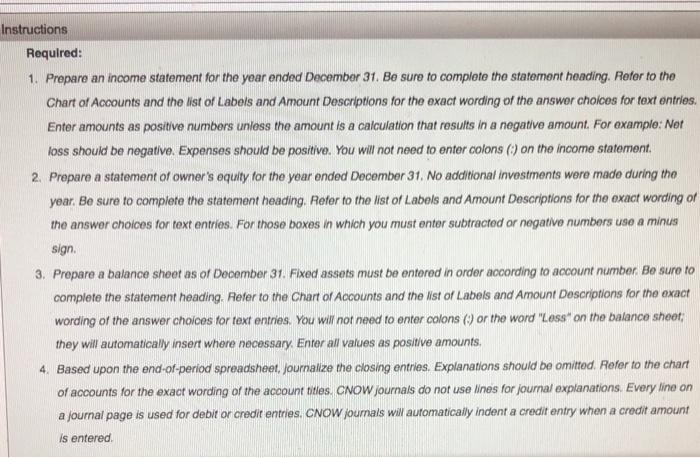

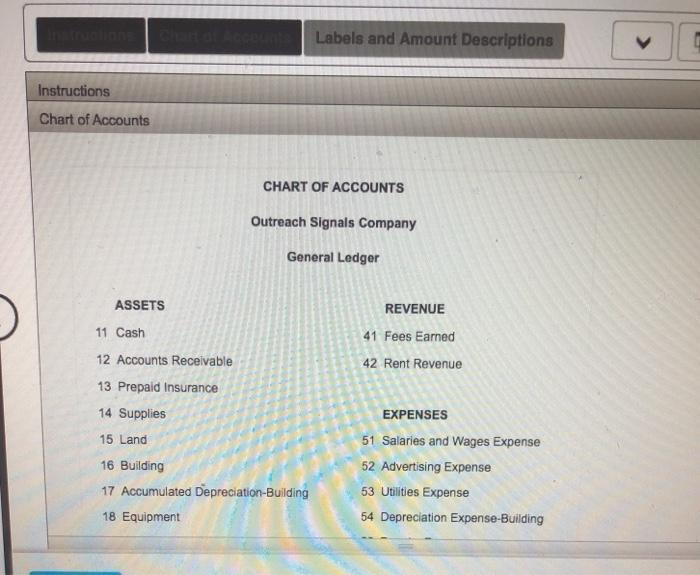

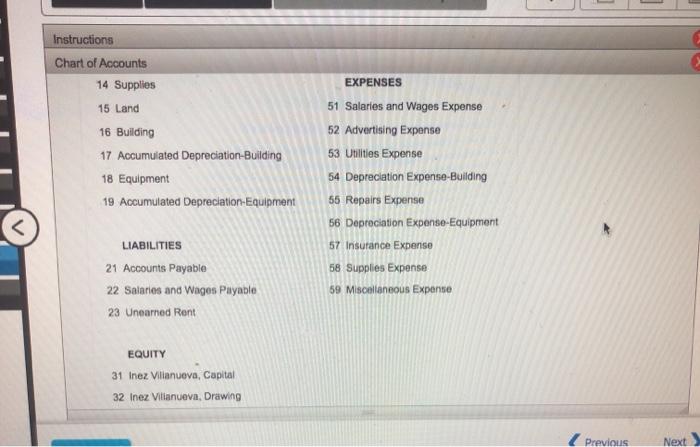

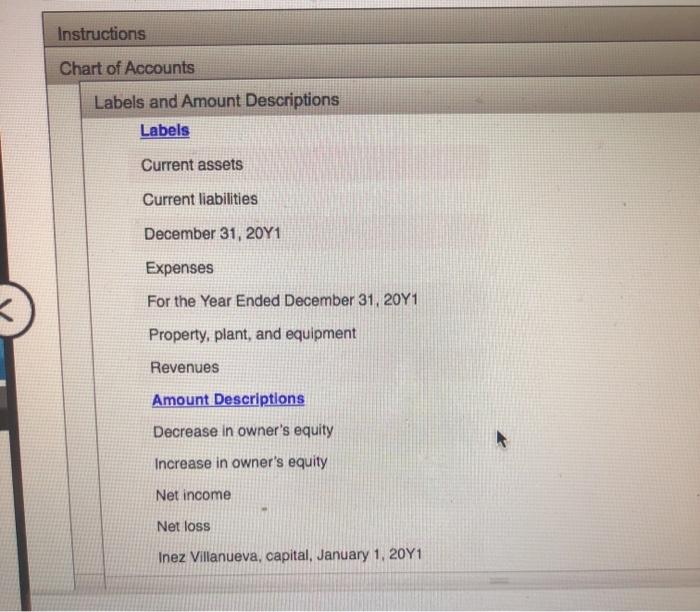

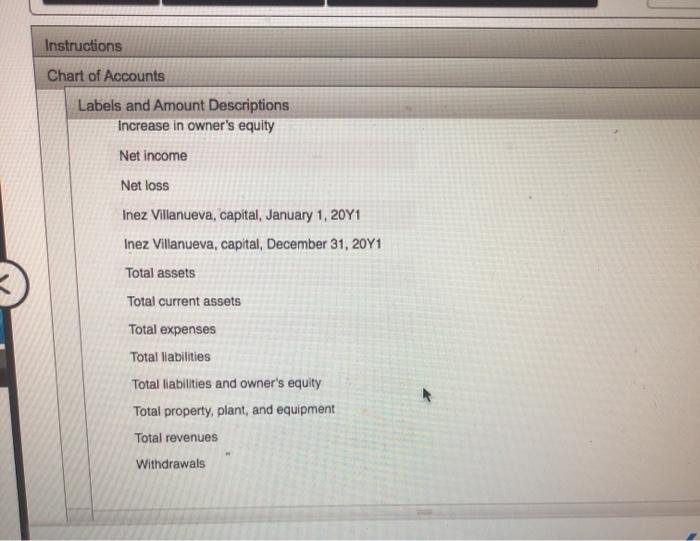

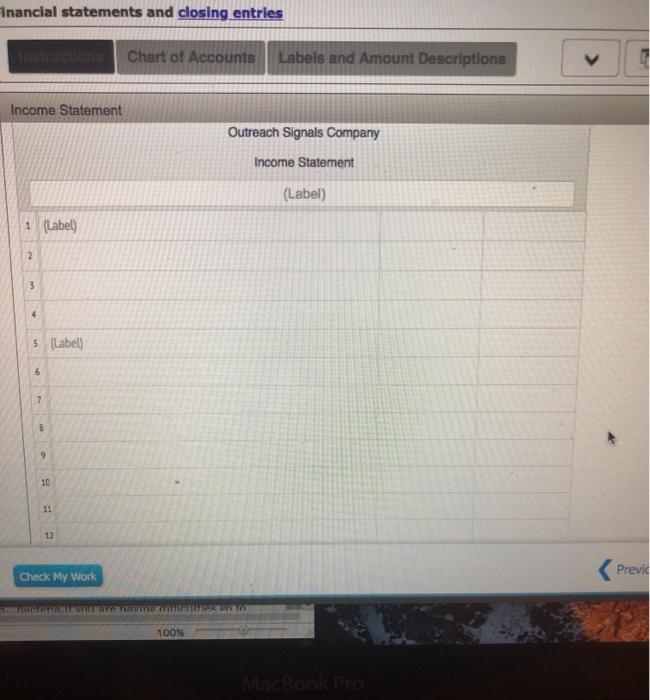

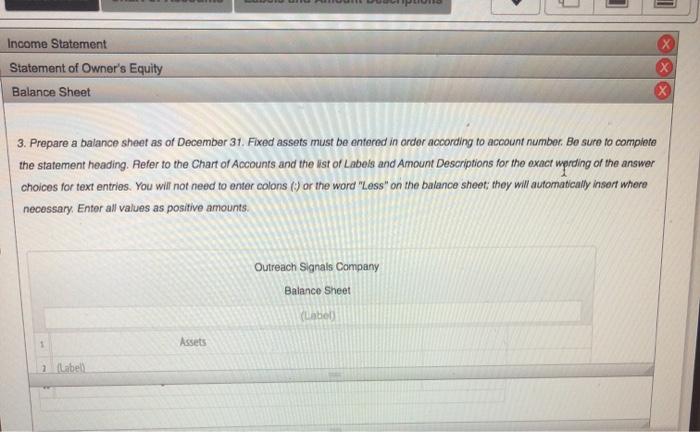

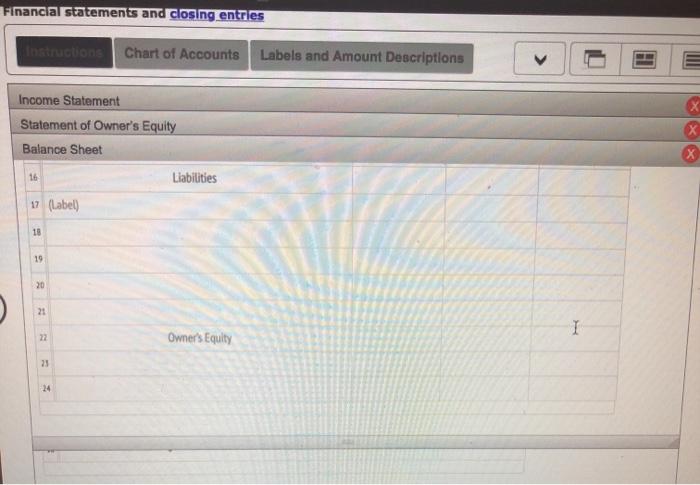

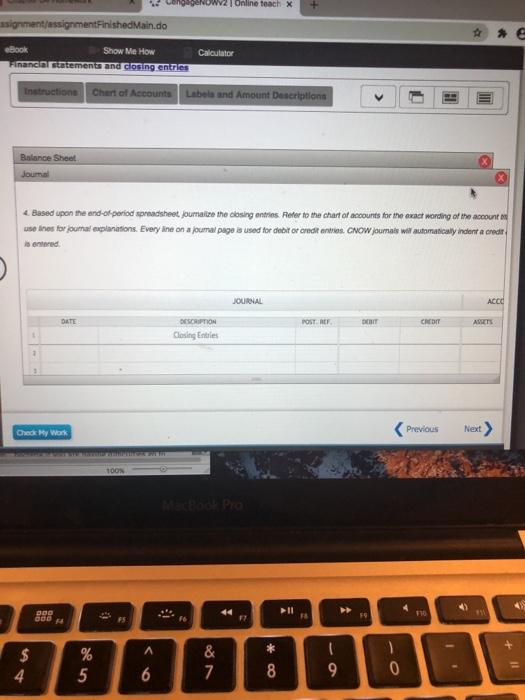

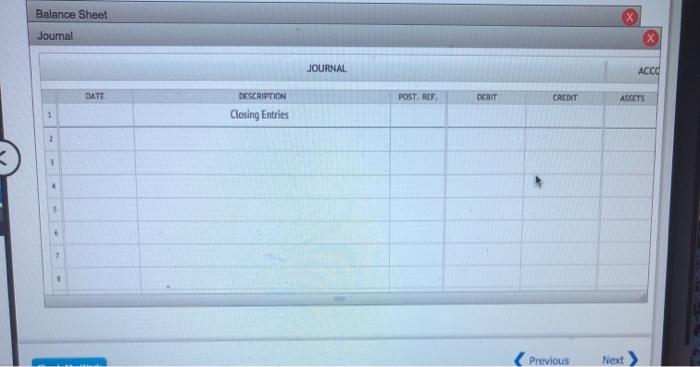

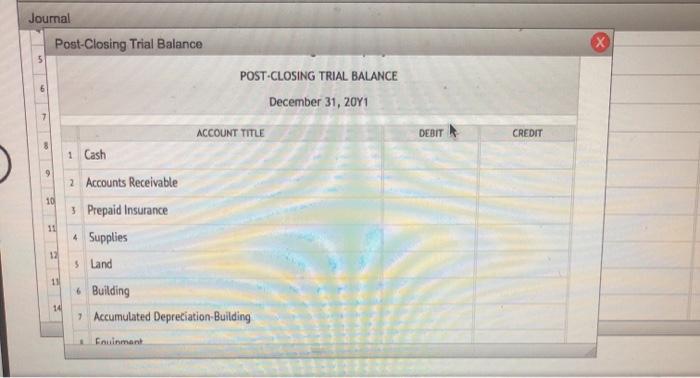

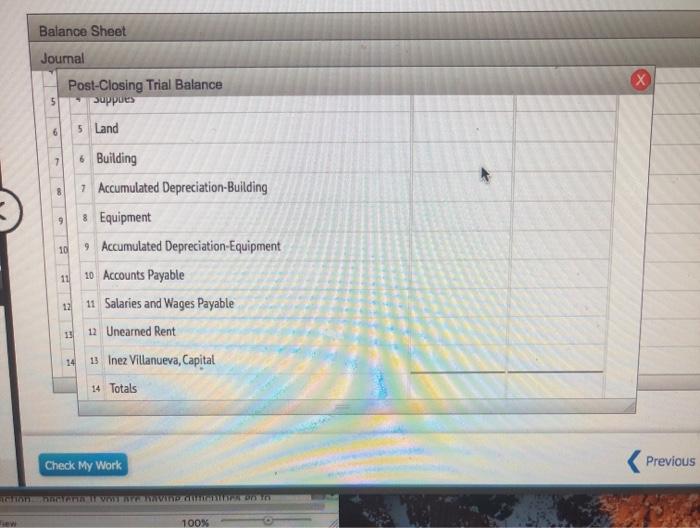

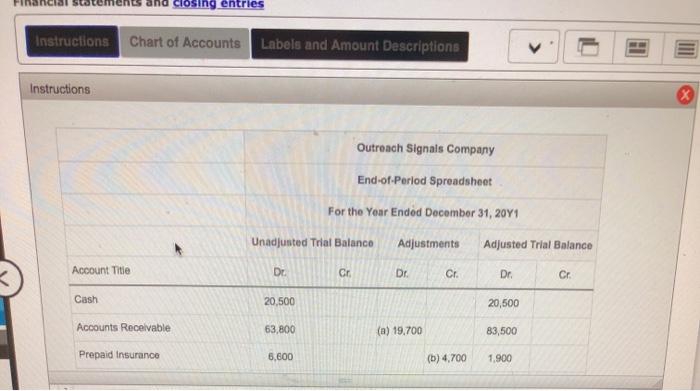

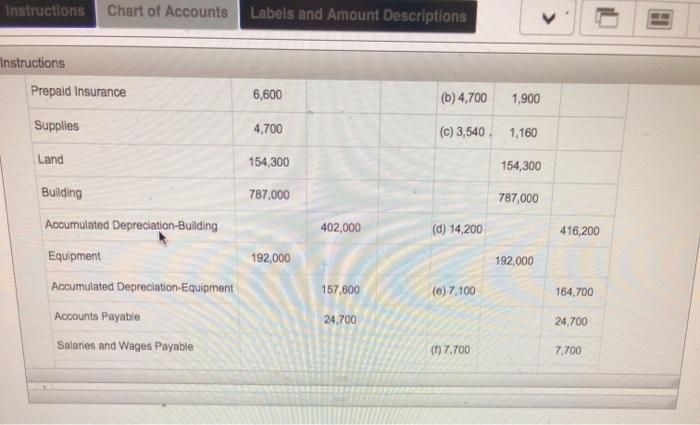

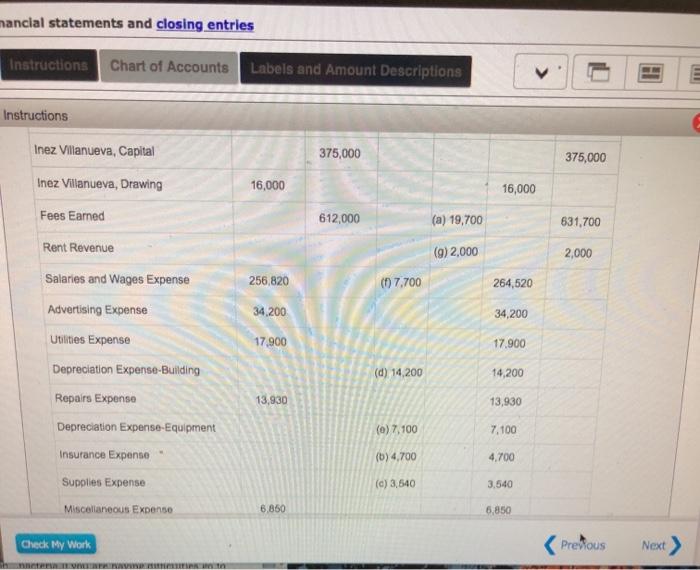

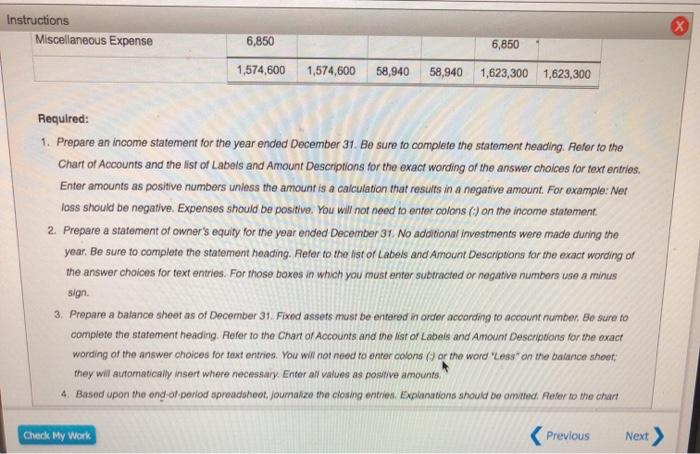

Instructions Required: 1. Prepare an income statement for the year ended December 31. Be sure to complete the statement heading. Refer to the Chart of Accounts and the list of Labels and Amount Descriptions for the exact wording of the answer choices for text entries. Enter amounts as positive numbers unless the amount is a calculation that results in a negative amount. For example: Ner loss should be negative. Expenses should be positive. You will not need to enter colons() on the income statement 2. Prepare a statement of owner's equity for the year ended December 31. No additional investments were made during the year. Be sure to complete the statement heading. Refer to the list of Labels and Amount Descriptions for the exact wording of the answer choices for text entries. For those boxes in which you must enter subtracted or negative numbers use a minus sign 3. Prepare a balance sheet as of December 31. Fixed assets must be entered in order according to account number. Be sure to complete the statement heading. Refer to the Chart of Accounts and the list of Labels and Amount Descriptions for the exact wording of the answer choices for text entries. You will not need to enter colons () or the word "Less" on the balance sheet they will automatically insert where necessary Enter all values as positive amounts. 4. Based upon the end-of-period spreadsheet, Journalize the closing entries. Explanations should be omitted. Refer to the chart of accounts for the exact wording of the account titles. CNOW journals do not use lines for journal explanations. Every line on a journal page is used for debitor credit entries. CNOW joumals will automatically indent a credit entry when a credit amount is entered Labels and Amount Descriptions V Instructions Chart of Accounts CHART OF ACCOUNTS Outreach Signals Company General Ledger ASSETS 11 Cash REVENUE 41 Fees Earned 42 Rent Revenue 12 Accounts Receivable 13 Prepaid Insurance 14 Supplies 15 Land 16 Building 17 Accumulated Depreciation Building 18 Equipment EXPENSES 51 Salaries and Wages Expense 52 Advertising Expense 53 Utilities Expense 54 Depreciation Expense-Building Instructions Chart of Accounts 14 Supplies 15 Land 16 Building 17 Accumulated Depreciation-Building 18 Equipment 19 Accumulated Depreciation Equipment EXPENSES 51 Salaries and Wages Expense 52 Advertising Expense 53 Utilities Expense 54 Depreciation Expense-Building 55 Repairs Expense 56 Depreciation Expense-Equipment 57 Insurance Expense 58 Supplies Expense 69 Miscellaneous Expense LIABILITIES 21 Accounts Payable 22 Salaries and Wages Payable 23 Unnamed Rent EQUITY 31 Inez Villanueva, Capital 32 Inez Villanueva, Drawing Previous Next Instructions Chart of Accounts Labels and Amount Descriptions Labels Current assets Current liabilities December 31, 20Y1 Expenses For the Year Ended December 31, 20Y1 Property, plant, and equipment Revenues Amount Descriptions Decrease in owner's equity Increase in owner's equity Net income Net loss Inez Villanueva, capital, January 1, 20Y1 Instructions Chart of Accounts Labels and Amount Descriptions Increase in owner's equity Net income Net loss Inez Villanueva, capital, January 1, 20Y1 Inez Villanueva, capital, December 31, 20Y1 Total assets Total current assets Total expenses Total liabilities Total liabilities and owner's equity Total property, plant, and equipment Total revenues Withdrawals inancial statements and closing entries Chart of Accounts Labels and Amount Descriptions Income Statement Outreach Signals Company Income Statement (Label) 1 (Label) 2 3 4 $ (Label) 6 7 3 9 10 11 12 Previc Check My Work Avina 100% MacBook Pro Financial statements and closing entries Chart of Accounts Labels and Amount Descriptions Income Statement 4 5 (Label) 7 8 9 10 11 12 13 14 15 16 Pre Check My Work Instructions Chart of Accounts Labels and Amount Descriptions Income Statement Statement of Owner's Equity x x 2. Prepare a statement of owner's equity for the year ended December 31. No additional investments were made during the year. Be sure to complete the statement heading. Refer to the list of Labels and Amount Descriptions for the exact wording of the answer choices for text entries. For those boxes in which you must enter subtracted or negative numbers use a minus sign Outreach Signals Company Statement of Owner's Equity (Label) 1 2 16 Income Statement Statement of Owner's Equity Outreach Signals Company Statement of Owner's Equity (Label) 1 2 3 4 5 Income Statement Statement of Owner's Equity Balance Sheet x 3. Prepare a balance sheet as of December 31. Fixed assets must be entered in order according to account number. Be sure to complete the statement heading. Refer to the Chart of Accounts and the list of Labels and Amount Descriptions for the exact wprding of the answer choices for text entries. You will not need to enter colons () or the word "Less" on the balance sheet: they will automatically insert where necessary Enter all values as positive amounts Outreach Signals Company Balance Sheet (Label 1 Assets 2 label Financial statements and closing entries Chart of Accounts Labels and Amount Descriptions Income Statement Statement of Owner's Equity Balance Sheet Outreach Signals Company Balance Sheet (Label) 1 Assets 2 (Label) 3 4 5 6 7 Financial statements and closing entries Chart of Accounts Labels and Amount Descriptions Income Statement Statement of Owner's Equity Balance Sheet x X 7 1 (Label) 9 10 11 12 I 13 14 15 16 Liabilities Financial statements and closing entries Instruction Chart of Accounts Labels and Amount Descriptions Income Statement Statement of Owner's Equity Balance Sheet 16 Liabilities 17 (Label 18 19 20 21 I 22 Owner's Equity 23 24 1 Online teach X signments hentFinishedMain.do R Calculator eBook Show Me How Financial statements and closing entries Instructions Chart of Accounts Label and Amount Descriptions X Balance Sheet Journal 4. Based upon the end of period spreadsheet, joumate the closing entries. Refer to the chart of accounts for the exact wording of the account use inos for ouma explanations. Every ine on a journal page is use is used for debit or conde enties. CNOW Jumat will automatically indent a crede is entered JOURNAL ACCO DATE POSTER DET CREDIT AMETS DESCRIPTION Closing Entries Check My Work Previous Next) TOON DOO 4 II 0 FO To 200 FS F A $ 4 % 5 & 7 Oo * 1 0 11+ 6 9 Balance Sheet Journal JOURNAL ACCO DATE POST. REF DEBIT CREDIT ACSETS DESCRIPTION Closing Entries 1 2 3 4 5 7 1 Previous Next Journal Post-Closing Trial Balance 5 POST-CLOSING TRIAL BALANCE December 31, 2011 ACCOUNT TITLE DEBIT CREDIT 1 Cash 9 2 Accounts Receivable 10 3. Prepaid Insurance 11 4 Supplies 12 5 Land 11 141 6 Building Accumulated Depreciation Building Fouinment Balance Sheet Journal X Post-Closing Trial Balance suppues 5 6 5 Land 7 8 9 10 6 Building Accumulated Depreciation-Building 8 Equipment 9 Accumulated Depreciation Equipment 10 Accounts Payable 11 Salaries and Wages Payable 12 Unearned Rent 11 12 10 14 13 Inez Villanueva, Capital 14 Totals Check My Work Previous on VIDEO 100% entries Instructions Chart of Accounts Labels and Amount Descriptions V Instructions Outreach Signals Company End-of-Period Spreadsheet For the Year Ended December 31, 20Y1 Unadjusted Trial Balance Adjustments Adjusted Trial Balance Account Title Dr. Gr. Dr. Cr. Dr. Cr. Cash 20,500 20,500 Accounts Receivable 63,800 (a) 19,700 83,500 Prepaid Insurance 6,600 (b) 4.700 1,900 Instructions Chart of Accounts Labels and Amount Descriptions Instructions Prepaid Insurance 6,600 (b) 4,700 1,900 Supplies 4,700 (c) 3,540 1,160 Land 154,300 154,300 Building 787,000 787,000 Accumulated Depreciation-Building 402,000 (d) 14,200 416,200 192,000 192,000 Equipment Accumulated Depreciation-Equipment 157,600 (0) 7.100 164,700 Accounts Payable 24,700 24,700 Salaries and Wages Payable (67.700 7,700 mancial statements and closing entries Instructions Chart of Accounts Labels and Amount Descriptions M Instructions Inez Villanueva, Capital 375,000 375,000 Inez Villanueva, Drawing 16,000 16,000 Fees Earned 612,000 (a) 19,700 631,700 Rent Revenue (9) 2,000 2,000 256,820 (1) 7.700 264,520 34,200 34,200 17.900 17.900 Salaries and Wages Expense Advertising Expense Utilities Expense Depreciation Expense-Building Repairs Expense Depreciation Expense-Equipment Insurance Expense Supplies Expense (d) 14,200 14,200 13,930 13,930 (0) 7,100 7.100 (b) 4,700 4.700 (c) 3,540 3.540 Miscellaneous Expense 6,850 6,850 Check My Work Preous Next > PENTIVERA Instructions Miscellaneous Expense 6,850 6,850 1,574,600 1,574,600 58,940 58,940 1,623,300 1,623,300 Required: 1. Prepare an income statement for the year ended December 31. Be sure to complete the statement heading. Peter to the Chart of Accounts and the list of Labels and Amount Descriptions for the exact wording of the answer choices for text entries, Enter amounts as positive numbers unless the amount is a calculation that results in a negative amount. For example: Net loss should be negative. Expenses should be positive. You will not need to enter colons() on the income statement. 2. Prepare a statement of owner's equity for the year ended December 31 No additional investments were made during the year. Be sure to complete the statement heading. Refer to the list of Labels and Amount Descriptions for the exact wording or the answer choices for text entries. For those boxes in which you must enter subtracted or negative numbers use a minus sign 3. Prepare a batance sheet as of December 31. Fixed assets must be entered in order according to account number. Be sure to complete the statement heading. Refer to the Chart of Accounts and the list of Labels and Amount Descriptions for the oxact wording of the answer choices for text entries. You will not need to enter colons (or the word "Less" on the balance sheet they will automatically insert where necessary Enter all values as positive amounts 4. Based upon the end of perlod spreadsheet, journalize the closing entries. Explorations should be omwited. Refer to the chart Check My Work Previous Next >

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts