Question: Instructions Round u p critical values d 1 and d 2 t o four decimal places. Use Excel, Matlab o r any package o f

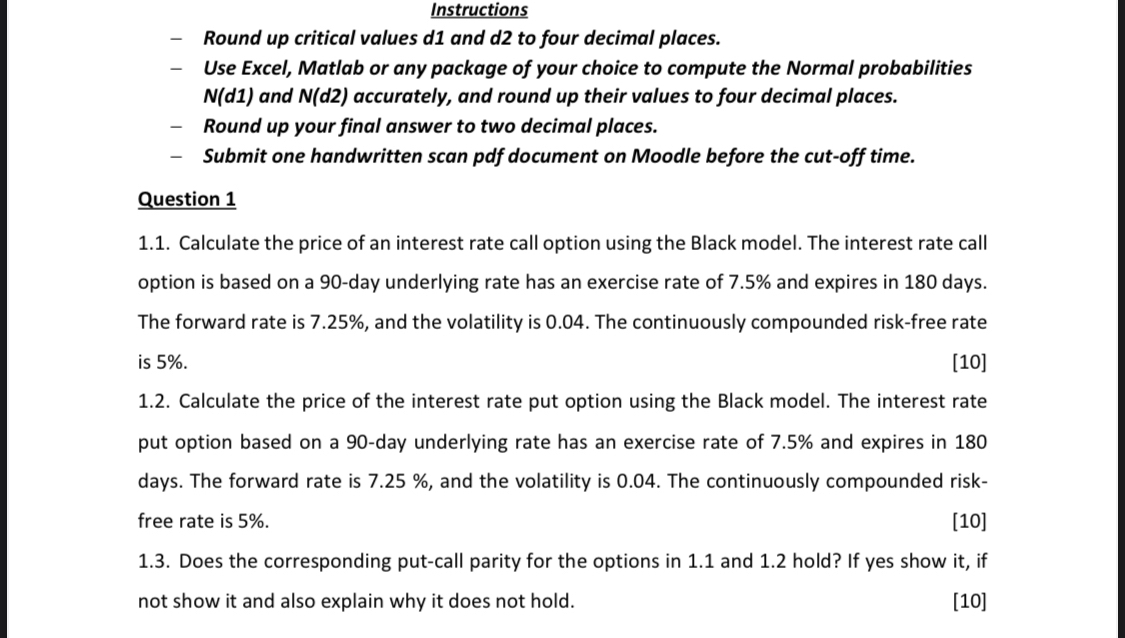

Instructions

Round critical values and four decimal places.

Use Excel, Matlab any package your choice compute the Normal probabilities

and accurately, and round their values four decimal places.

Round your final answer two decimal places.

Submit one handwritten scan document Moodle before the cutoff time.

Question

Calculate the price interest rate call option using the Black model. The interest rate call

option based day underlying rate has exercise rate and expires days.

The forward rate and the volatility The continuously compounded riskfree rate

Calculate the price the interest rate put option using the Black model. The interest rate

put option based day underlying rate has exercise rate and expires

days. The forward rate and the volatility The continuously compounded risk

free rate

Does the corresponding putcall parity for the options and hold? yes show

not show and also explain why does not hold.

Instructions

Round critical values and four decimal places.

Use Excel, Matlab any package your choice compute the Normal probabilities

and accurately, and round their values four decimal places.

Round your final answer two decimal places.

Submit one handwritten scan document Moodle before the cutoff time.

Question

Calculate the price interest rate call option using the Black model. The interest rate call

option based day underlying rate has exercise rate and expires days.

The forward rate and the volatility The continuously compounded riskfree rate

Calculate the price the interest rate put option using the Black model. The interest rate

put option based day underlying rate has exercise rate and expires

days. The forward rate and the volatility The continuously compounded risk

free rate

Does the corresponding putcall parity for the options and hold? yes show

not show and also explain why does not hold.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock