Question: Instructions Solving Financial Problems with Excel Functions 1. You pay $25.00 for a bond which can be redeemed in 20 years for $50.00. What annual

Instructions

Solving Financial Problems with Excel Functions

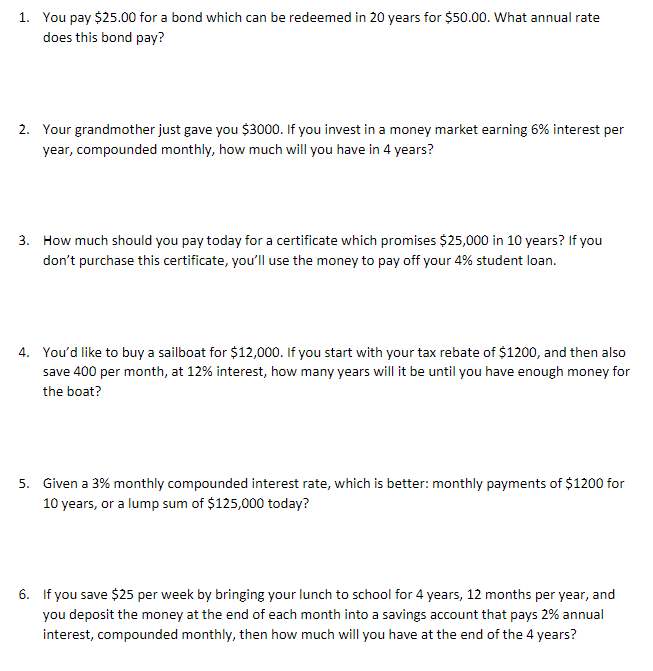

1. You pay $25.00 for a bond which can be redeemed in 20 years for $50.00. What annual rate does this bond pay? 2. Your grandmother just gave you $3000. If you invest in a money market earning 6% interest per year, compounded monthly, how much will you have in 4 years? 3. How much should you pay today for a certificate which promises $25,000 in 10 years? If you don't purchase this certificate, you'll use the money to pay off your 4% student loan. 4. You'd like to buy a sailboat for $12,000. If you start with your tax rebate of $1200, and then also save 400 per month, at 12% interest, how many years will it be until you have enough money for the boat? 5. Given a 3% monthly compounded interest rate, which is better: monthly payments of $1200 for 10 years, or a lump sum of $125,000 today? 6. If you save $25 per week by bringing your lunch to school for 4 years, 12 months per year, and you deposit the money at the end of each month into a savings account that pays 2% annual interest, compounded monthly, then how much will you have at the end of the 4 years

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts