Question: Instructions Task 3: Common-size and Comparative Analysis Follow the format of the attached example to conduct these two analyses for both balance sheet and income

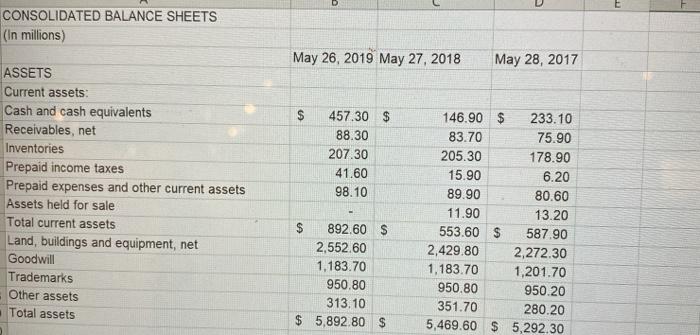

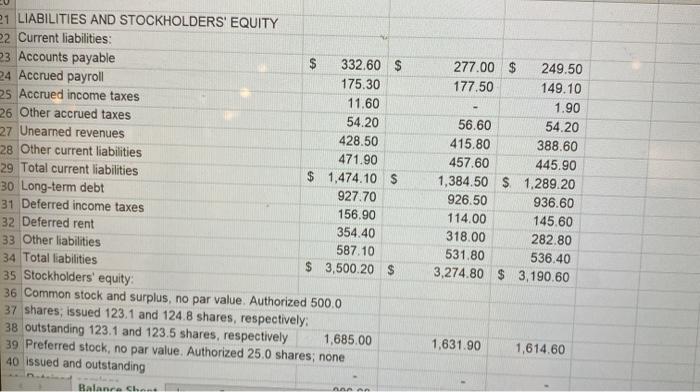

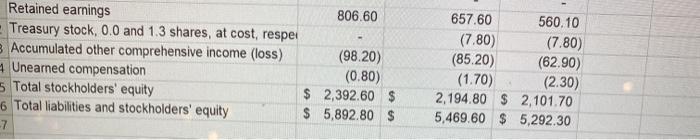

Instructions Task 3: Common-size and Comparative Analysis Follow the format of the attached example to conduct these two analyses for both balance sheet and income statement for all three years. CONSOLIDATED BALANCE SHEETS (In millions) May 26, 2019 May 27, 2018 May 28, 2017 $ ASSETS Current assets: Cash and cash equivalents Receivables, net Inventories Prepaid income taxes Prepaid expenses and other current assets Assets held for sale Total current assets Land, buildings and equipment, net Goodwill Trademarks Other assets Total assets 457.30 $ 88.30 207.30 41.60 98.10 $ $ 892.60 $ 2,552.60 1,183.70 950.80 313.10 $ 5,892.80 $ 146.90 $ 233.10 83.70 75.90 205.30 178.90 15.90 6.20 89.90 80.60 11.90 13.20 553.60 $ 587.90 2,429.80 2,272.30 1,183.70 1,201.70 950.80 950.20 351.70 280.20 5,469.60 $ 5,292.30 21 LIABILITIES AND STOCKHOLDERS' EQUITY 22 Current liabilities: 23 Accounts payable $ 332.60 $ 24 Accrued payroll 175.30 25 Accrued income taxes 11.60 26 Other accrued taxes 54.20 27 Unearned revenues 428.50 28 Other current liabilities 471.90 29 Total current liabilities $ 1,474.10 $ 30 Long-term debt 927.70 31 Deferred income taxes 156.90 32 Deferred rent 354.40 33 Other liabilities 587.10 34 Total liabilities $ 3,500.20 $ 35 Stockholders' equity 36 Common stock and surplus, no par value. Authorized 500.0 37 shares, issued 123.1 and 124.8 shares, respectively, 38 outstanding 123.1 and 123.5 shares, respectively 1,685.00 39 Preferred stock, no par value. Authorized 25.0 shares, none 40 issued and outstanding Balance Ch. 277.00 $ 249.50 177.50 149.10 1.90 56.60 54.20 415.80 388.60 457.60 445.90 1,384.50 $ 1.289.20 926.50 936.60 114.00 145.60 318.00 282.80 531.80 536.40 3,274.80 $ 3.190.60 1,631.90 1,614.60 ANA Retained earnings 806.60 - Treasury stock, 0.0 and 1.3 shares, at cost, respet Accumulated other comprehensive income (loss) (98.20) Unearned compensation (0.80) 5 Total stockholders' equity $ 2,392.60 $ 6 Total liabilities and stockholders' equity $ 5,892.80 $ 657.60 560.10 (7.80) (7.80) (85.20) (62.90) (1.70) (2.30) 2,194.80 $ 2,101.70 5,469.60 $ 5,292.30 -7 Instructions Task 3: Common-size and Comparative Analysis Follow the format of the attached example to conduct these two analyses for both balance sheet and income statement for all three years. CONSOLIDATED BALANCE SHEETS (In millions) May 26, 2019 May 27, 2018 May 28, 2017 $ ASSETS Current assets: Cash and cash equivalents Receivables, net Inventories Prepaid income taxes Prepaid expenses and other current assets Assets held for sale Total current assets Land, buildings and equipment, net Goodwill Trademarks Other assets Total assets 457.30 $ 88.30 207.30 41.60 98.10 $ $ 892.60 $ 2,552.60 1,183.70 950.80 313.10 $ 5,892.80 $ 146.90 $ 233.10 83.70 75.90 205.30 178.90 15.90 6.20 89.90 80.60 11.90 13.20 553.60 $ 587.90 2,429.80 2,272.30 1,183.70 1,201.70 950.80 950.20 351.70 280.20 5,469.60 $ 5,292.30 21 LIABILITIES AND STOCKHOLDERS' EQUITY 22 Current liabilities: 23 Accounts payable $ 332.60 $ 24 Accrued payroll 175.30 25 Accrued income taxes 11.60 26 Other accrued taxes 54.20 27 Unearned revenues 428.50 28 Other current liabilities 471.90 29 Total current liabilities $ 1,474.10 $ 30 Long-term debt 927.70 31 Deferred income taxes 156.90 32 Deferred rent 354.40 33 Other liabilities 587.10 34 Total liabilities $ 3,500.20 $ 35 Stockholders' equity 36 Common stock and surplus, no par value. Authorized 500.0 37 shares, issued 123.1 and 124.8 shares, respectively, 38 outstanding 123.1 and 123.5 shares, respectively 1,685.00 39 Preferred stock, no par value. Authorized 25.0 shares, none 40 issued and outstanding Balance Ch. 277.00 $ 249.50 177.50 149.10 1.90 56.60 54.20 415.80 388.60 457.60 445.90 1,384.50 $ 1.289.20 926.50 936.60 114.00 145.60 318.00 282.80 531.80 536.40 3,274.80 $ 3.190.60 1,631.90 1,614.60 ANA Retained earnings 806.60 - Treasury stock, 0.0 and 1.3 shares, at cost, respet Accumulated other comprehensive income (loss) (98.20) Unearned compensation (0.80) 5 Total stockholders' equity $ 2,392.60 $ 6 Total liabilities and stockholders' equity $ 5,892.80 $ 657.60 560.10 (7.80) (7.80) (85.20) (62.90) (1.70) (2.30) 2,194.80 $ 2,101.70 5,469.60 $ 5,292.30 -7

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts