Question: Instructions The following are independent errors made by a company that uses the periodic inventory system: a. Goods in transit, purchased on credit and

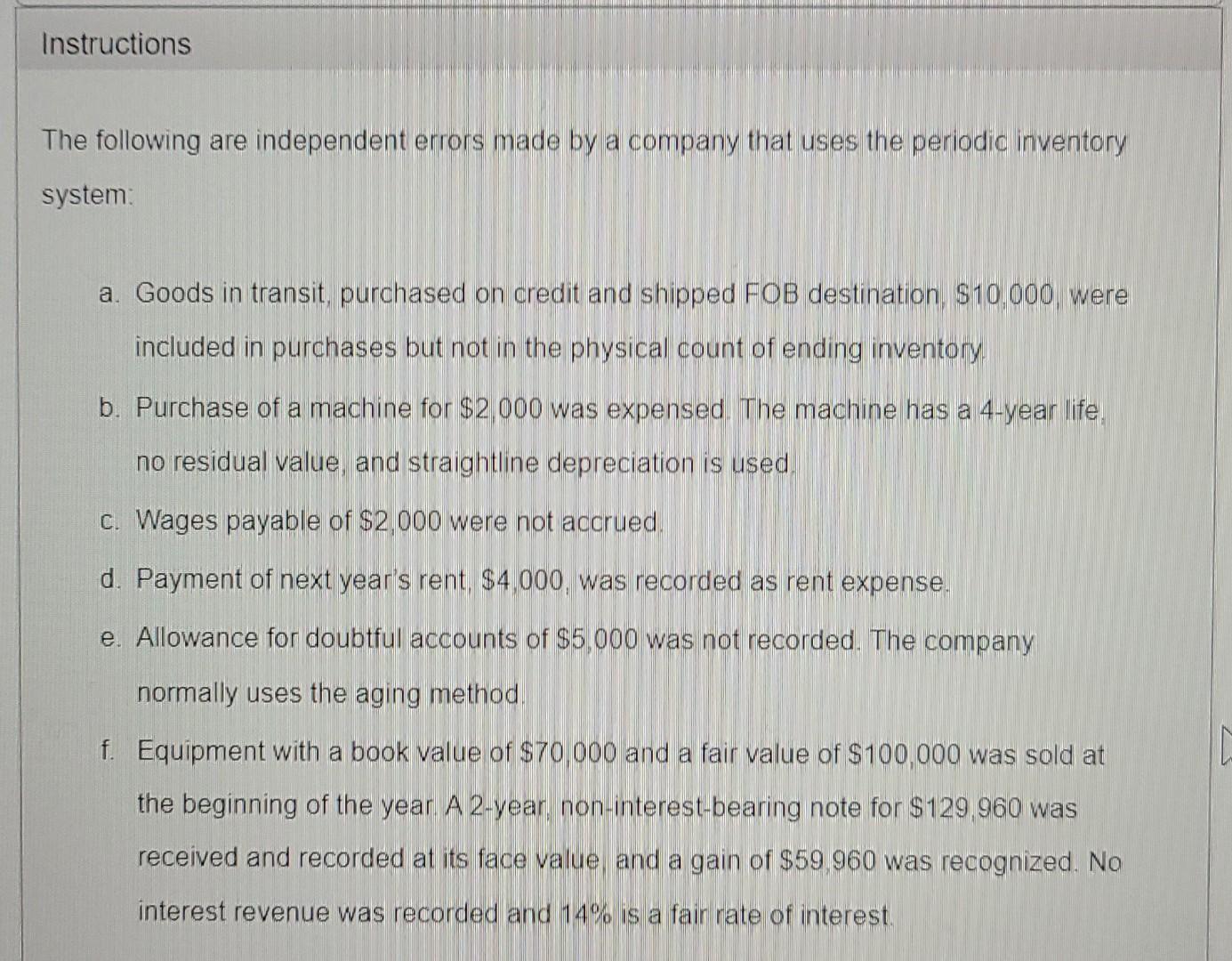

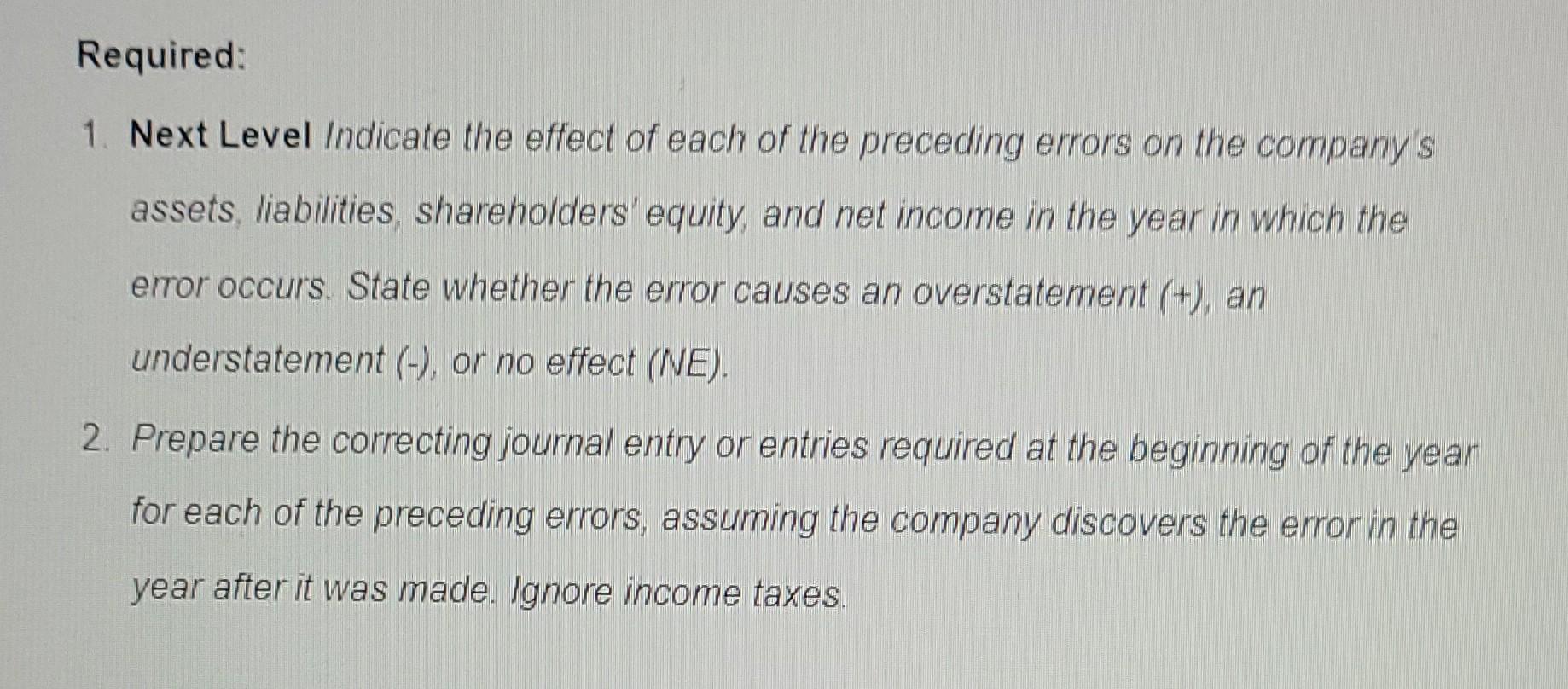

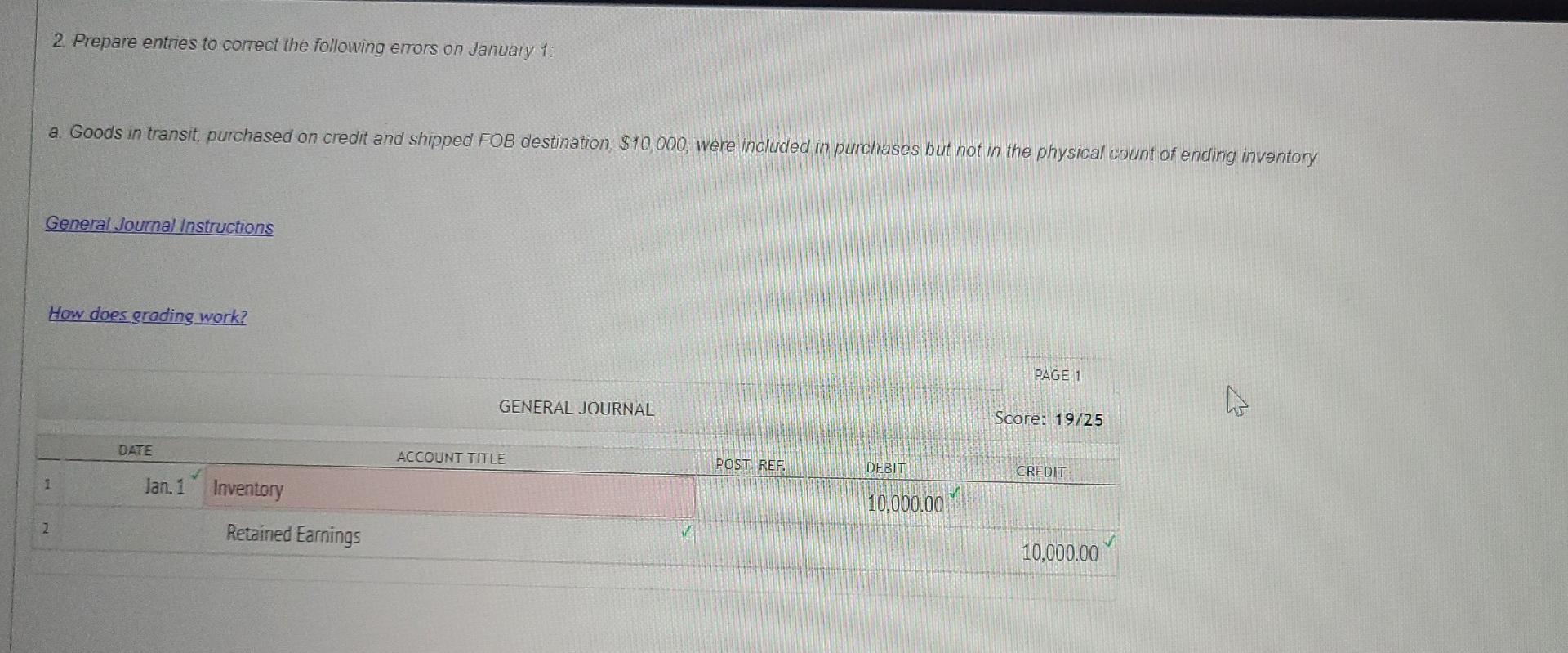

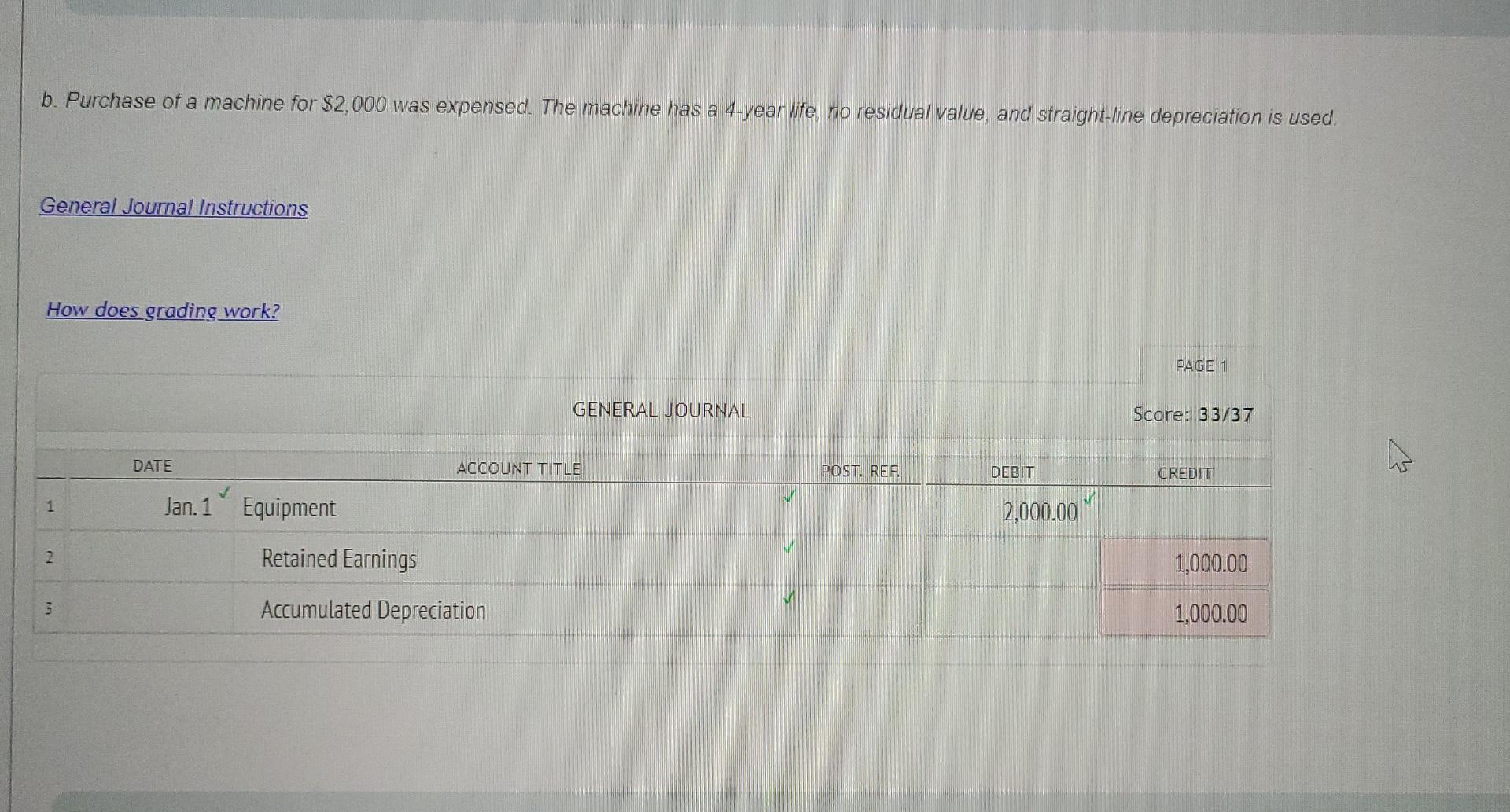

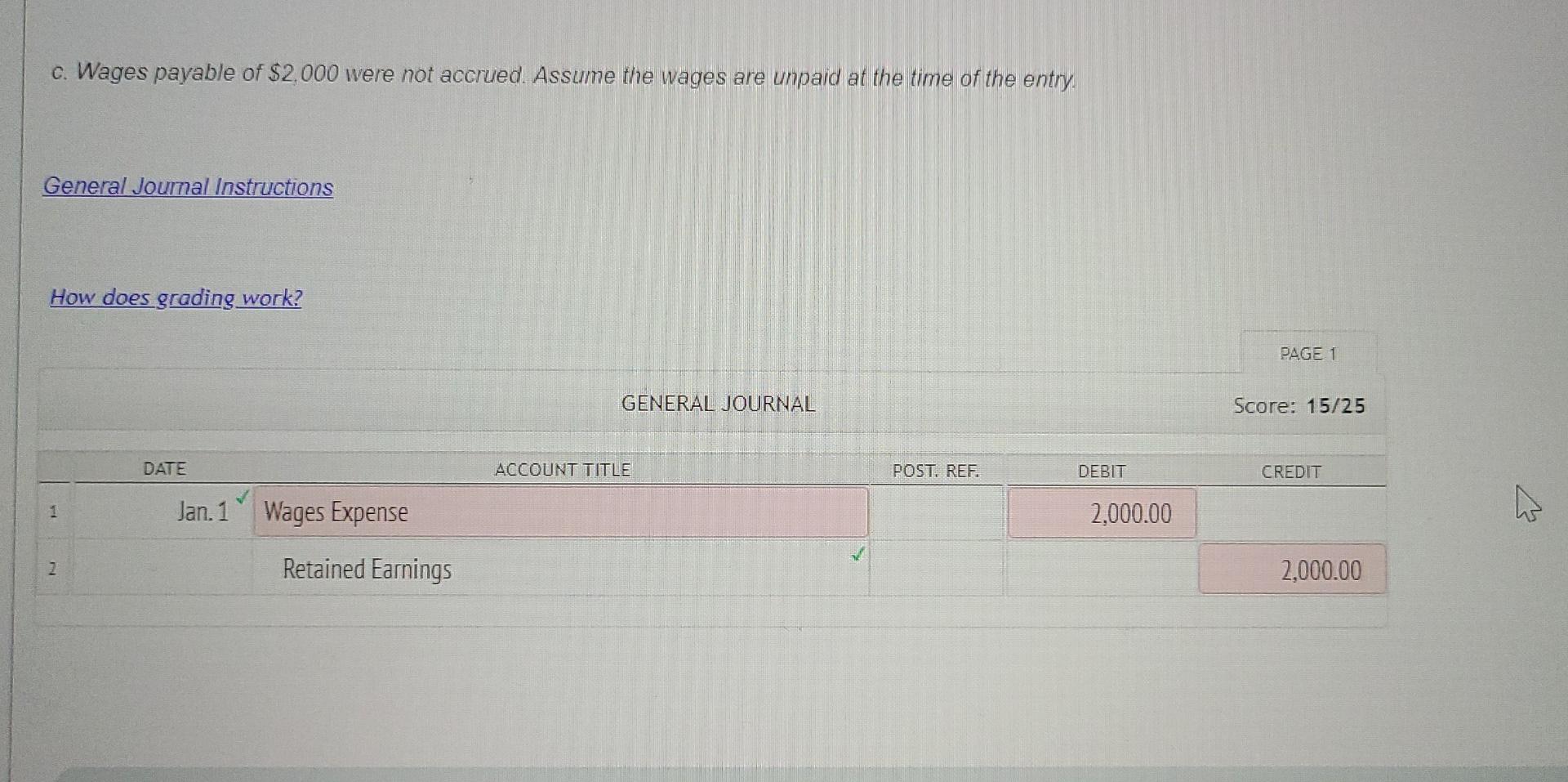

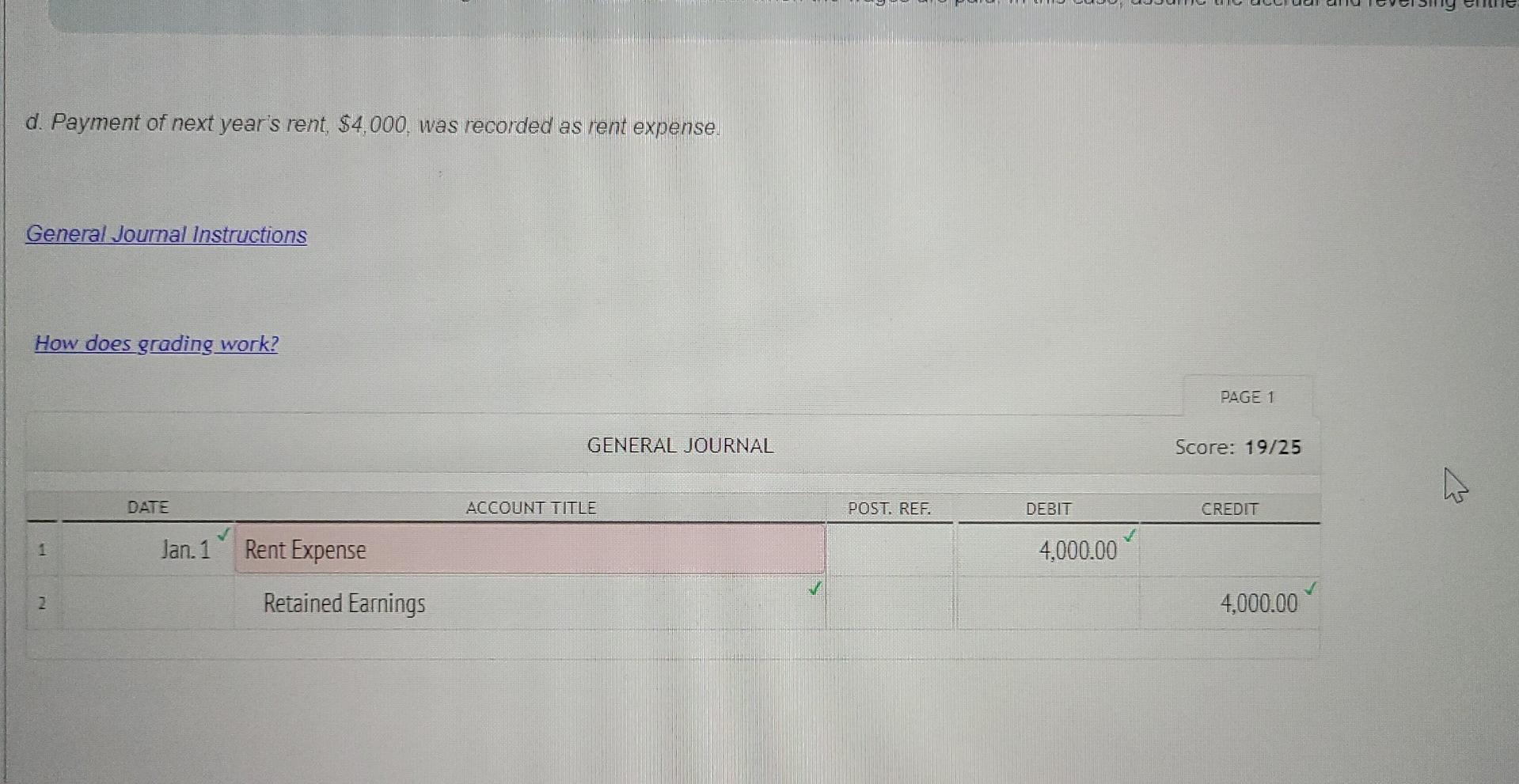

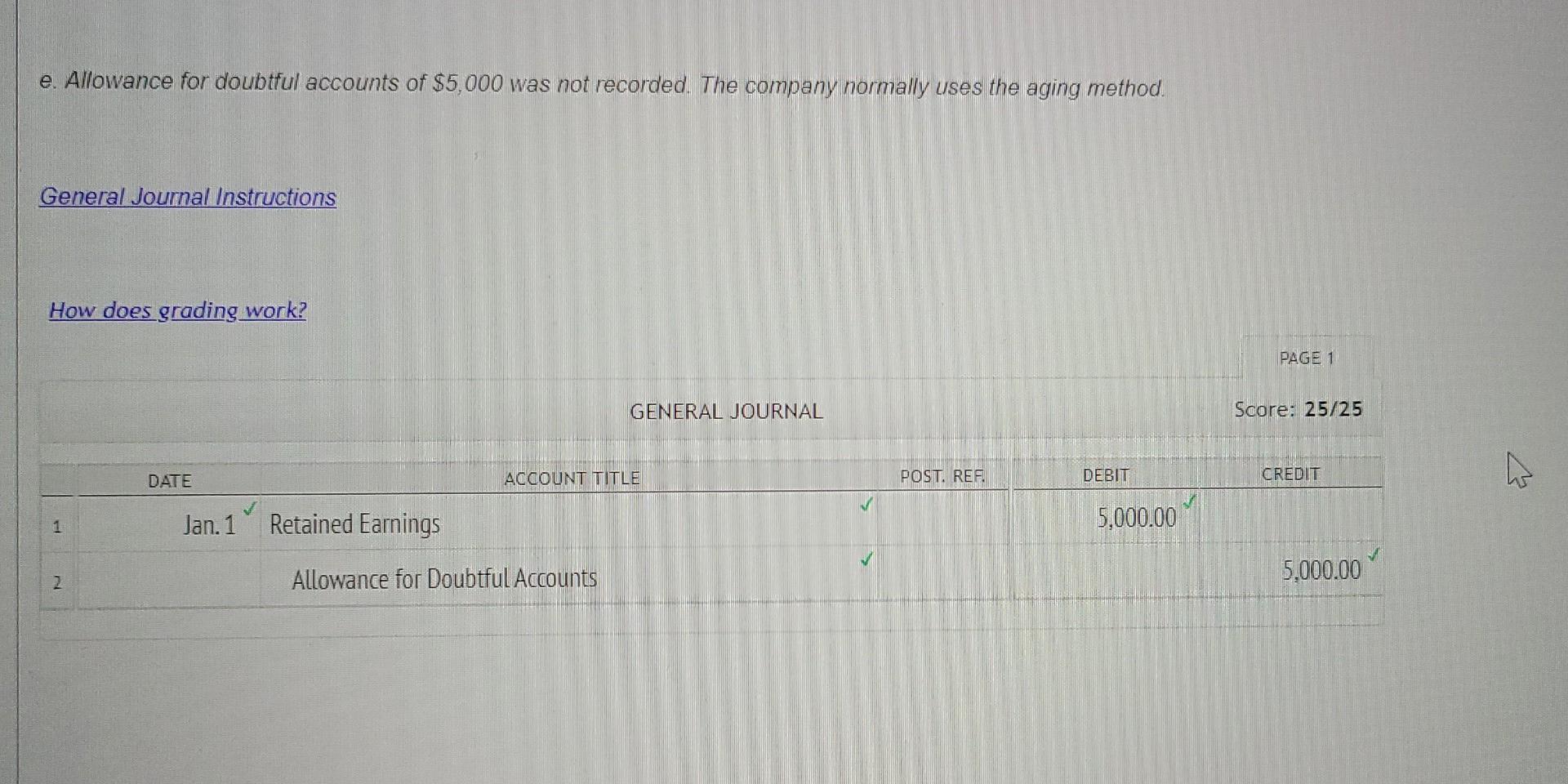

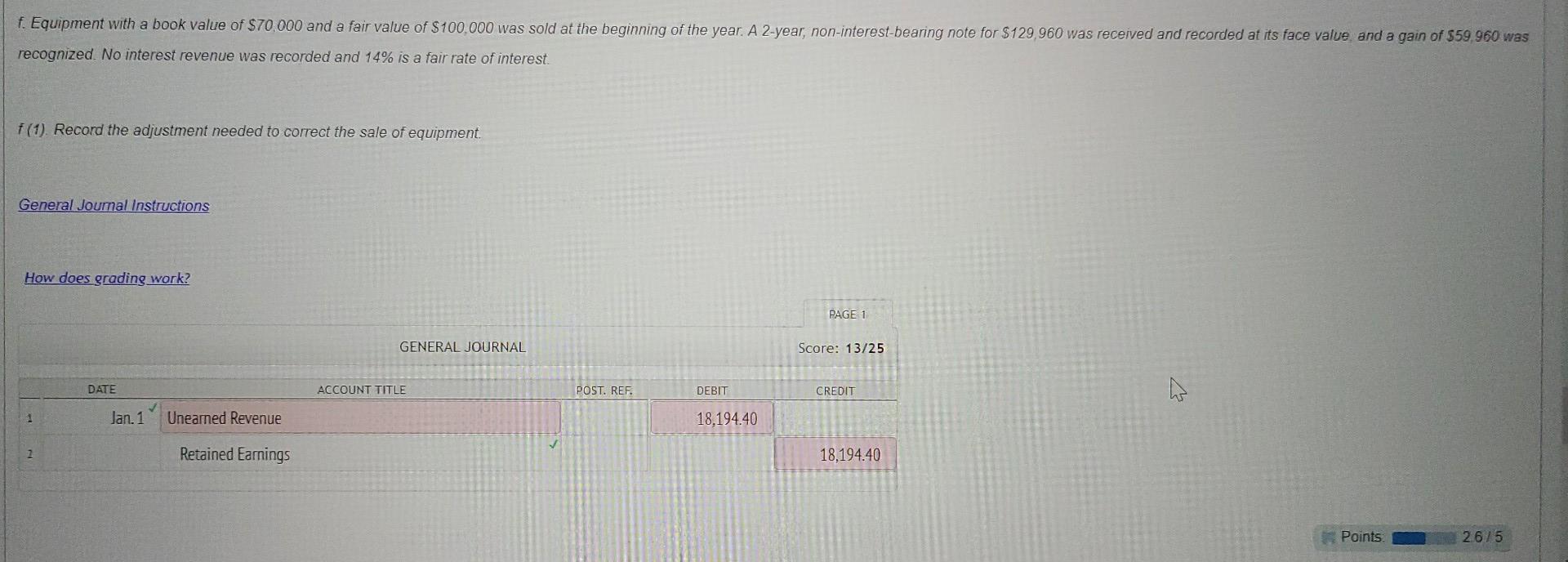

Instructions The following are independent errors made by a company that uses the periodic inventory system: a. Goods in transit, purchased on credit and shipped FOB destination, $10,000, were included in purchases but not in the physical count of ending inventory. b. Purchase of a machine for $2,000 was expensed. The machine has a 4-year life, no residual value, and straightline depreciation is used. c. Wages payable of $2,000 were not accrued. d. Payment of next year's rent, $4,000, was recorded as rent expense. e. Allowance for doubtful accounts of $5,000 was not recorded. The company normally uses the aging method. f. Equipment with a book value of $70,000 and a fair value of $100,000 was sold at the beginning of the year. A 2-year, non-interest-bearing note for $129,960 was received and recorded at its face value, and a gain of $59,960 was recognized. No interest revenue was recorded and 14% is a fair rate of interest.

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts