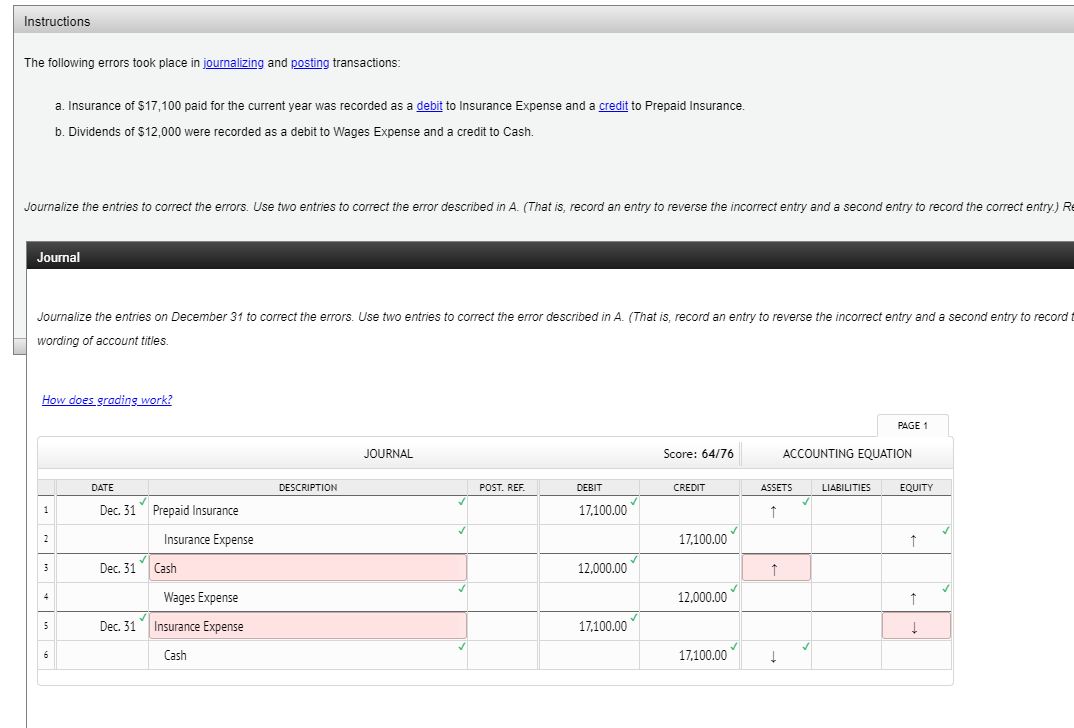

Question: Instructions The following errors took place in journalizing and posting transactions: a. Insurance of $17,100 paid for the current year was recorded as a debit

Instructions The following errors took place in journalizing and posting transactions: a. Insurance of $17,100 paid for the current year was recorded as a debit to Insurance Expense and a credit to Prepaid Insurance b. Dividends of $12,000 were recorded as a debit to Wages Expense and a credit to Cash. Journalize the entries to correct the errors. Use two entries to correct the error described in A. (That is, record an entry to reverse the incorrect entry and a second entry to record the correct entry.) R Journal Journalize the entries on December 31 to correct the errors. Use two entries to correct the error described in A. (That is, record an entry to reverse the incorrect entry and a second entry to record wording of account titles. How does grading work? PAGE 1 JOURNAL Score: 64/76 ACCOUNTING EQUATION DATE DESCRIPTION POST. REF DEBIT CREDIT ASSETS LIABILITIES EQUITY 1 Dec 31 Prepaid Insurance 17,100.00 1 2 Insurance Expense 17.100.00 1 3 Dec. 31 Cash 12,000.00 1 4 Wages Expense 12,000.00 5 Dec. 31 Insurance Expense 17,100.00 + Cash 17,100.00 +

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts