Question: Instructions: The following tutorial questions serve to assess your knowledge on TVM and Bond Valuation. The correct answers to the questions should be posted and

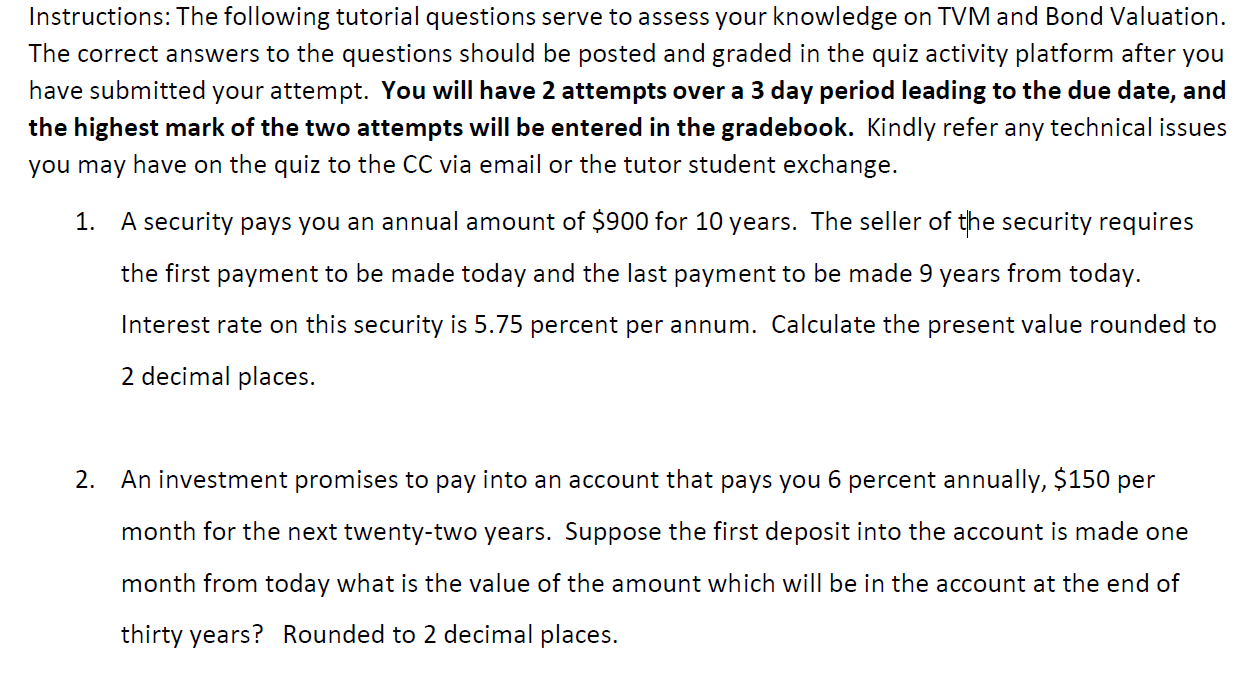

Instructions: The following tutorial questions serve to assess your knowledge on TVM and Bond Valuation. The correct answers to the questions should be posted and graded in the quiz activity platform after you have submitted your attempt. You will have 2 attempts over a 3 day period leading to the due date, and the highest mark of the two attempts will be entered in the gradebook. Kindly refer any technical issues you may have on the quiz to the CC via email or the tutor student exchange. 1. A security pays you an annual amount of $900 for 10 years. The seller of the security requires the first payment to be made today and the last payment to be made 9 years from today. Interest rate on this security is 5.75 percent per annum. Calculate the present value rounded to 2 decimal places. 2. An investment promises to pay into an account that pays you 6 percent annually, $150 per month for the next twenty-two years. Suppose the first deposit into the account is made one month from today what is the value of the amount which will be in the account at the end of thirty years? Rounded to 2 decimal places

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts