Question: Instructions: This is an open book, open notes, open web exam. You are allowed to use MS Excel, Project, &calculator. Question 1:(20 Points) Three mutually

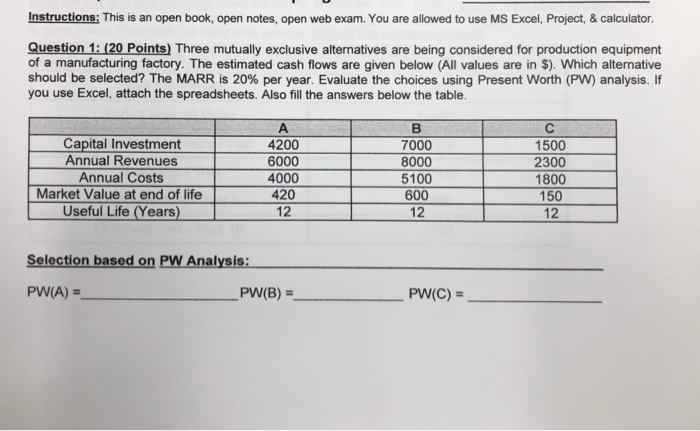

Instructions: This is an open book, open notes, open web exam. You are allowed to use MS Excel, Project, &calculator. Question 1:(20 Points) Three mutually exclusive alternatives are being considered for production equipment of a manufacturing factory. The estimated cash flows are given below (All values are in $). Which alternative should be selected? The MARR s 20% per year. Evaluate the choices using Present Worth (P analysis. If you use Excel, attach the spreadsheets. Also fill the answers below the table. Capital Investment Annual Revenues Annual Costs 4200 6000 4000 420 12 7000 8000 5100 600 12 1500 2300 1800 150 12 Market Value at end of life Useful Life (Years) Selection based on PW Analysis PW(A) PW(B) PMC) =

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts