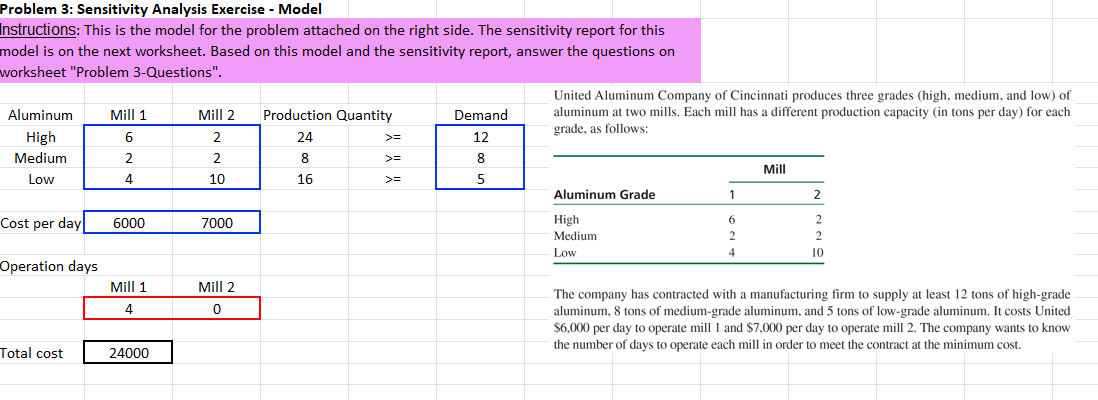

Question: Instructions: This is the model for the problem attached on the right side. The sensitivity report for this model is on the next worksheet. Based

Instructions: This is the model for the problem attached on the right side. The sensitivity report for this

model is on the next worksheet. Based on this model and the sensitivity report, answer the questions on

worksheet "Problem Questions".

Problem : Sensitivity Analysis Exercise Sensitivity Report

Problem : Sensitivity questions

What is the current optimal solution and the objective function value?

What is the objective function coefficient of decision variable operation days of mill

What is the sensitivity range for the objective function coefficient of decision variable operation days of mill

If the operation cost of mill increases from $ to $ will the optimal solution change? And why?

What is the objective function coefficient of decision variable operation days of mill

What is the sensitivity range for the objective function coefficient of decision variable operation days of mill

If the operation cost of mill decreases from $ to $ will the optimal solution change? And why?

Which constrains are binding?

If we can decrease the demand of highgrade aluminum by tons at the cost of $ ton, is it worth doing this? And why?

If the demand of mediumgrade aluminum increases by tons, what is the new total cost? And why?

If we can purchase tons of mediumgrade aluminum from our competitors at $ ton to satisfy part of the demand, instead of making it in our mills in other words, we can decrease the demand by tons at the price of $ ton is it worth doing this? And why?

If the customer needs additional tons of lowgrade aluminum and is willing to pay $ ton, do we want to accept this offer? And why?

If the customer needs additional tons of lowgrade aluminum and is willing to pay $ ton, do we want to accept this offer? And why?

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock