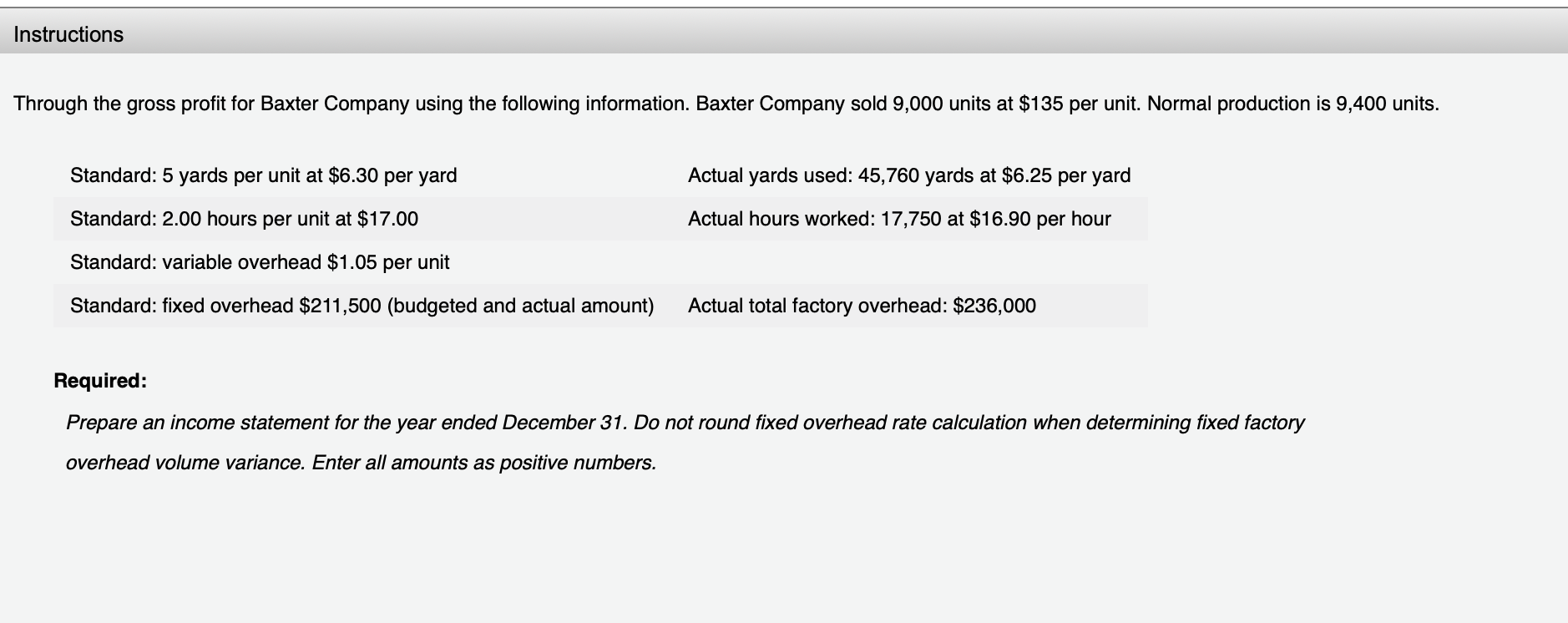

Question: Instructions Through the gross profit for Baxter Company using the following information. Baxter Company sold 9,000 units at $135 per unit. Normal production is 9,400

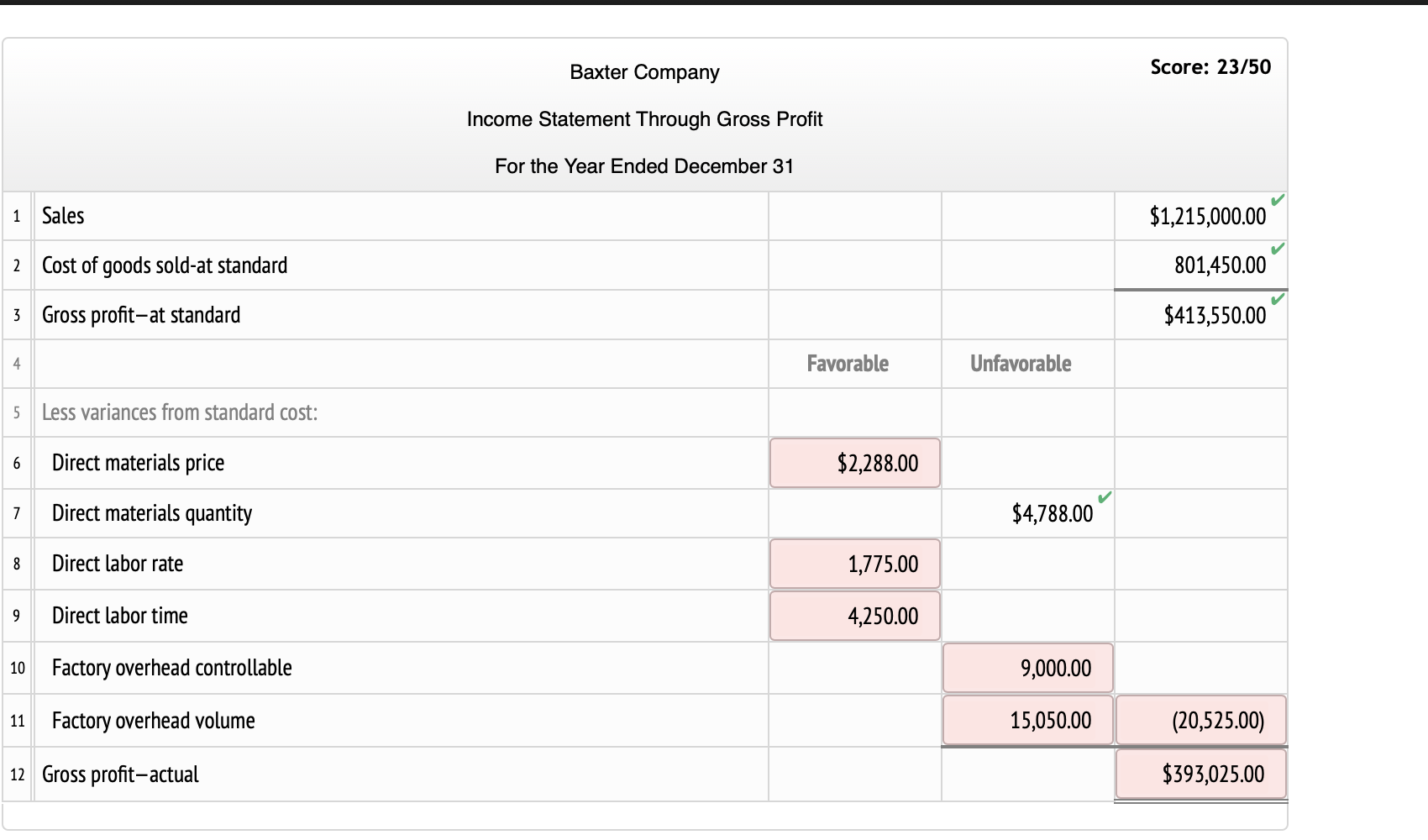

Instructions Through the gross profit for Baxter Company using the following information. Baxter Company sold 9,000 units at $135 per unit. Normal production is 9,400 units. Standard: 5 yards per unit at $6.30 per yard Actual yards used: 45,760 yards at $6.25 per yard Standard: 2.00 hours per unit at $17.00 Actual hours worked: 17,750 at $16.90 per hour Standard: variable overhead $1.05 per unit Standard: fixed overhead $211,500 (budgeted and actual amount) Actual total factory overhead: $236,000 Required: Prepare an income statement for the year ended December 31. Do not round fixed overhead rate calculation when determining fixed factory overhead volume variance. Enter all amounts as positive numbers. Baxter Company Score: 23/50 Income Statement Through Gross Profit For the Year Ended December 31 1 Sales $1,215,000.00 2 Cost of goods sold-at standard 801,450.00 3 Gross profit-at standard $413,550.00 4. Favorable Unfavorable 5 Less variances from standard cost: 6 Direct materials price $2,288.00 7 Direct materials quantity $4,788.00 8 Direct labor rate 1,775.00 9 Direct labor time 4,250.00 10 Factory overhead controllable 9,000.00 11 Factory overhead volume 15,050.00 (20,525.00) 12 Gross profit-actual $393,025.00

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts