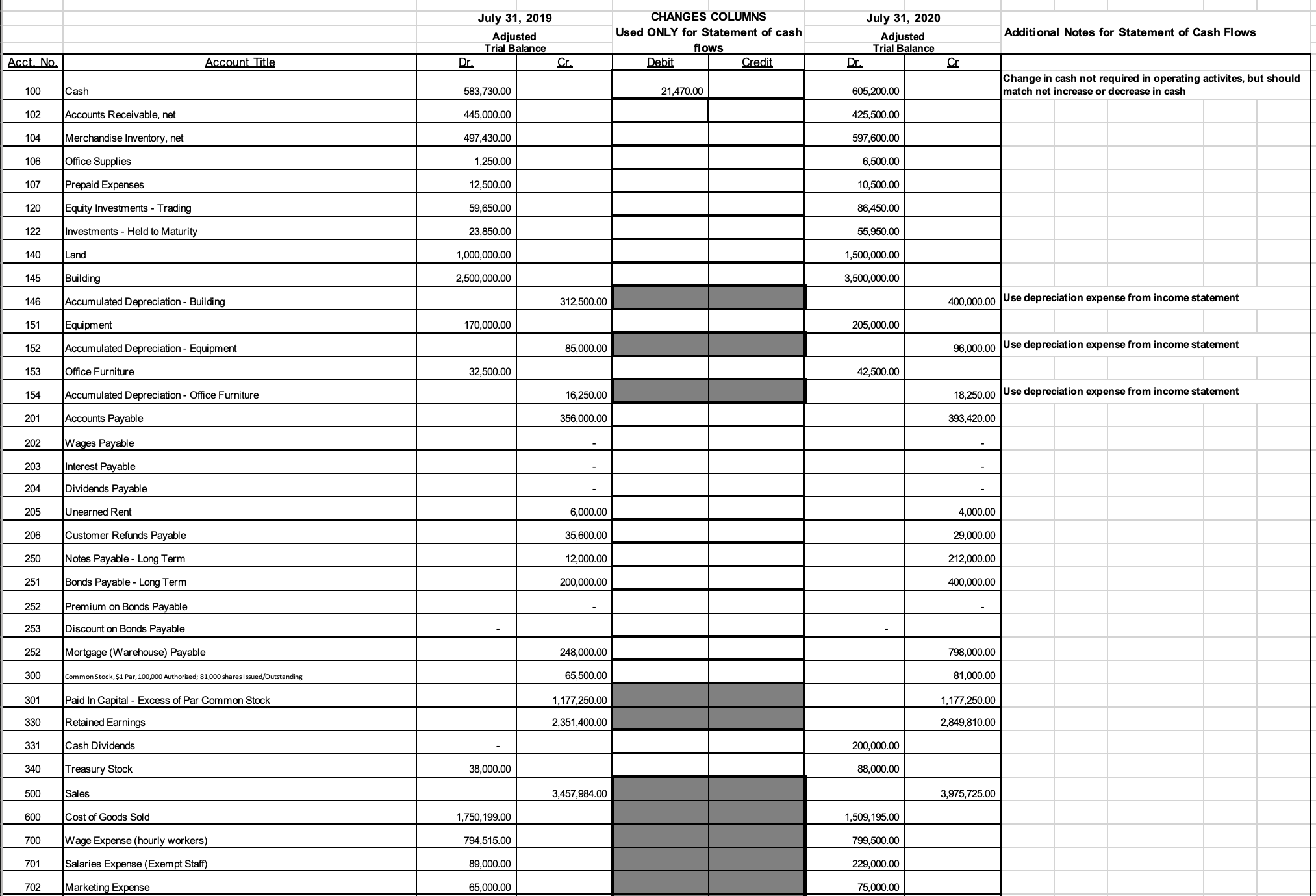

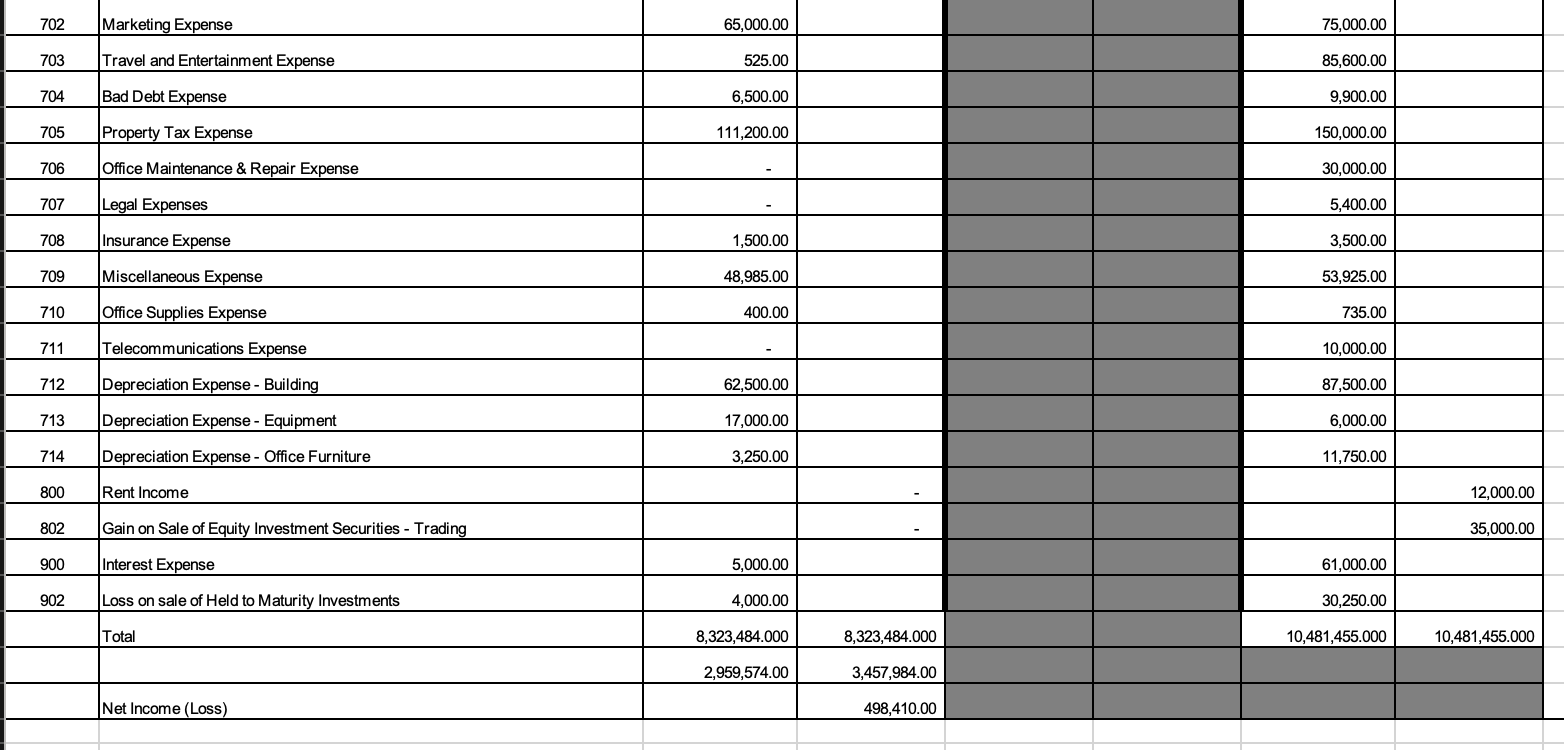

Question: Instructions: Using the changes columns and additional information from the adjusted trial balance tab AND the income statement, make statement of cash flows following the

| Instructions: Using the "changes columns" and additional information from the adjusted trial balance tab AND the income statement, make statement of cash flows following the INDIRECT METHOD. Round all amounts to the nearest cent. Follow the below tips The formatting is up to the student. Note that grades are based on organization, formula use, and clarity of financial statement. Other required items: |

| a. Only use accounts that have changes or cash flows |

| b. Include proper report title |

| c. Not all rows or columns need to be used. Formulas MUST be used when necessary. |

| TIPS PLEASE READ: |

| 1. Correct selection of "Increase" or "Decrease" in accounts must be used as part of the label where applicable |

| 2. Correct use of "cash paid" or "cash received" must be used where applicable |

| 3. Subtotals for each section MUST be properly identified as cash "used in" or "provided by" |

| 4. All changes utilize CASH. There ARE GAINS AND LOSSES from investments that must be included in operating activities |

| 5. Net change in cash + beginning cash balance (from a adjusted trial balance July 2019 column) must equal ending cash balance and be included at the bottom of this statement. |

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock