Question: Instructions Using the information below, complete the top portion of form 941, part 1, and part 2. You do not need to complete parts 3,

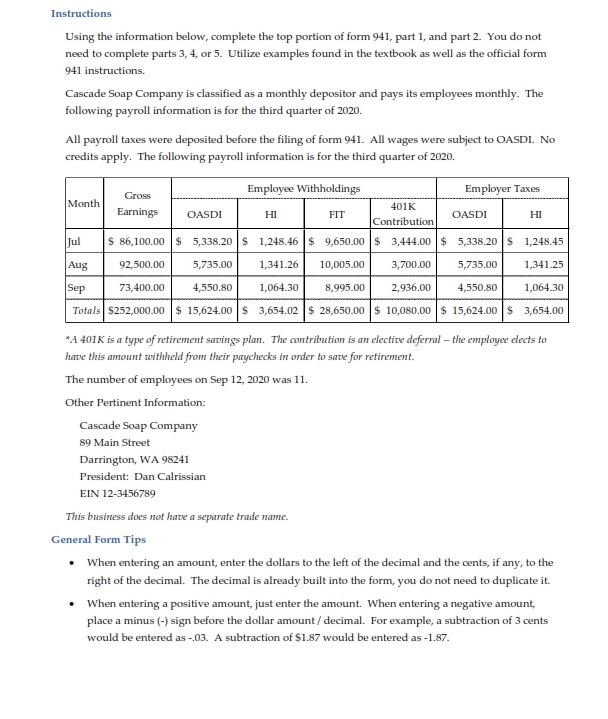

Instructions Using the information below, complete the top portion of form 941, part 1, and part 2. You do not need to complete parts 3, 4, or 5. Utilize examples found in the textbook as well as the official form 941 instructions. Cascade Soap Company is classified as a monthly depositor and pays its employees monthly. The following payroll information is for the third quarter of 2020. All payroll taxes were deposited before the filing of form 941. All wages were subject to OASDI. No credits apply. The following payroll information is for the third quarter of 2020. Employee Withholdings Employer Taxes Gross Month Earnings 401K OASDI HI FIT OASDI HI Contribution $ 86,100.00 $ 5,338.20 $ 1,248.46 $ 9,650.00 $ 3,444.00 $ 5,338.20 $ 1,248.45 Aug 92,500.00 5,735.00 1,341.26 10,005.00 3,700.00 5,735.00 1,341.25 Sep 73,400.00 4,550.80 1,064.30 8,995.00 2,936.00 4,550.80 1,064.30 Totals $252,000.00 $ 15,624.00 $ 3,654.02 $ 28,650.00 $ 10,080.00 $ 15,624.00 $ 3,654.00 "A 401K is a type of retirement savings plan. The contribution is an elective deferral - the employee elects to have this amount withheld from their paychecks in order to save for retirement. The number of employees on Sep 12, 2020 was 11. Other Pertinent Information: Cascade Soap Company 89 Main Street Darrington, WA 98241 President: Dan Calrissian EIN 12-3456789 This business does not have a separate trade name. General Form Tips . When entering an amount, enter the dollars to the left of the decimal and the cents, if any, to the right of the decimal. The decimal is already built into the form, you do not need to duplicate it. When entering a positive amount, just enter the amount. When entering a negative amount, place a minus (-) sign before the dollar amount / decimal. For example, a subtraction of 3 cents would be entered as -.03. A subtraction of $1.87 would be entered as -1.87.If a line requires you to add a set of amounts and enter it on that line, do so. Don't skip it. Press the tab key to move from one entry cell to the next. To save a completed form, click File, select Save As, and save it with a new name. Close it. Then re-open your saved form to make sure it saved properly before you submit it. Form 941 Line 2 The amount to enter on line 2, Wages, tips and other compensation, excludes elective deferrals such as contributions to a 401k or 403b plan. Given this information, how should you determine the amount to enter on line 2 of form 941? For more details on what to include and exclude on Form 941 line 2, read 2020 Form W-2 Instructions, page 16, Box 1 and 2020 Form 941 Instructions, page 8, #2 Wages, Tips, and Other Compensation. Form 941 Line 7 Total wages for a quarter is a large amount, and when we multiply it by a percentage, we get a certain amount (lines 5a through 5d). But employers calculate those taxes every time there's a pay period and for individual employees. Each time tax is calculated, the amount is rounded to the nearest cent. When we add up all those smaller amounts that have been rounded, the sum of those rounded amounts won't always equal the tax on a larger quarterly amount of earnings. The difference is what we call "fractions of cents" - the difference between the tax as calculated on the form and the total tax as calculated by the employer (the sum of all individual tax withholdings throughout the quarter). This difference is entered on line 7. If line 6 is smaller than the total from the payroll records, the fractions of cents is added. If it's larger, the fraction of cents is subtracted. Line 13a should include the total taxes deposited for the quarter, per the payroll records. Work back from there to determine fraction of cents needed to reconcile the taxes calculated on the form (line 6) and the total taxes per the payroll records (lines 10, 12, and 13)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts