Question: Instructions: You are the controller at Star Wars, Inc., a wholesale distributor of light sabers and other interstellar weaponry. The corporation was founded in galaxy

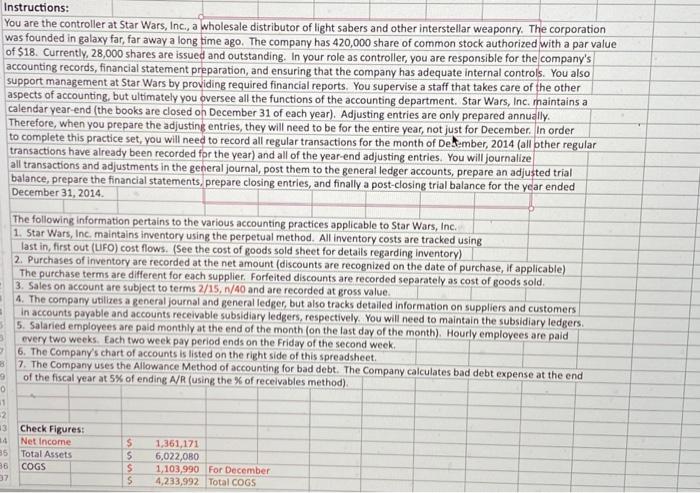

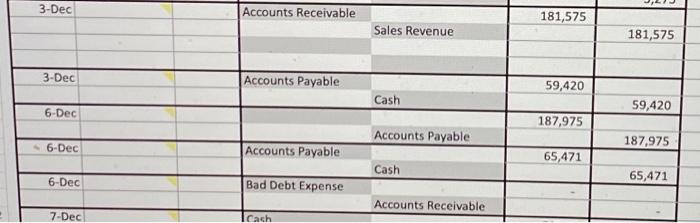

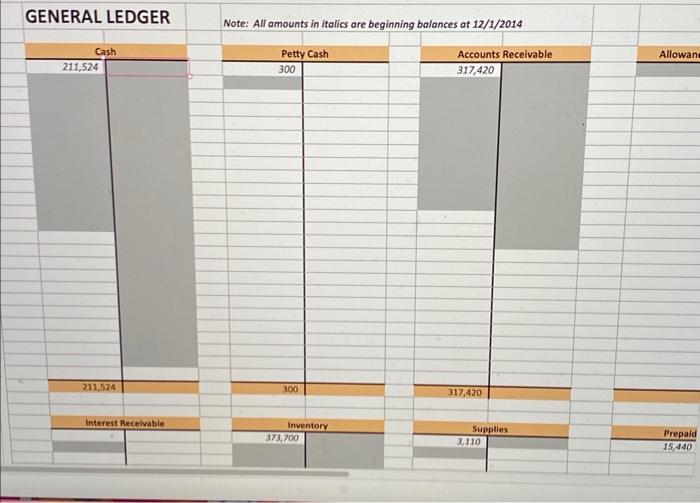

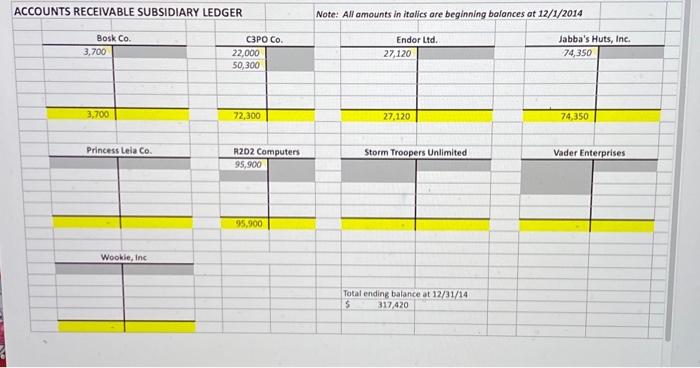

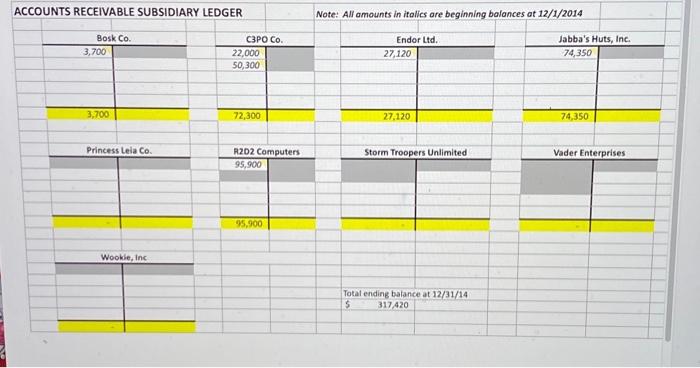

Instructions: You are the controller at Star Wars, Inc., a wholesale distributor of light sabers and other interstellar weaponry. The corporation was founded in galaxy far, far away a long time ago. The company has 420,000 share of common stock authorized with a par value of $18. Currently, 28,000 shares are issued and outstanding. In your role as controller, you are responsible for the company's accounting records, financial statement preparation, and ensuring that the company has adequate internal controls. You also support management at Star. Wars by providing required financial reports. You supervise a staff that takes care of the other aspects of accounting, but ultimately you oversee all the functions of the accounting department. Star Wars, Inc. maintains a calendar year-end (the books are closed on December 31 of each year). Adjusting entries are only prepared annually. Therefore, when you prepare the adjusting entries, they will need to be for the entire year, not just for December. In order to complete this practice set, you will need to record all regular transactions for the month of Deatember, 2014 (all other regular transactions have already been recorded for the year) and all of the year-end adjusting entries. You will journalize all transactions and adjustments in the general journal, post them to the general ledger accounts, prepare an adjusted trial balance, prepare the financial statements, prepare closing entries, and finally a post-closing trial balance for the ycar ended December 31, 2014. The following information pertains to the various accounting practices applicable to Star Wars, Inc. 1. Star Wars, Inc. maintains inventory using the perpetual method. All inventory costs are tracked using last in, first out (UFO) cost flows. (See the cost of goods sold sheet for details regarding inventory) 2. Purchases of inventory are recorded at the net amount (discounts are recognized on the date of purchase, If applicable) The purchase terms are different for each supplier. Forfeited discounts are recorded separately as cost of goods sold. 3. Sales on account are subject to terms 2/15,n/40 and are recorded at gross value. 4. The company utilizes a general journal and general ledger, but also tracks detailed information on suppliers and customers in accounts payable and accounts receivable subsidiary ledgers, respectively. You will need to maintain the subsidiary ledgers. 5. Salaried employees are paid monthly at the end of the month (on the last day of the month). Hourly employees are paid every two weeks. Each two week pay period ends on the Friday of the second week. 6. The Company's chart of accounts is listed on the right side of this spreadsheet. 7. The Company uses the Allowance Method of accounting for bad debt. The Company calculates bad debt expense at the end of the fiscal year at 5% of ending A/R (using the % of receivables method). Check Figures: \begin{tabular}{|l|l|l|l|} \hline Net income & 5 & 1,361,171 & \\ \hline Total Assets & 5 & 6,022,080 & \\ \hline coGS & 5 & 1,103,990 & For December \\ \hline & 5 & 4,233,992 & Total CoGs \\ \hline \end{tabular} GENERAL LEDGER Note: All amounts in italics are beginning balances at 12/1/2014 ACCOUNTS RECEIVABLE SUBSIDIARY LEDGER Note: Alf amounts in italles are beginning bolances at 12/1/2014 Vader Enterprises Total ending batance at 12/31/14 5317.420 ACCOUNTS RECEIVABLE SUBSIDIARY LEDGER Note: Alf amounts in italles are beginning bolances at 12/1/2014 Vader Enterprises Total ending batance at 12/31/14 5317.420 Instructions: You are the controller at Star Wars, Inc., a wholesale distributor of light sabers and other interstellar weaponry. The corporation was founded in galaxy far, far away a long time ago. The company has 420,000 share of common stock authorized with a par value of $18. Currently, 28,000 shares are issued and outstanding. In your role as controller, you are responsible for the company's accounting records, financial statement preparation, and ensuring that the company has adequate internal controls. You also support management at Star. Wars by providing required financial reports. You supervise a staff that takes care of the other aspects of accounting, but ultimately you oversee all the functions of the accounting department. Star Wars, Inc. maintains a calendar year-end (the books are closed on December 31 of each year). Adjusting entries are only prepared annually. Therefore, when you prepare the adjusting entries, they will need to be for the entire year, not just for December. In order to complete this practice set, you will need to record all regular transactions for the month of Deatember, 2014 (all other regular transactions have already been recorded for the year) and all of the year-end adjusting entries. You will journalize all transactions and adjustments in the general journal, post them to the general ledger accounts, prepare an adjusted trial balance, prepare the financial statements, prepare closing entries, and finally a post-closing trial balance for the ycar ended December 31, 2014. The following information pertains to the various accounting practices applicable to Star Wars, Inc. 1. Star Wars, Inc. maintains inventory using the perpetual method. All inventory costs are tracked using last in, first out (UFO) cost flows. (See the cost of goods sold sheet for details regarding inventory) 2. Purchases of inventory are recorded at the net amount (discounts are recognized on the date of purchase, If applicable) The purchase terms are different for each supplier. Forfeited discounts are recorded separately as cost of goods sold. 3. Sales on account are subject to terms 2/15,n/40 and are recorded at gross value. 4. The company utilizes a general journal and general ledger, but also tracks detailed information on suppliers and customers in accounts payable and accounts receivable subsidiary ledgers, respectively. You will need to maintain the subsidiary ledgers. 5. Salaried employees are paid monthly at the end of the month (on the last day of the month). Hourly employees are paid every two weeks. Each two week pay period ends on the Friday of the second week. 6. The Company's chart of accounts is listed on the right side of this spreadsheet. 7. The Company uses the Allowance Method of accounting for bad debt. The Company calculates bad debt expense at the end of the fiscal year at 5% of ending A/R (using the % of receivables method). Check Figures: \begin{tabular}{|l|l|l|l|} \hline Net income & 5 & 1,361,171 & \\ \hline Total Assets & 5 & 6,022,080 & \\ \hline coGS & 5 & 1,103,990 & For December \\ \hline & 5 & 4,233,992 & Total CoGs \\ \hline \end{tabular} GENERAL LEDGER Note: All amounts in italics are beginning balances at 12/1/2014 ACCOUNTS RECEIVABLE SUBSIDIARY LEDGER Note: Alf amounts in italles are beginning bolances at 12/1/2014 Vader Enterprises Total ending batance at 12/31/14 5317.420 ACCOUNTS RECEIVABLE SUBSIDIARY LEDGER Note: Alf amounts in italles are beginning bolances at 12/1/2014 Vader Enterprises Total ending batance at 12/31/14 5317.420

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts