Question: INSTRUCTIONS: You MUST answer the TWO questions in this Section showing your working in the spaces provided. Marks available for each question or part of

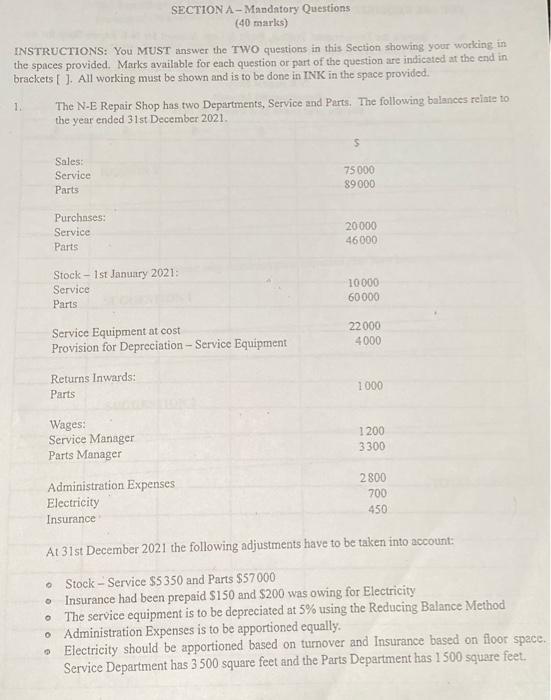

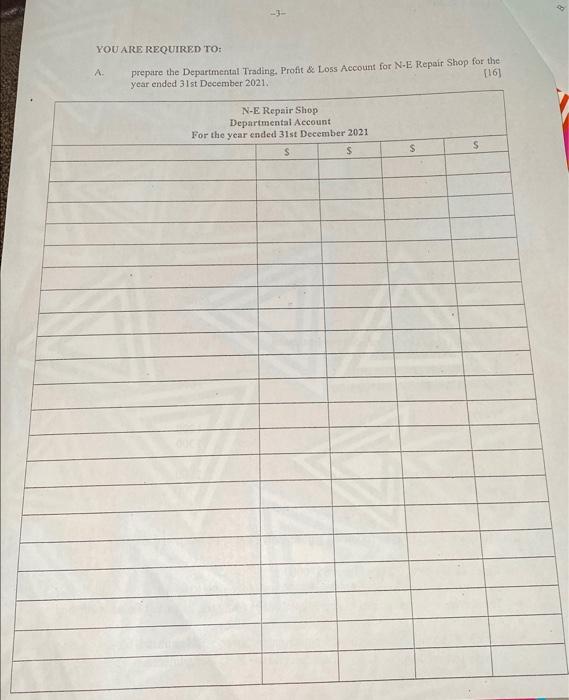

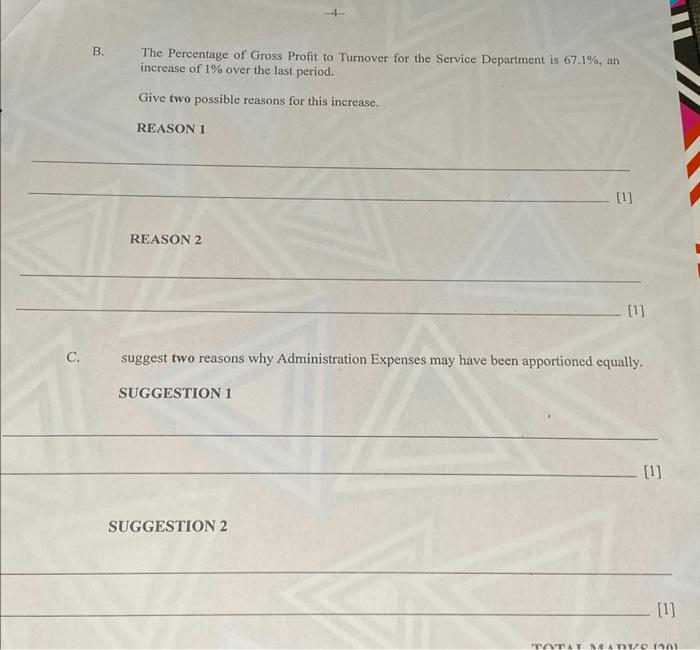

INSTRUCTIONS: You MUST answer the TWO questions in this Section showing your working in the spaces provided. Marks available for each question or part of the question are inticated at the end in brackets [ ]. All working must be shown and is to be done in INK in the space provided. 1. The N-E Repair Shop has two Departments, Service and Parts. The following balances reiate to At 31 st December 2021 the following adjustments have to be taken into account: - Stock - Service $5350 and Parts $57000 - Insurance had been prepaid $150 and $200 was owing for Electricity - The service equipment is to be depreciated at 5% using the Reducing Balance Method - Administration Expenses is to be apportioned equally. - Electricity should be apportioned based on turnover and Insurance based on floor space Service Department has 3500 square feet and the Parts Department has 1500 square feet. YOU ARE REQUIRED TO: A. prepare the Departmental Trading. Profit \& Loss Accouat for N-E Repair Shop for the year ended 31 st December 2021 . B. The Percentage of Gross Profit to Turnover for the Service Department is 67.1%, an increase of 1% over the last period. Give two possible reasons for this increase. REASON 1 [1] REASON 2 [1] C. suggest two reasons why Administration Expenses may have been apportioned equally

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts