Question: Instructions: You should work individually on this assignment. The assignment must be completed and the answers to the problems below should be submitted in a

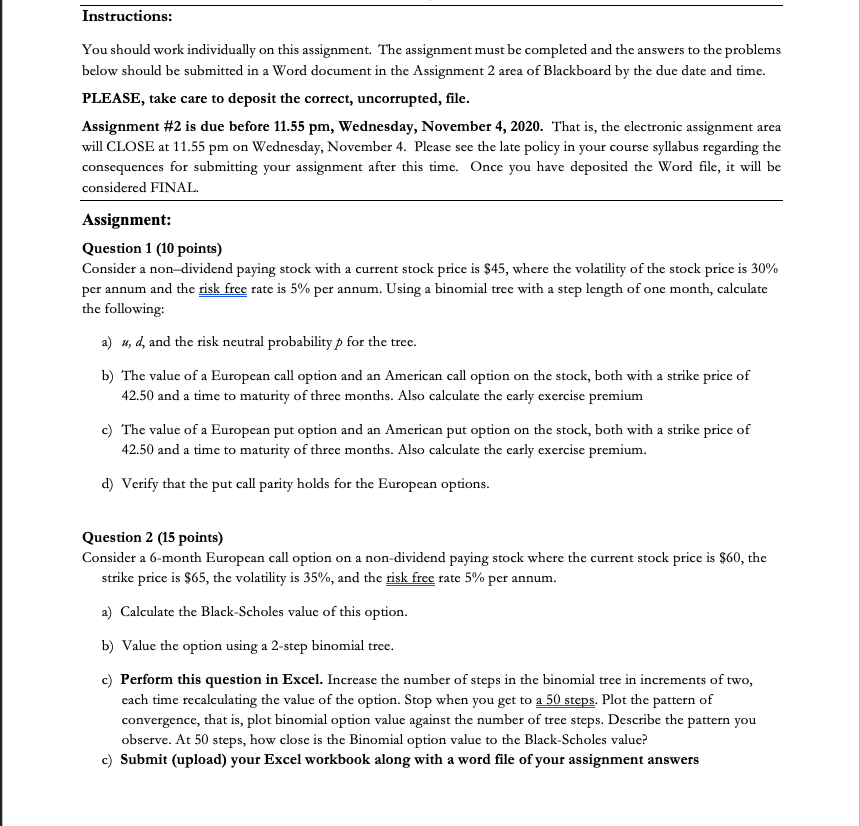

Instructions: You should work individually on this assignment. The assignment must be completed and the answers to the problems below should be submitted in a Word document in the Assignment 2 area of Blackboard by the due date and time. PLEASE, take care to deposit the correct, uncorrupted, file. Assignment #2 is due before 11.55 pm, Wednesday, November 4, 2020. That is, the electronic assignment area will CLOSE at 11.55 pm on Wednesday, November 4. Please see the late policy in your course syllabus regarding the consequences for submitting your assignment after this time. Once you have deposited the Word file, it will be considered FINAL Assignment: Question 1 (10 points) Consider a non-dividend paying stock with a current stock price is $45, where the volatility of the stock price is 30% per annum and the risk free rate is 5% per annum. Using a binomial tree with a step length of one month, calculate the following: a) , d, and the risk neutral probability p for the tree. b) The value of a European call option and an American call option on the stock, both with a strike price of 42.50 and a time to maturity of three months. Also calculate the early exercise premium c) The value of a European put option and an American put option on the stock, both with a strike price of 42.50 and a time to maturity of three months. Also calculate the early exercise premium. d) Verify that the put call parity holds for the European options. Question 2 (15 points) Consider a 6-month European call option on a non-dividend paying stock where the current stock price is $60, the strike price is $65, the volatility is 35%, and the risk free rate 5% per annum. a) Calculate the Black-Scholes value of this option. b) Value the option using a 2-step binomial tree. c) Perform this question in Excel. Increase the number of steps in the binomial tree in increments of two, each time recalculating the value of the option. Stop when you get to a 50 steps. Plot the pattern of convergence, that is, plot binomial option value against the number of tree steps. Describe the pattern you observe. At 50 steps, how close is the Binomial option value to the Black-Scholes value? c) Submit (upload) your Excel workbook along with a word file of your assignment answers Instructions: You should work individually on this assignment. The assignment must be completed and the answers to the problems below should be submitted in a Word document in the Assignment 2 area of Blackboard by the due date and time. PLEASE, take care to deposit the correct, uncorrupted, file. Assignment #2 is due before 11.55 pm, Wednesday, November 4, 2020. That is, the electronic assignment area will CLOSE at 11.55 pm on Wednesday, November 4. Please see the late policy in your course syllabus regarding the consequences for submitting your assignment after this time. Once you have deposited the Word file, it will be considered FINAL Assignment: Question 1 (10 points) Consider a non-dividend paying stock with a current stock price is $45, where the volatility of the stock price is 30% per annum and the risk free rate is 5% per annum. Using a binomial tree with a step length of one month, calculate the following: a) , d, and the risk neutral probability p for the tree. b) The value of a European call option and an American call option on the stock, both with a strike price of 42.50 and a time to maturity of three months. Also calculate the early exercise premium c) The value of a European put option and an American put option on the stock, both with a strike price of 42.50 and a time to maturity of three months. Also calculate the early exercise premium. d) Verify that the put call parity holds for the European options. Question 2 (15 points) Consider a 6-month European call option on a non-dividend paying stock where the current stock price is $60, the strike price is $65, the volatility is 35%, and the risk free rate 5% per annum. a) Calculate the Black-Scholes value of this option. b) Value the option using a 2-step binomial tree. c) Perform this question in Excel. Increase the number of steps in the binomial tree in increments of two, each time recalculating the value of the option. Stop when you get to a 50 steps. Plot the pattern of convergence, that is, plot binomial option value against the number of tree steps. Describe the pattern you observe. At 50 steps, how close is the Binomial option value to the Black-Scholes value? c) Submit (upload) your Excel workbook along with a word file of your assignment answers

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts