Question: Instructions: Your report is based on the data that you have been collecting so far since the beginning of the class. Please Use the attached

Instructions:

Your report is based on the data that you have been collecting so far since the beginning of the class. Please Use the attached Excel sheet if needed

https://docs.google.com/spreadsheets/d/1qYmhUHwdFP3UUONA6cqemEgJBqnIOleLjJzMKHz JZsk/edit#gid=247634732

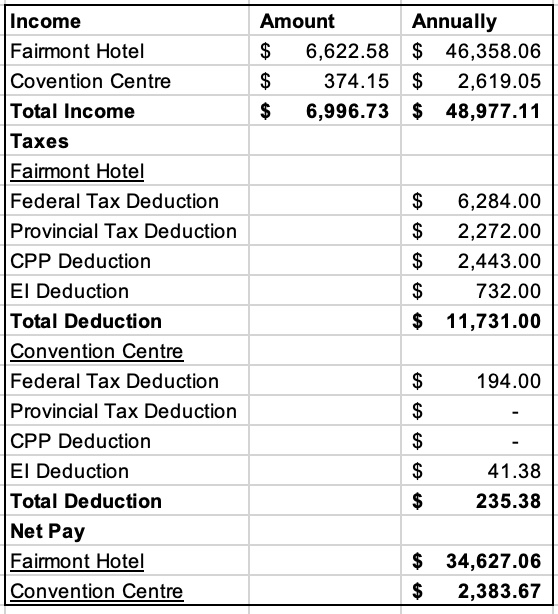

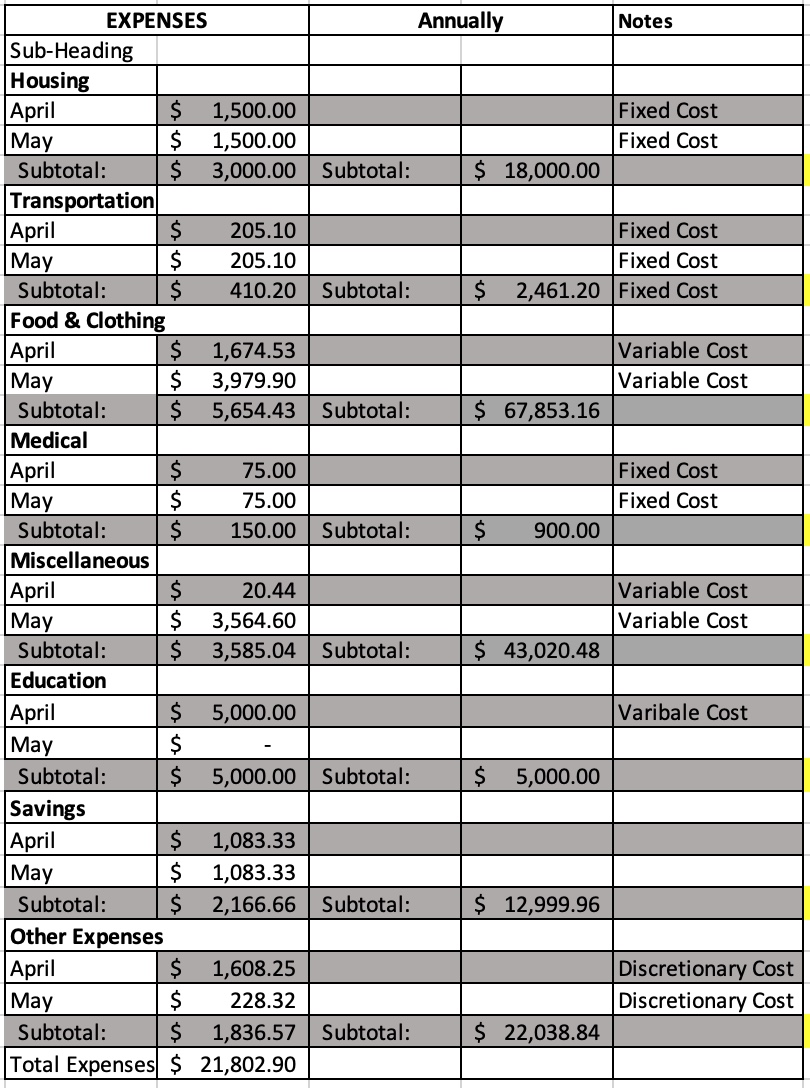

Your analysis should be based on the data you have been tracking since the first day of this class. You should have at least one month's data that shows your expenses and all incomes. Make sure you detailed all sources of income and catagorised all your expenses into fixed, variable, and discretionary costs. Use this on or 2-month budget and expand it to 12 months which shows your annual budget.

Based on your annual budget,

Prepare cash flow statement. Just like your previous individual assignment, add screenshots of your financial analysis (from Excel). Use a pie chart that shows your categorized expenses.

Comment on your spending habit and pinpoint options to reduce your expenses.

Create budget and link that to your SMART goal (Retirement).

Even if you are not investing currently, write about your investment plans in the future. Discuss the types of funds that help you achieve your goal. Choose a specific asset allocation that matches your risk tolerance by creating a pie chart in Excel of specific investments that you could invest in. Please choose any investment that you think is better from the link below.

https://www.nerdwallet.com/article/investing/the-best-investments-right-now

Prepare your balance Sheet that contains your Net Worth at some point in the future.

Explain your risk management plans. Throughout your report, include many text notes to help you explain your thinking.

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts