Question: Instructions:Using the 2018 trial balance and additional information below, prepare the projected (2019) financial statements for Walnut Grove. The prior year data (provided) is the

Instructions:Using the 2018 trial balance and additional information below, prepare the

projected (2019) financial statements for Walnut Grove. The prior year data

(provided) is the starting point for your projections, and then each of the

assumptions listed below will also be used.

Prepare an Excel workbook which contains the following information:

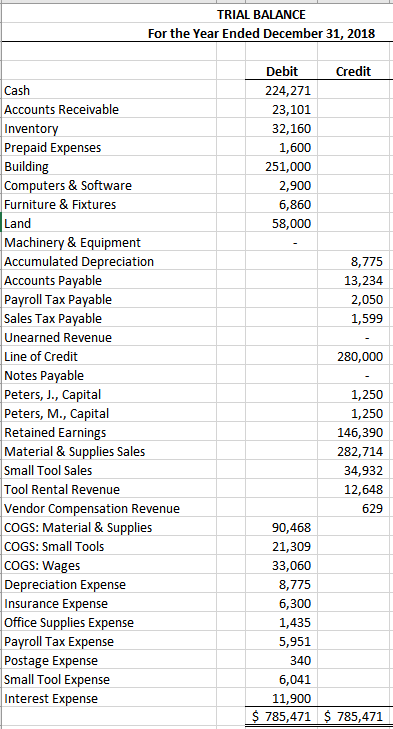

Tab 1: 2018 Trial Balance (provided in the template)

Tab 2: 2019 Projected Income Statement

Tab 3: 2019 Projected Balance Sheet

Tab 4: 2019 Projected Statement of Cash Flows Assumptions:

1. Sales will change as follows:

a. Material & Supplies Sales will increase 5%

b. Small Tool Sales will increase 5%

c. Tool Rental Revenue will continue throughout the 2018 year. An

average of 16 tools will be rented each week, at an average of $55

per tool for 52 weeks.

2. Vendor compensation will increase consistently with Material & Supplies

Sales and Small Tools Sales.

3. Cost of sales for materials and supplies and small tools will increase

proportionately based on their current percentage of sales, respectively.

(HINT: You will need to use vertical analysis.)

4. Small tools expenses, including blades and other items, are expected to total

$7,800 in 2019.

5. Office supplies and postage are expected to increase by 60% during 2019.

6. On January 1st, the company will invest $119,500 in new equipment for its

custom cabinet division. This equipment will have a 5-year life and should

be depreciated using the straight-line method. This purchase represents

the only expected change to property, plant, and equipment. The company

will finance the equipment purchase with a 5 year note at 3.60% interest.

You will need to use an amortization schedule to find the principle and

interest payment amounts. The loan is paid monthly.

7. In relation to #6 above, the custom cabinet sales division begins operations

in 2019. The following assumptions must be used to project the impact on

the financial statements.

(Hint: You may need to add accounts to the trial balance.)

a. Walnut Grove anticipates that it will sell 180 cabinets at an average

selling price of $2,050 each during 2019.

b. Direct materials per cabinet are $700 per unit.

c. The direct labor per cabinet is 3.75 hours, and Walnut Grove pays

$27.50/hour for this labor.

d. Factory overhead is calculated at 55% of direct labor.

8. The building is being depreciated over a 39-year life, the computers and

software are being depreciated over a 3-year life, and the furniture and

fixtures are being depreciated over a 5-year life, all using straight-line

depreciation.

9. Because of the new cabinet division, insurance costs will increase to $26,000

per year effective January 1. The company prepaid 2 years of this insurance

and received a 3.30% discount for the 2-year prepayment.

10. On March 1, a new cabinet division manager will be hired at a cost of

$49,500. In additional to the new cabinet division manager, 3 new

employees will be hired at an average wage of $21.25 per hour, employees

work an average of 40 hours per week. Payroll taxes should be calculated

at 18% of wages.

11. With 18 weeks remaining in the year, 2 additional employees will be hired

at a rate of $17.00 per hour, based on an average of 35 hours per week.

12. The income tax rate is 21%.

13. At the end of the year, Walnut Grove will have $32,000 in ending inventory.

14. Purchases are made evenly throughout the year and are paid in full in the

month following purchase.

15. Sales are collected in full the month following the sale. During the month

of December, invoiced sales totaled $137,250.

16. The sales tax rate is 6.30%.

17. At the end of the year, Walnut Grove has received full payment for 20

custom cabinet orders that will be completed in January 2020.

TRIAL BALANCE For the Year Ended December 31, 2018 Debit Credit Cash Accounts Receivable Inventory Prepaid Expenses Building Computers & Software Furniture & Fixtures Land Machinery & Equipment Accumulated Depreciation Accounts Payable Payroll Tax Payable Sales Tax Payable Unearned Revenue Line of Credit Notes Payable Peters, J., Capital Peters, M., Capital Retained Earnings Material & Supplies Sales Small Tool Sales Tool Rental Revenue Vendor Compensation Revenue COGS: Material & Supplies COGS: Small Tools COGS: Wages Depreciation Expense Insurance Expense Office Supplies Expense Payroll Tax Expense Postage Expense Small Tool Expense Interest Expense 224,271 23,101 32,160 1,600 251,000 2,900 6,860 58,000 8,775 13,234 2,050 1,599 280,000 1,250 1,250 146,390 282,714 34,932 12,648 629 90,468 21,309 33,060 8,775 6,300 1,435 5,951 340 6,041 11,900 $ 785,471 $ 785,471 TRIAL BALANCE For the Year Ended December 31, 2018 Debit Credit Cash Accounts Receivable Inventory Prepaid Expenses Building Computers & Software Furniture & Fixtures Land Machinery & Equipment Accumulated Depreciation Accounts Payable Payroll Tax Payable Sales Tax Payable Unearned Revenue Line of Credit Notes Payable Peters, J., Capital Peters, M., Capital Retained Earnings Material & Supplies Sales Small Tool Sales Tool Rental Revenue Vendor Compensation Revenue COGS: Material & Supplies COGS: Small Tools COGS: Wages Depreciation Expense Insurance Expense Office Supplies Expense Payroll Tax Expense Postage Expense Small Tool Expense Interest Expense 224,271 23,101 32,160 1,600 251,000 2,900 6,860 58,000 8,775 13,234 2,050 1,599 280,000 1,250 1,250 146,390 282,714 34,932 12,648 629 90,468 21,309 33,060 8,775 6,300 1,435 5,951 340 6,041 11,900 $ 785,471 $ 785,471

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts