Question: Instructor: Liuren Wu Course: 20185pringF Assigniment: F Version B Date: 1. Kelly bought a stock at a price of $22.50. She received a $1.75 dividend

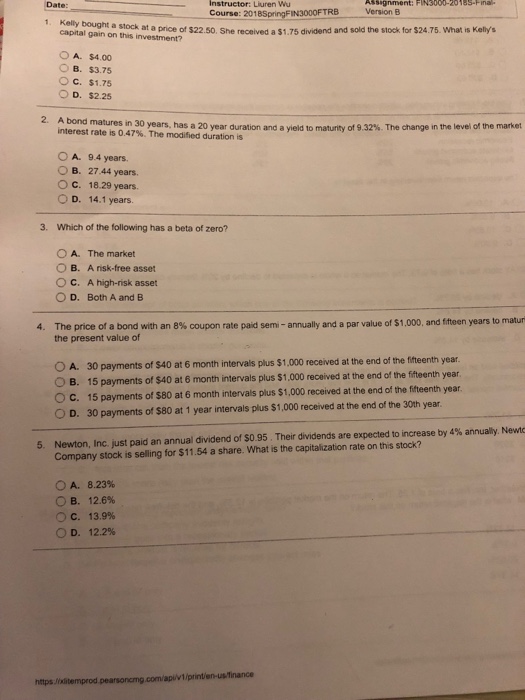

Instructor: Liuren Wu Course: 20185pringF Assigniment: F Version B Date: 1. Kelly bought a stock at a price of $22.50. She received a $1.75 dividend and capital gain on this investment? sold the stock for $24.75. What is Kely's O A. $4.00 B. $3.75 C. $1.75 OD. $2.25 2. A bond matures in 30 interest rate is 0.47%. The modified duration is years has a 20 year duration and a yeld to matur ty o 9.32%. The change in the level of the market O A. 9.4 years. B. 27.44 years. C. 18.29 years. OD. 14.1 years. 3. Which of the following has a beta of zero? A. The market O B. A risk-free asset O C. A high-risk asset O D. Both A and B The price of a bond with an 8% coupon rate paid semi-annually and a par value of $1,000, and fifteen years to matur the present value of 4. ? A. 30 payments of $40 at 6 month intervals plus $1,000 received at the end of the fifteenth year O B. 15 payments of $40 at 6 month intervals plus s 1,000 received at the end of the fifteenth year O c. 15 payments of $80 at 6 month intervals plus $1,000 received at the end of the fteenth year O D. 30 payments of $80 at 1 year intervals plus $1,000 received at the end of the 30th year Their dividends are expected to increase by 4% annualy Newt Newton, InC. just paid an annual dividend of $0.95 Company stock is selling for $11.54 a share. What is the capitalization rate on this stock? 5. A. 8.23% B. 12.6% c. 13.9% D. 12.2%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts