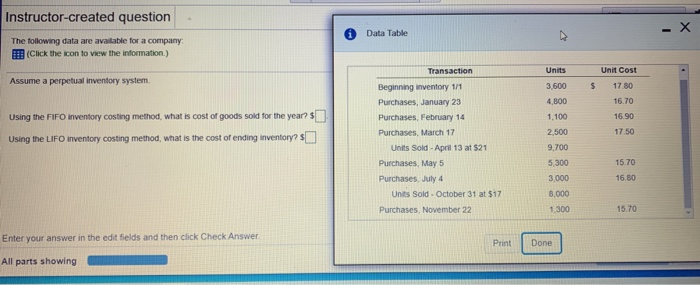

Question: Instructor-created question Data Table -X The following data are available for a company (Click the icon to view the information) Assume a perpetual inventory system

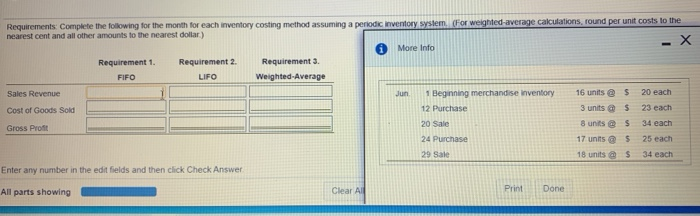

Instructor-created question Data Table -X The following data are available for a company (Click the icon to view the information) Assume a perpetual inventory system Transaction Beginning inventory 1/1 Purchases, January 23 Unit Cost 17.80 16.70 16.90 1750 Using the FIFO inventory costing method, what is cost of goods sold for the years Using the LIFO inventory costing method, what is the cost of ending inventory? Purchases, February 14 Purchases, March 17 Units Sold - April 13 at 521 Purchases, May 5 Purchases, July 4 Units Sold - October 31 at $17 Purchases, November 22 3.600 4,800 1,100 2.500 9.700 5,300 3,000 8.000 15.70 16.80 1300 15.70 Enter your answer in the edit fields and then click Check Answer Print Done All parts showing Requirements Complete the following for the month for each inventory costing method assuming a periodic inventory system. For weighted average calculations, round per unit costs to the nearest cent and all other amounts to the nearest dollar) More Info -X Requirement 1. Requirement 2 Requirement 3. FIFO LIFO Weighted Average Sales Revenue 1 Beginning merchandise inventory 16 units @ $ 20 each Cost of Goods Sold 12 Purchase 3 units @ $ 23 each Gross Profit 8 units@ $ 34 each 24 Purchase 17 units @ $ 25 each 18 units @ $ 34 each Enter any number in the edit fields and then click Check Answer Print Clear All All parts showing Done

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts