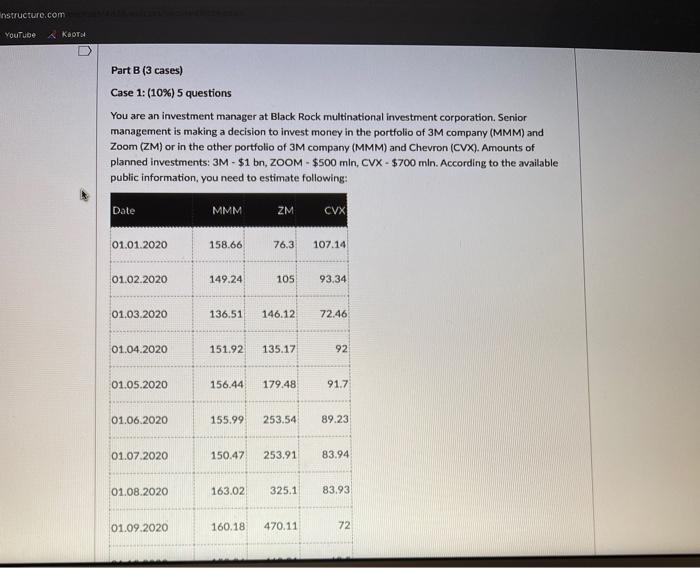

Question: Instructure.com YouTube Part B (3 cases) Case 1: (10%) 5 questions You are an investment manager at Black Rock multinational investment corporation. Senior management is

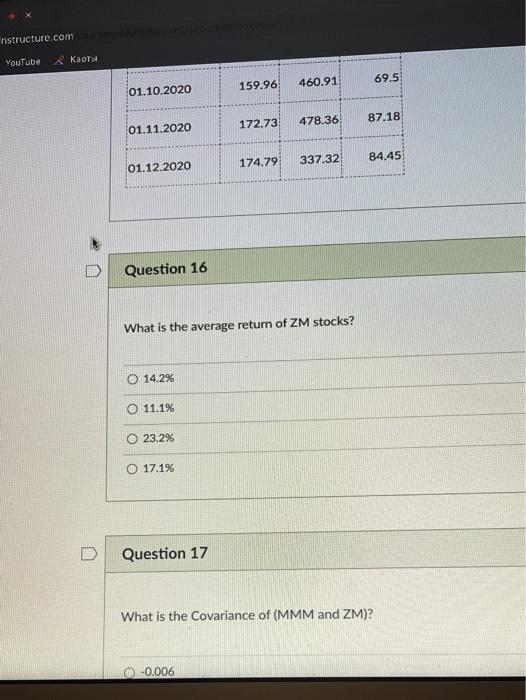

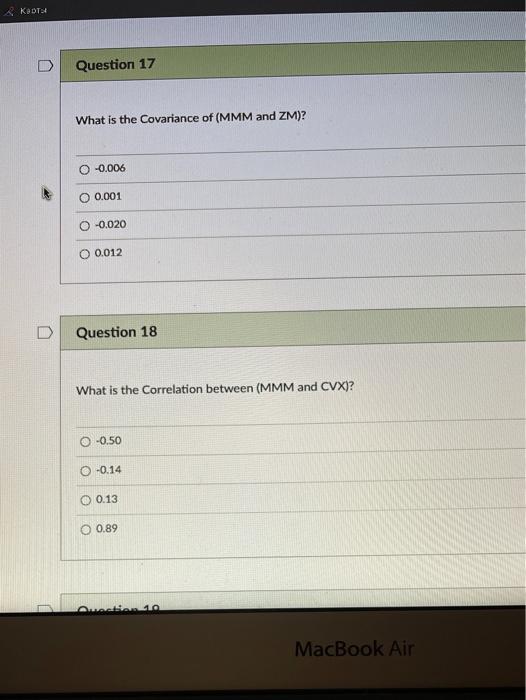

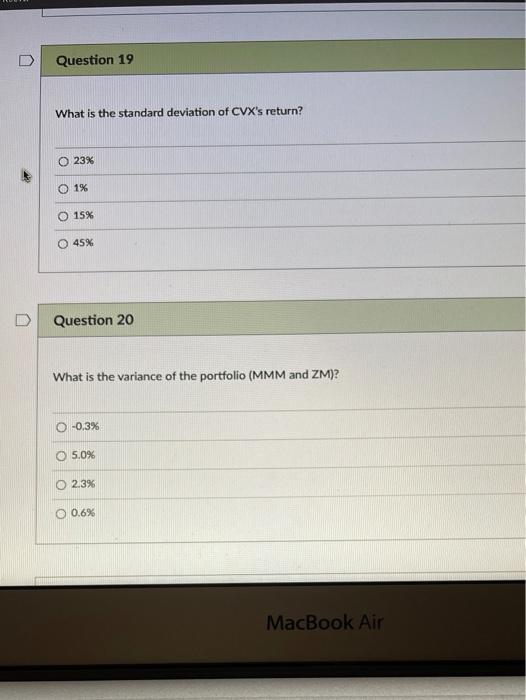

Instructure.com YouTube Part B (3 cases) Case 1: (10%) 5 questions You are an investment manager at Black Rock multinational investment corporation. Senior management is making a decision to invest money in the portfolio of 3M company (MMM) and Zoom (ZM) or in the other portfolio of 3M company (MMM) and Chevron (CVX). Amounts of planned investments : 3M - $1 bn, ZOOM - $500 min, CVX - $700 mln. According to the available public information, you need to estimate following: Date MMM ZM CVX 01.01.2020 158.66 76.3 107.14 01.02.2020 149.24 105 93.34 01.03.2020 136.51 146.12 72.46 01.04.2020 151.92 135.17 92 01.05.2020 156.44 179.48 91.7 01.06.2020 155.99 253.54 89.23 01.07.2020 150.47 253.91 83.94 01.08.2020 163.02 325.1 83.93 01.09.2020 160.18 470.11 72 nstructure.com YouTube : 460,91 69.5 01.10.2020 159.96 478.36 87.18 01.11.2020 172.73 174.79 337.32 84.45 01.12.2020 n Question 16 What is the average return of ZM stocks? O 14.2% O 11.1% 23.2% O 17.1% Question 17 What is the Covariance of (MMM and ZM)? -0.006 KODT Question 17 What is the Covariance of (MMM and ZM)? -0.006 O 0.001 -0.020 0.012 D Question 18 What is the correlation between (MMM and CVX)? 0 -0.50 0 -0.14 O 0.13 O 0.89 MacBook Air Question 19 What is the standard deviation of CVX's return? O 23% O 1% 15% 45% Question 20 What is the variance of the portfolio (MMM and ZM)? 0 -0.3% 5.0% 2.3% O 0.6% MacBook Air

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts