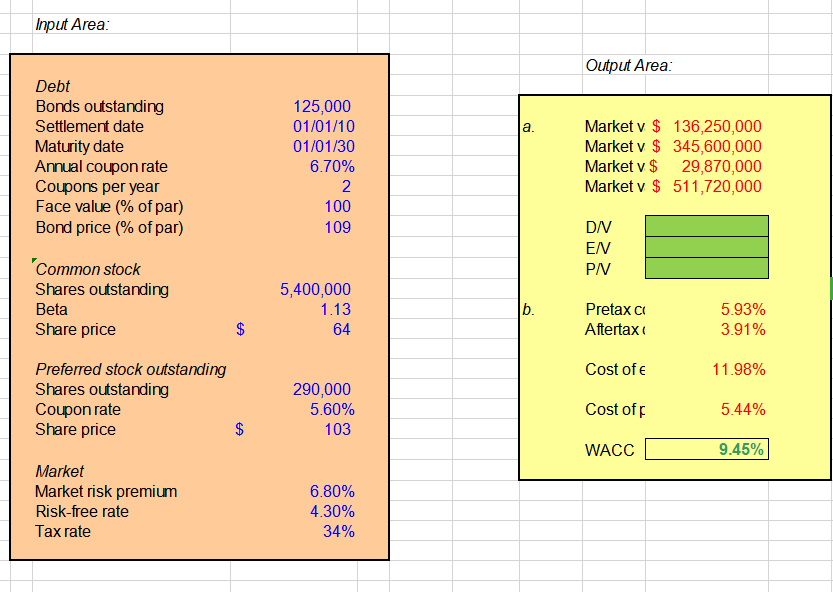

Question: Insturction: Input the excel formulae/ function for the green cell so it will show the numerical answer. Input Area: Output Area: a. Debt Bonds outstanding

Insturction: Input the excel formulae/ function for the green cell so it will show the numerical answer.

Input Area: Output Area: a. Debt Bonds outstanding Settlement date Maturity date Annual coupon rate Coupons per year Face value (% of par) Bond price (% of par) 125,000 01/01/10 01/01/30 6.70% 2. 100 109 Market v $ 136,250,000 Market v $ 345,600,000 Market v$ 29,870,000 Market v $ 511,720,000 DN EN PNV 'Common stock Shares outstanding Beta Share price 5,400,000 1.13 b. Pretax ct Aftertax 5.93% 3.91% $ 64 Cost of 11.98% Preferred stock outstanding Shares outstanding Coupon rate Share price 290,000 5.60% 103 Cost off 5.44% $ WACC 9.45% Market Market risk premium Risk-free rate Tax rate 6.80% 4.30% 34%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts