Question: insurance & risk management m. please provide a answer nor already submitted. thank you lan is 75 years oid when she decides to get a

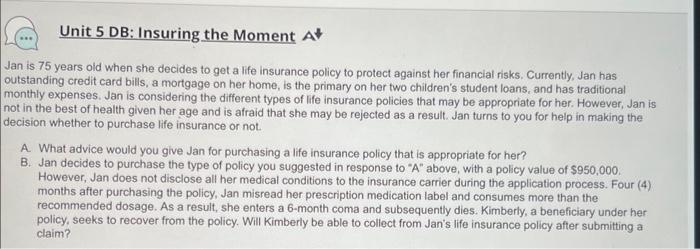

lan is 75 years oid when she decides to get a life insurance policy to protect against her financial risks. Currently, Jan has utstanding credit card bills, a mortgage on her home, is the primary on her two children's student loans, and has traditional nonthly expenses. Jan is considering the different types of life insurance policies that may be appropriate for her. However, Jan is ot in the best of health given her age and is afraid that she may be rejected as a result. Jan turns to you for help in making the ecision whether to purchase life insurance or not. A. What advice would you give Jan for purchasing a life insurance policy that is appropriate for her? B. Jan decides to purchase the type of policy you suggested in response to "A" above, with a policy value of $950,000. However, Jan does not disclose all her medical conditions to the insurance carrier during the application process. Four (4) months after purchasing the policy, Jan misread her prescription medication label and consumes more than the recommended dosage. As a result, she enters a 6-month coma and subsequently dies. Kimberly, a beneficiary under her policy, seeks to recover from the policy. Will Kimberly be able to collect from Jan's life insurance policy after submitting a claim

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts