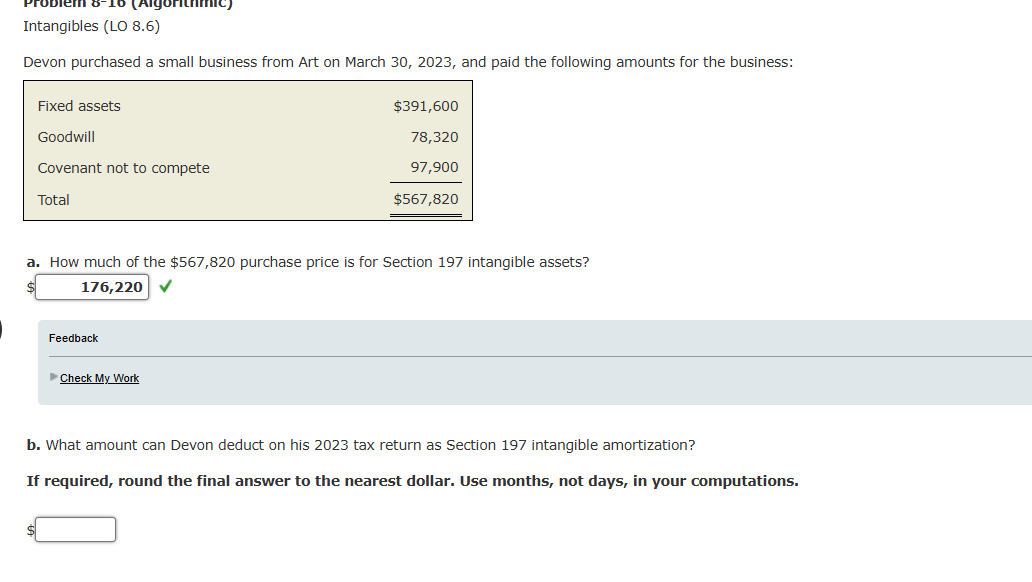

Question: Intangibles ( LO 8 . 6 ) Devon purchased a small business from Art on March 3 0 , 2 0 2 3 , and

Intangibles LO

Devon purchased a small business from Art on March and paid the following amounts for the business:

Line Item DescriptionAmountFixed assets$GoodwillCovenant not to competeTotal$

Question Content Area

a How much of the $ purchase price is for Section intangible assets?

fill in the blank of $

Question Content Area

bWhat amount can Devon deduct on his tax return as Section intangible amortization?

If required, round the final answer to the nearest dollar. Use months, not days, in your computations.

fill in the blank of $

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock