Question: Int=C pud Puc 3a. (12 Points Total; 6 each). Bonds that mature in 15 years were recently issued by Princeton Printers, Inc. They have a

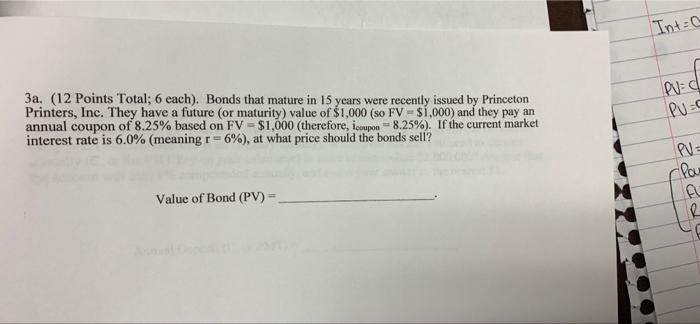

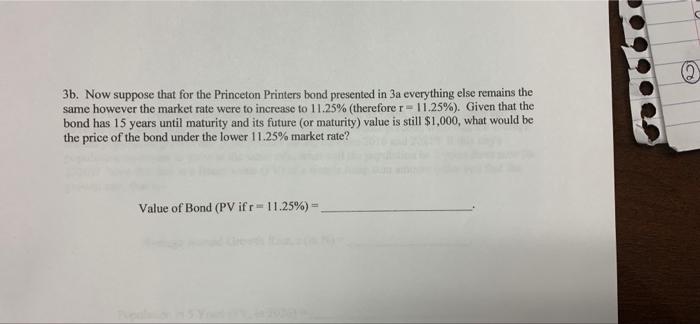

Int=C pud Puc 3a. (12 Points Total; 6 each). Bonds that mature in 15 years were recently issued by Princeton Printers, Inc. They have a future (or maturity) value of $1,000 (so FV = $1,000) and they pay an annual coupon of 8.25% based on FV = $1,000 (therefore, ioupon = 8.25%). If the current market interest rate is 6.0% (meaning r=6%), at what price should the bonds sell? Pou 23d Value of Bond (PV) = R 3b. Now suppose that for the Princeton Printers bond presented in 3a everything else remains the same however the market rate were to increase to 11.25% (therefore r = 11.25%). Given that the bond has 15 years until maturity and its future (or maturity) value is still $1,000, what would be the price of the bond under the lower 11.25% market rate? Value of Bond (PV ifr-11.25%) =

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts