Question: Integrated Audit Practice 7th Edition - Assignment 3 - Current Workpapers 5-4 ELECTRONIC WORKPAPER OPTION: Complete and print workpaper 5-3 using Excel. Allocation of materiality-performance

Integrated Audit Practice 7th Edition - Assignment 3 - Current Workpapers 5-4

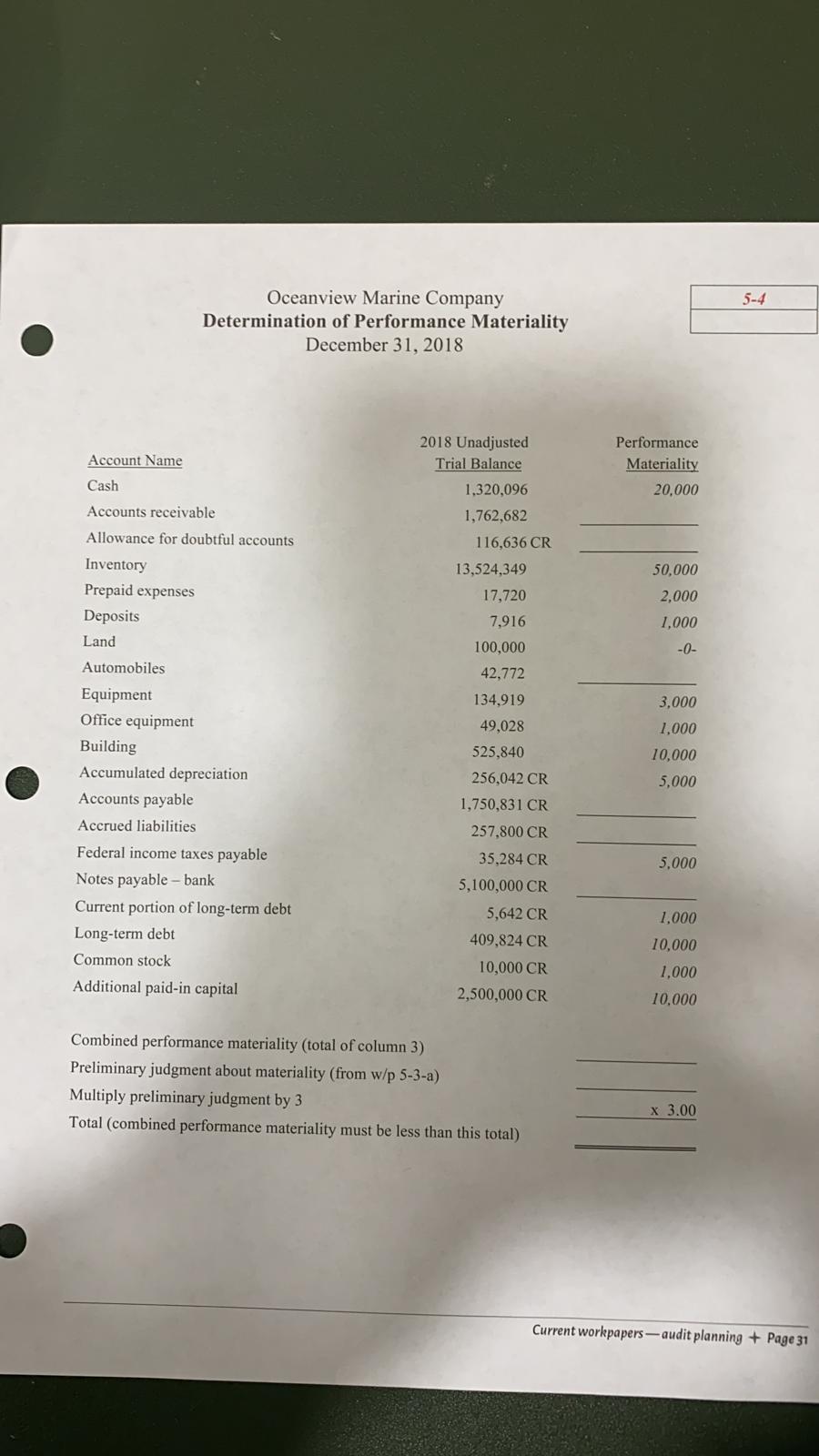

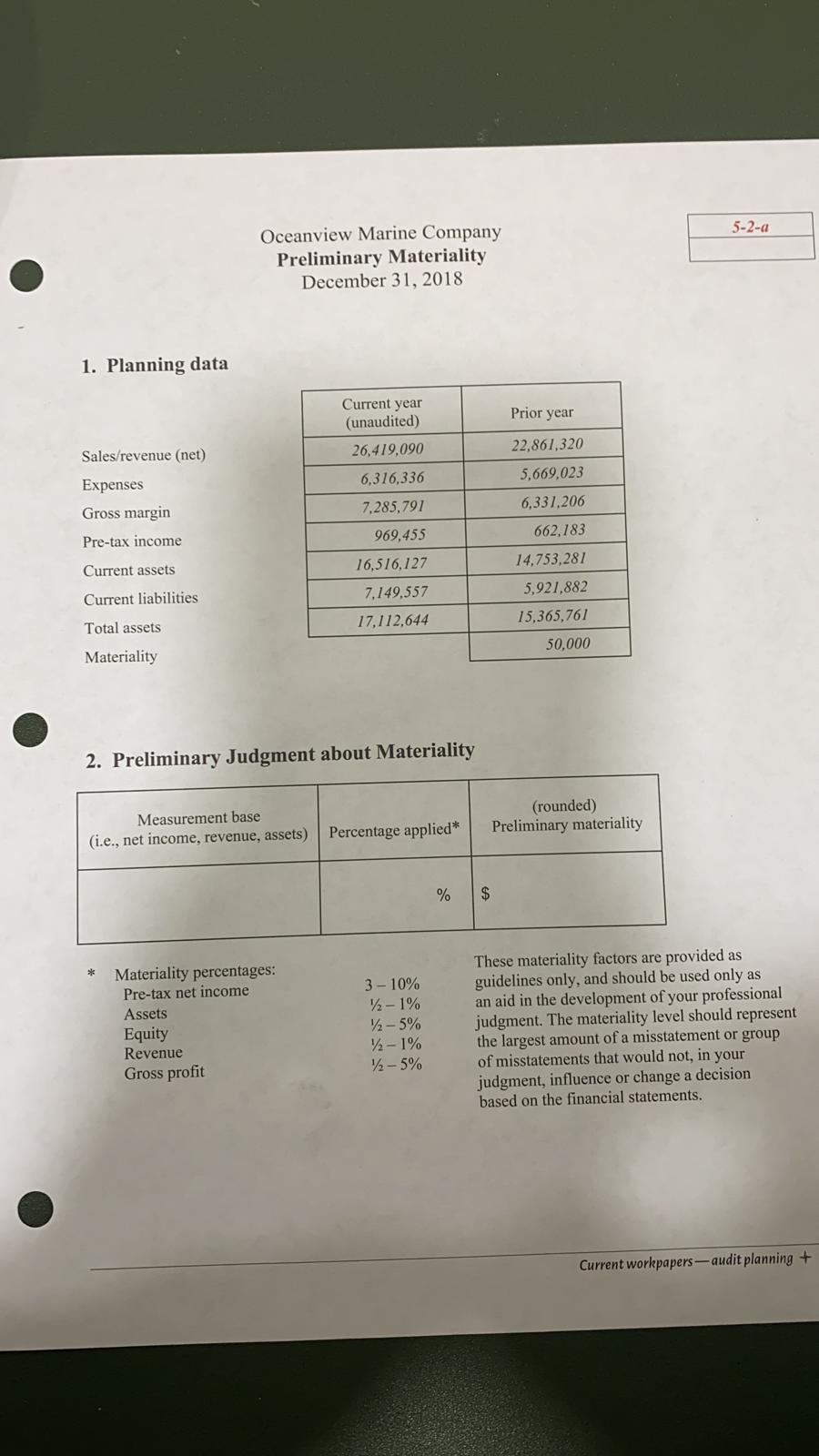

ELECTRONIC WORKPAPER OPTION: Complete and print workpaper 5-3 using Excel. Allocation of materiality-performance materiality f. On workpaper 5-4, complete the Performance Materiality column to establish performance materiality for each balance sheet account. Bill has already established performance materiality for several of the accounts. Follow the guidelines provided in the bottom section of your firm's POLICY STATEMENT included with this assignment to establish performance materiality for each of the remaining accounts. In making your allocations, you should attempt to allocate the maximum total allowable allocation of three times your preliminary materiality level. Complete the bottom portion of workpaper 5-4 and make sure that your total performance materiality does not exceed the maximum allowable allocation of three times your preliminary materiality level. ELECTRONIC WORKPAPER OPTION: Complete and print workpaper 5-4 using Excel. Review of audit planning checklist and audit budgets 5-4 Oceanview Marine Company Determination of Performance Materiality December 31, 2018 Performance Materiality Account Name Cash 20,000 Accounts receivable 2018 Unadjusted Trial Balance 1,320,096 1,762,682 116,636 CR 13,524,349 50,000 2,000 17,720 7,916 1,000 100,000 42,772 134,919 Allowance for doubtful accounts Inventory Prepaid expenses Deposits Land Automobiles Equipment Office equipment Building Accumulated depreciation Accounts payable Accrued liabilities Federal income taxes payable Notes payable - bank Current portion of long-term debt Long-term debt Common stock Additional paid-in capital 49,028 525,840 256,042 CR 3,000 1,000 10,000 5,000 5.000 1,750,831 CR 257,800 CR 35,284 CR 5,100,000 CR 5,642 CR 409,824 CR 10,000 CR 2,500,000 CR 1,000 10,000 1,000 10,000 Combined performance materiality (total of column 3) Preliminary judgment about materiality (from w/p 5-3-a) Multiply preliminary judgment by 3 Total (combined performance materiality must be less than this total) X 3.00 Current workpapers -- audit planning + Page 31 5-2-a Oceanview Marine Company Preliminary Materiality December 31, 2018 1. Planning data Current year (unaudited) Prior year 26,419,090 22,861,320 Sales/revenue (net) 5,669,023 Expenses Gross margin Pre-tax income 6,316,336 7,285,791 969,455 16,516,127 7.149,557 Current assets 6,331,206 662,183 14,753,281 5,921.882 15,365,761 50,000 Current liabilities Total assets 17,112,644 Materiality 2. Preliminary Judgment about Materiality Measurement base (i.e., net income, revenue, assets) (rounded) Preliminary materiality Percentage applied* % $ Materiality percentages: Pre-tax net income Assets Equity Revenue Gross profit 3- 10% 12- 1% 12-5% 12- 1% 12-5% These materiality factors are provided as guidelines only, and should be used only as an aid in the development of your professional judgment. The materiality level should represent the largest amount of a misstatement or group of misstatements that would not, in your judgment, influence or change a decision based on the financial statements. Current workpapers--audit planning + ELECTRONIC WORKPAPER OPTION: Complete and print workpaper 5-3 using Excel. Allocation of materiality-performance materiality f. On workpaper 5-4, complete the Performance Materiality column to establish performance materiality for each balance sheet account. Bill has already established performance materiality for several of the accounts. Follow the guidelines provided in the bottom section of your firm's POLICY STATEMENT included with this assignment to establish performance materiality for each of the remaining accounts. In making your allocations, you should attempt to allocate the maximum total allowable allocation of three times your preliminary materiality level. Complete the bottom portion of workpaper 5-4 and make sure that your total performance materiality does not exceed the maximum allowable allocation of three times your preliminary materiality level. ELECTRONIC WORKPAPER OPTION: Complete and print workpaper 5-4 using Excel. Review of audit planning checklist and audit budgets 5-4 Oceanview Marine Company Determination of Performance Materiality December 31, 2018 Performance Materiality Account Name Cash 20,000 Accounts receivable 2018 Unadjusted Trial Balance 1,320,096 1,762,682 116,636 CR 13,524,349 50,000 2,000 17,720 7,916 1,000 100,000 42,772 134,919 Allowance for doubtful accounts Inventory Prepaid expenses Deposits Land Automobiles Equipment Office equipment Building Accumulated depreciation Accounts payable Accrued liabilities Federal income taxes payable Notes payable - bank Current portion of long-term debt Long-term debt Common stock Additional paid-in capital 49,028 525,840 256,042 CR 3,000 1,000 10,000 5,000 5.000 1,750,831 CR 257,800 CR 35,284 CR 5,100,000 CR 5,642 CR 409,824 CR 10,000 CR 2,500,000 CR 1,000 10,000 1,000 10,000 Combined performance materiality (total of column 3) Preliminary judgment about materiality (from w/p 5-3-a) Multiply preliminary judgment by 3 Total (combined performance materiality must be less than this total) X 3.00 Current workpapers -- audit planning + Page 31 5-2-a Oceanview Marine Company Preliminary Materiality December 31, 2018 1. Planning data Current year (unaudited) Prior year 26,419,090 22,861,320 Sales/revenue (net) 5,669,023 Expenses Gross margin Pre-tax income 6,316,336 7,285,791 969,455 16,516,127 7.149,557 Current assets 6,331,206 662,183 14,753,281 5,921.882 15,365,761 50,000 Current liabilities Total assets 17,112,644 Materiality 2. Preliminary Judgment about Materiality Measurement base (i.e., net income, revenue, assets) (rounded) Preliminary materiality Percentage applied* % $ Materiality percentages: Pre-tax net income Assets Equity Revenue Gross profit 3- 10% 12- 1% 12-5% 12- 1% 12-5% These materiality factors are provided as guidelines only, and should be used only as an aid in the development of your professional judgment. The materiality level should represent the largest amount of a misstatement or group of misstatements that would not, in your judgment, influence or change a decision based on the financial statements. Current workpapers--audit planning +

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts