Question: Integrated Audit Practice Case, 6th edition, David S. Kerr. Assignment 1 1. Charles Ward, the engagement partner, has already completed the Client Acceptance Form in

Integrated Audit Practice Case, 6th edition, David S. Kerr. Assignment 1

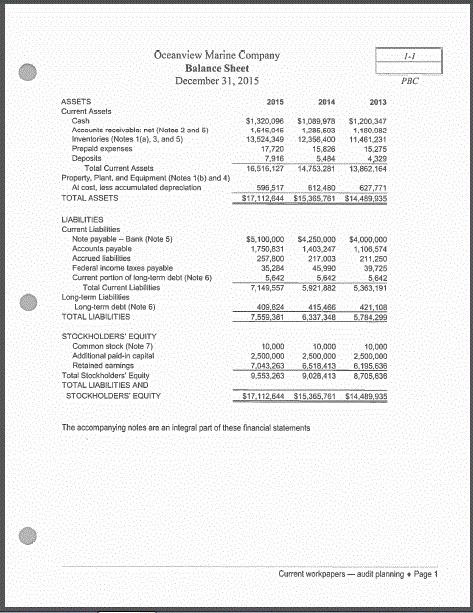

1. Charles Ward, the engagement partner, has already completed the Client Acceptance Form in the permanent file. Based on the information you studied in the Permanent File and the unaudited financial statements included in the Current Workpapers (workpapers 1-1 through 1-5), evaluate the client acceptance decision. Organize your answer using the two-column format shown below.

a. Indicate two favorable factors most important to the client acceptance decision (one factor has been provided as an example).

b. Indicate three concerns you have about accepting Oceanview as a client.

2. Indicate whether you agree with the decision to accept the client. Justify your decision, indicating the one or two factors from your response to the first question that had the greatest influence on your decision.

3. The client and our firm have agreed on an initial estimated audit fee of $29,000 (see the engagement letter). However, the estimated total cost of performing this years audit is $37,590 (see the fee budget on workpaper 6-5). Discuss possible reasons why a CPA firm might charge a new client an audit fee that is lower than the estimated first-year costs of performing the audit.

4. Auditing standards require auditors who are considering accepting an audit engagement to communicate with the previous auditors.

a. What is the primary purpose of this communication between the new (successor) and old (predecessor) auditors?

b. Why is the clients permission required before this communication can take place?

c. The successor auditor also often reviews the predecessor auditors workpapers. What is the primary purpose of reviewing these workpapers?

Oceanview Marine Company Balance Sheet December 3, 2015 PRC ASSETS Current Assels 2015 2014 Accounts receivaba: net {Natoc and G) Inventories (Noles (a),3, and 5) Prepald xpenses $1,320,096 $1,089,978 $1,200,347 1,386,603 3,524,349 12,358,400 11,461 231 1,646,046 1,180,082 15,275 862,164 627,771 15,826 5484 7.916 16,516,127 1 Tolal Current Assets 14,753.281 13, Property. Plant, and Equipment (Notes 1ib) and 4) 595,517 612.480 17,112,444 515 385 761 $14,489 Al cost, lass accumulaled depredlation TOTAL ASSETS Currant Liablities Note psyable- Bank (Nole 5) Accounts payable Apcrued abiises Federal income taxes payable Current portion of $5,100,00O S4.250,000 $4,000,000 1,750,8311,403.2471,108,574 211.250 39,725 5,642 149,557 5,921882 5,363,191 257,800 35,284 217.003 46,990 lang-em Total Cuent Liablities Long erm Liabiliies TOTAL LIABILITIES STCCKHOLDERS' EQUITY Long-term debt (Note 6) 421.108 10,000 Common stock (Note 7 Additioneall paid-In capital Retained camings 0,000 2,500,000 2,500,000 2.500,000 9,553,2639,026,4138,705,638 17,112,644 Total Slockholders' Equity TOTAL LIABILITIES AND STOCKHOLDERS' EQUITY 14.499 The accompaying noles are an integral part of these financial statements Current workpapers-audit planning Page 1

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts