Question: Integrative Case 1.1 Walmart o 1. The first case at the end of this chapter and numerous subsequent chapters is a series of integrative cases

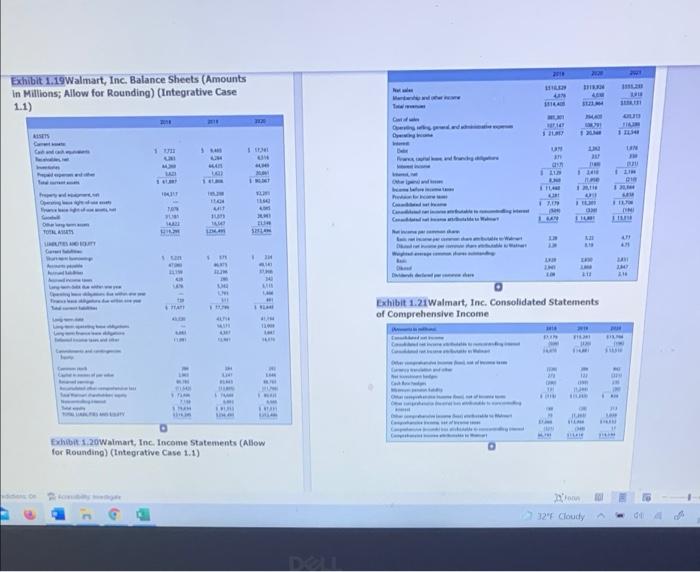

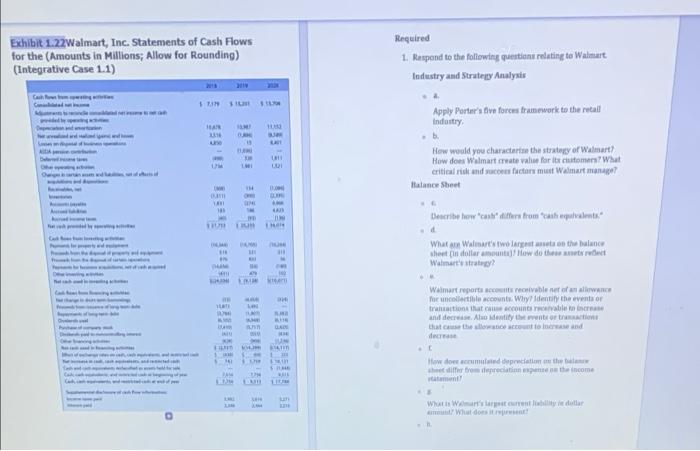

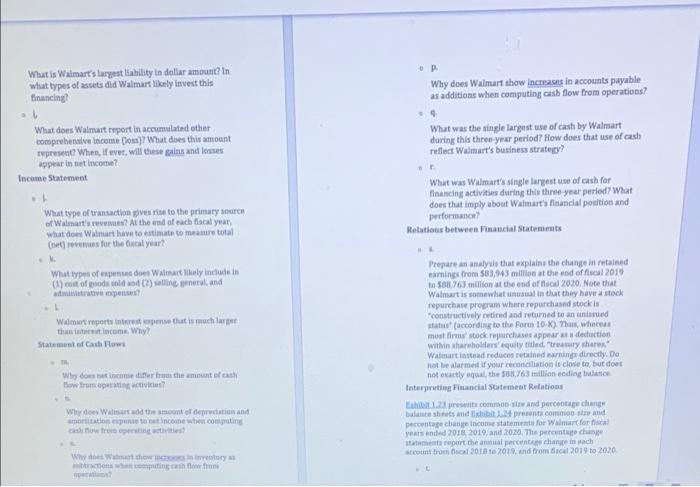

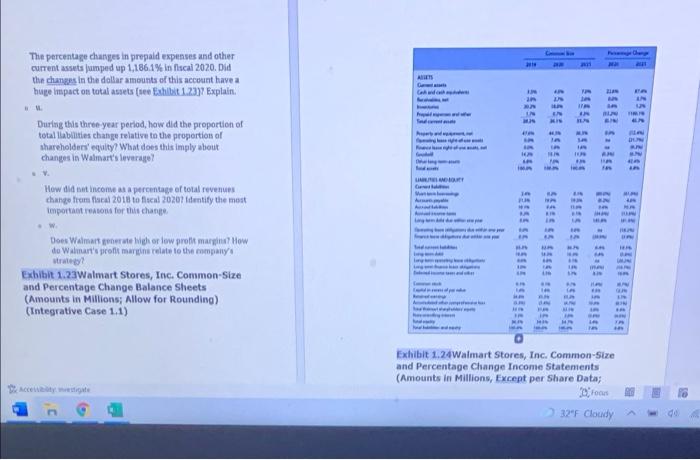

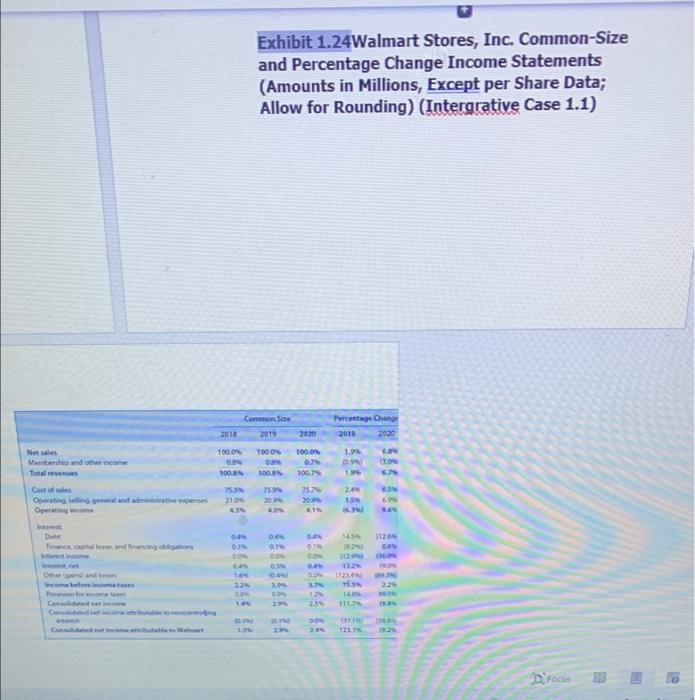

Integrative Case 1.1 Walmart o 1. The first case at the end of this chapter and numerous subsequent chapters is a series of integrative cases involving Walmart, Inc. (Walmart). The series of cases applies the concepts and analytical tools discussed in each chapter to Walmart's financial statements and notes. The preparation of responses to the questions in these cases results in an integrated illustration of the six sequential steps in financial statement analysis discussed in this chapter and throughout the book. Introduction 1. Walmart is a very large chain of retail stores selling consumer goods. As it states in its Form 10-K for fiscal 2020: Walmart Inc. ("Walmart," the "Company" or "we") helps people around the world save money and live better - anytime and anywhere - by providing the opportunity to shop in retail stores and through eCommerce. Through innovation, we strive to continuously improve a customer-centric experience that seamlessly integrates our eCommerce and retail stores in an omnichannel offering that saves time for our customers. Each week, we serve over 265 million customers who visit approximately 11,500 stores and numerous eCommerce websites under 56 banners in 27 countries. Our strategy is to make every day easier for busy families, operate with discipline, sharpen our culture and become digital, and make trust a competitive advantage. Making life easier for busy families includes our commitment to price vestigate easier for busy families includes our commitment to price leadership, which has been and will remain a cornerstone of our business, as well as increasing convenience to save our customers time. By leading on price, we earn the trust of our customers every day by providing a broad assortment of quality merchandise and services at everyday low prices ("EDLP"), EDLP is our pricing philosophy under which we price items at a low price every day so our customers trust that our prices will not change under frequent promotional activity. Everyday low cost ("EDLC") is our commitment to control expenses so our cost savings can be passed along to our customers, Our operations comprise three reportable segments: Walmart U.S., Walmart International and Sam's Club. Our fiscal year ends on January 31 for our United States ("U.S.) and Canadian operations. We consolidate all other operations generally using a one-month lag and on a calendar year basis. Our discussion is as of and for the fiscal years ended January 31, 2020 fiscal as of and for the fiscal years ended January 31, 2020 (fiscal 2020"), January 31, 2019 (fiscal 2019"), and January 31, 2018 ("fiscal 2018"). During fiscal 2020, we generated total revenues of $524.0 billion, which primarily comprised net sales of $519.9 billion. For more detailed discussion of Walmart's stores, products, customers, and business model, visit the company's website: www.corporate.walmart.com.* Financial Statements Exhibit 1.19 presents comparative balance sheets, Exhibit 1.20 presents comparative income statements, Exhibit 1.21 presents statements of comprehensive income, and Exhibit 1.22 presents comparative statements of cash flows for Walmart for the three fiscal years ending January 31, 2019, 2020, and 2021. Because Walmart's fiscal year end occurs at the end of January, we refer to the calendar years ended January 31, 2019, 2020 and 2021 as fiscal years 2018, 2019, and 2020, respectively, because 11/12 of the months falls in these latter years. Firms vary in their practice of referring to their own fiscal year based on this convention or the calendar year in which the year end falls. However, from an analyst's perspective, it is helpful to reference fiscal years consistently across companies, for example because it is more appropriate to compare, say, Walmart's 2020 results (as we reference) to a firm with a December 31, 2020 fiscal year end Walmart, prepares its financial statements in accordance with O.S. GAAP. For more detail on Walmart financial statements, or to download the fiscal 2020 Form 10-K, you can visi Walmart's investor relations page: stock.walmart.com investors delauljastix. 2018 Exhibit 1.19Walmart, Inc. Balance Sheets (Amounts in Millions; Allow for Rounding) (Integrative Case 1.1) WP . 111 OLE I SETS IMTE 1 UN INT UN w WID SIT 12 HIT w HOVE 10 Card IN TO SI AT GOTT HE I CHE INT w Exhibit 1.21 Walmart, Inc. Consolidated Statements of Comprehensive Income mm 132 UM # HE ER wit 1 Exhibit 1.20 Walmart, Inc. Income Statements (Allow for Rounding) (Integrative Case 1.1) 12 Cloudy Exhibit 1.22Walmart, Inc. Statements of Cash Flows for the (Amounts in Millions; Allow for Rounding) (Integrative Case 1.1) Required 1. Respond to the following questions relating to Walmart Industry and Strategy Analysis 11 Apply Porter's five forces framework to the retail Industry 13 How would you characters the strategy of Walmart How does Walmart create value for its customers? What critical island octors must Walmart me? Halance Sheet um TA Describe how cant differs from each equat What A Walmart wanneer on the balance shert in dollar amount low do the street Walmarty? Walmart reports tecnivable of an awe for collectible account. Why? Identify the event or traction that contable to create and der Also dentity the water to that cause the slow cooler and 1 5 How does med practice e differ from depreciation was not the income Whereby deter What does it! Why does Walmart show increases in accounts payable as additions when computing cash flow from operations? . What is Walmart's largest liability in dollar amount? In what types of assets did Walmart likely invest this financing 1 What does Walmart report in accumulated other comprehensive Income on) What does this amount represent? When, if ever, will these pains and losses appear in net income? Income Statement What was the single largest use of cash by Walmart during this three year period? How does that use of cash reflect Walmart's business strategy? . What type of transaction les rise to the primary source of Walmart's revenus? At the end of each scal year, what does Walmart have to estimate to measure total (hereveres for the clear What was Walmart's single largest use of cash for financing activities during this three year period? What does that imply about Walmart financial position and performance? Relations between Pinancial Statemente What types of endos Walmart ayindade in (1) food old and () eingerland rative expenses! Walmart reports interes pene that is much larper than to come. Why? Statement of Cash Flows Prepare an analysis that explains the change in retained naming rom $83,943 million at the end of fal 2010 In 56.763 million at the end of 2020. Note that Walmart is somewhat unusual in that they have a stock repurchase program where repurchased stock is constructively retired and returned to an unted stus (according to the Form 10-x). Thus, where most fimm stock purchases appear as deduction within shareholders equity titled "trary shares Walmart instead reduces retained warning directly De not be alarme if your reconciliation is close to, but doet not exactly equal the $3.763 million coding blanc Interpreting Financial Statement Relations Ehrew and percentage change balance shes and Exhibit 1. common stand percentage change income statements for Walmart for years ended 2011, 2019 and 2020. The percentage change report the annual percent change in wach sont troca 2011 2010, and from the 2019 to 2020 Why does the differ from the amount of how from operatiivi? Why does Walmart the amount of depind amortitatem expune tout income when computing how trompettes Why within my concepting the w B The percentage changes in prepaid expenses and other current assets jumped up 1,186,1% in fiscal 2020. Did the changes in the dollar amounts of this account have a huge impact on total assets (tee Exhibit 1.237 Explain. AT Card IN UN www EN MIS M During this three year period, how did the proportion of total liabilities change relative to the proportion of shareholders' equity? What does this imply about changes in Walmart's leverage IR How did income as a percentage of total revenues change frem flacal 2018 to focal 20207 Identity the most Important for this change IN HO EN Does Walmart onerate high or low profit margin? How do Walmart's profit marine relate to the company strategy Exhibit 1.23 Walmart Stores, Inc. Common Size and Percentage Change Balance Sheets (Amounts in Millions; Allow for Rounding) (Integrative Case 1.1) MR Exhibit 1.24 Walmart Stores, Inc. Common Size and Percentage Change Income Statements (Amounts in Millions, Except per Share Data; 32F Cloudy Exhibit 1.24Walmart Stores, Inc. Common-Size and Percentage Change Income Statements (Amounts in Millions, Except per Share Data; Allow for Rounding) (Intergrative Case 1.1) Commen Sie 2012 Percentage Ong 2019 2020 2018 2030 100.0% 1000 1.9 Mattles Membership and the income Total 100.0 D 100N 100 100,7 19% Govo Operating in and depenses Operating in 210 5. 2009 25.7 209 1 24 15 16 ON 145 D Finance capitulum w necie chigenom 0.4 0.14 00 Wh ON DAN 12.90 00 0 1123 O 12 Po Codec 1 111 DO Cuddles Walmart Drodus Integrative Case 1.1 Walmart o 1. The first case at the end of this chapter and numerous subsequent chapters is a series of integrative cases involving Walmart, Inc. (Walmart). The series of cases applies the concepts and analytical tools discussed in each chapter to Walmart's financial statements and notes. The preparation of responses to the questions in these cases results in an integrated illustration of the six sequential steps in financial statement analysis discussed in this chapter and throughout the book. Introduction 1. Walmart is a very large chain of retail stores selling consumer goods. As it states in its Form 10-K for fiscal 2020: Walmart Inc. ("Walmart," the "Company" or "we") helps people around the world save money and live better - anytime and anywhere - by providing the opportunity to shop in retail stores and through eCommerce. Through innovation, we strive to continuously improve a customer-centric experience that seamlessly integrates our eCommerce and retail stores in an omnichannel offering that saves time for our customers. Each week, we serve over 265 million customers who visit approximately 11,500 stores and numerous eCommerce websites under 56 banners in 27 countries. Our strategy is to make every day easier for busy families, operate with discipline, sharpen our culture and become digital, and make trust a competitive advantage. Making life easier for busy families includes our commitment to price vestigate easier for busy families includes our commitment to price leadership, which has been and will remain a cornerstone of our business, as well as increasing convenience to save our customers time. By leading on price, we earn the trust of our customers every day by providing a broad assortment of quality merchandise and services at everyday low prices ("EDLP"), EDLP is our pricing philosophy under which we price items at a low price every day so our customers trust that our prices will not change under frequent promotional activity. Everyday low cost ("EDLC") is our commitment to control expenses so our cost savings can be passed along to our customers, Our operations comprise three reportable segments: Walmart U.S., Walmart International and Sam's Club. Our fiscal year ends on January 31 for our United States ("U.S.) and Canadian operations. We consolidate all other operations generally using a one-month lag and on a calendar year basis. Our discussion is as of and for the fiscal years ended January 31, 2020 fiscal as of and for the fiscal years ended January 31, 2020 (fiscal 2020"), January 31, 2019 (fiscal 2019"), and January 31, 2018 ("fiscal 2018"). During fiscal 2020, we generated total revenues of $524.0 billion, which primarily comprised net sales of $519.9 billion. For more detailed discussion of Walmart's stores, products, customers, and business model, visit the company's website: www.corporate.walmart.com.* Financial Statements Exhibit 1.19 presents comparative balance sheets, Exhibit 1.20 presents comparative income statements, Exhibit 1.21 presents statements of comprehensive income, and Exhibit 1.22 presents comparative statements of cash flows for Walmart for the three fiscal years ending January 31, 2019, 2020, and 2021. Because Walmart's fiscal year end occurs at the end of January, we refer to the calendar years ended January 31, 2019, 2020 and 2021 as fiscal years 2018, 2019, and 2020, respectively, because 11/12 of the months falls in these latter years. Firms vary in their practice of referring to their own fiscal year based on this convention or the calendar year in which the year end falls. However, from an analyst's perspective, it is helpful to reference fiscal years consistently across companies, for example because it is more appropriate to compare, say, Walmart's 2020 results (as we reference) to a firm with a December 31, 2020 fiscal year end Walmart, prepares its financial statements in accordance with O.S. GAAP. For more detail on Walmart financial statements, or to download the fiscal 2020 Form 10-K, you can visi Walmart's investor relations page: stock.walmart.com investors delauljastix. 2018 Exhibit 1.19Walmart, Inc. Balance Sheets (Amounts in Millions; Allow for Rounding) (Integrative Case 1.1) WP . 111 OLE I SETS IMTE 1 UN INT UN w WID SIT 12 HIT w HOVE 10 Card IN TO SI AT GOTT HE I CHE INT w Exhibit 1.21 Walmart, Inc. Consolidated Statements of Comprehensive Income mm 132 UM # HE ER wit 1 Exhibit 1.20 Walmart, Inc. Income Statements (Allow for Rounding) (Integrative Case 1.1) 12 Cloudy Exhibit 1.22Walmart, Inc. Statements of Cash Flows for the (Amounts in Millions; Allow for Rounding) (Integrative Case 1.1) Required 1. Respond to the following questions relating to Walmart Industry and Strategy Analysis 11 Apply Porter's five forces framework to the retail Industry 13 How would you characters the strategy of Walmart How does Walmart create value for its customers? What critical island octors must Walmart me? Halance Sheet um TA Describe how cant differs from each equat What A Walmart wanneer on the balance shert in dollar amount low do the street Walmarty? Walmart reports tecnivable of an awe for collectible account. Why? Identify the event or traction that contable to create and der Also dentity the water to that cause the slow cooler and 1 5 How does med practice e differ from depreciation was not the income Whereby deter What does it! Why does Walmart show increases in accounts payable as additions when computing cash flow from operations? . What is Walmart's largest liability in dollar amount? In what types of assets did Walmart likely invest this financing 1 What does Walmart report in accumulated other comprehensive Income on) What does this amount represent? When, if ever, will these pains and losses appear in net income? Income Statement What was the single largest use of cash by Walmart during this three year period? How does that use of cash reflect Walmart's business strategy? . What type of transaction les rise to the primary source of Walmart's revenus? At the end of each scal year, what does Walmart have to estimate to measure total (hereveres for the clear What was Walmart's single largest use of cash for financing activities during this three year period? What does that imply about Walmart financial position and performance? Relations between Pinancial Statemente What types of endos Walmart ayindade in (1) food old and () eingerland rative expenses! Walmart reports interes pene that is much larper than to come. Why? Statement of Cash Flows Prepare an analysis that explains the change in retained naming rom $83,943 million at the end of fal 2010 In 56.763 million at the end of 2020. Note that Walmart is somewhat unusual in that they have a stock repurchase program where repurchased stock is constructively retired and returned to an unted stus (according to the Form 10-x). Thus, where most fimm stock purchases appear as deduction within shareholders equity titled "trary shares Walmart instead reduces retained warning directly De not be alarme if your reconciliation is close to, but doet not exactly equal the $3.763 million coding blanc Interpreting Financial Statement Relations Ehrew and percentage change balance shes and Exhibit 1. common stand percentage change income statements for Walmart for years ended 2011, 2019 and 2020. The percentage change report the annual percent change in wach sont troca 2011 2010, and from the 2019 to 2020 Why does the differ from the amount of how from operatiivi? Why does Walmart the amount of depind amortitatem expune tout income when computing how trompettes Why within my concepting the w B The percentage changes in prepaid expenses and other current assets jumped up 1,186,1% in fiscal 2020. Did the changes in the dollar amounts of this account have a huge impact on total assets (tee Exhibit 1.237 Explain. AT Card IN UN www EN MIS M During this three year period, how did the proportion of total liabilities change relative to the proportion of shareholders' equity? What does this imply about changes in Walmart's leverage IR How did income as a percentage of total revenues change frem flacal 2018 to focal 20207 Identity the most Important for this change IN HO EN Does Walmart onerate high or low profit margin? How do Walmart's profit marine relate to the company strategy Exhibit 1.23 Walmart Stores, Inc. Common Size and Percentage Change Balance Sheets (Amounts in Millions; Allow for Rounding) (Integrative Case 1.1) MR Exhibit 1.24 Walmart Stores, Inc. Common Size and Percentage Change Income Statements (Amounts in Millions, Except per Share Data; 32F Cloudy Exhibit 1.24Walmart Stores, Inc. Common-Size and Percentage Change Income Statements (Amounts in Millions, Except per Share Data; Allow for Rounding) (Intergrative Case 1.1) Commen Sie 2012 Percentage Ong 2019 2020 2018 2030 100.0% 1000 1.9 Mattles Membership and the income Total 100.0 D 100N 100 100,7 19% Govo Operating in and depenses Operating in 210 5. 2009 25.7 209 1 24 15 16 ON 145 D Finance capitulum w necie chigenom 0.4 0.14 00 Wh ON DAN 12.90 00 0 1123 O 12 Po Codec 1 111 DO Cuddles Walmart Drodus

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts