Question: Integrative Expected return, standard deviation, and coefficient of variation An asset is currently being considered by Perth Industries. The probabaty distribution of expected returns for

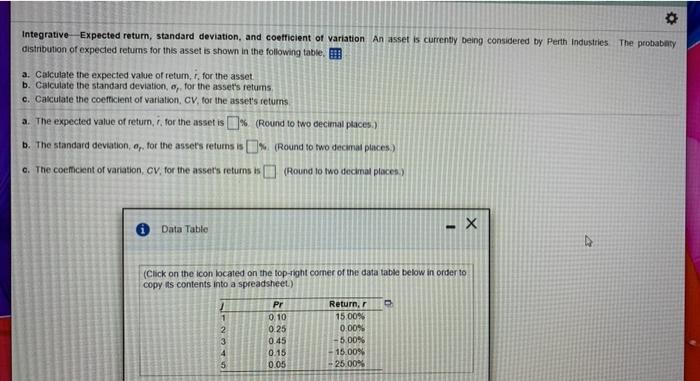

Integrative Expected return, standard deviation, and coefficient of variation An asset is currently being considered by Perth Industries. The probabaty distribution of expected returns for this asset is shown in the following table. a. Calculate the expected value of retum, i, for the asset b. Calculate the standard deviation for the asset's returns c. Calculate the coefficient of variation, CV, for the asset's retums a. The expected value of return, i, for the asset is (% (Round to two decimal places.) b. The standard deviation for the asset's retums is % (Round to two decimal places) c. The comcent of variation, cv, for the asser's returns (Round to two decimal places) 1 Data Table (Click on the icon located on the top-right comer of the data table below in order to copy its contents into a spreadsheet) Tona Pr 0.10 0.25 0.45 0.15 0.05 Return, 15 00 0.00% -5.00% - 15.00% - 25.00%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts