Question: Integrative Expected return, standard deviation, and coefficient of variation Anast currently bong considered by Port de The probly dibution of expected returns for the in

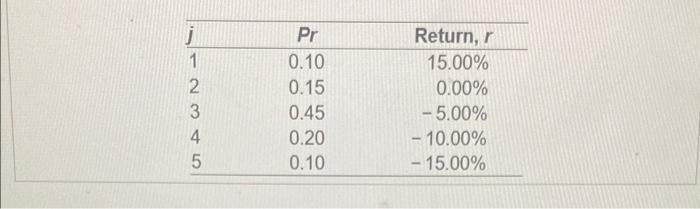

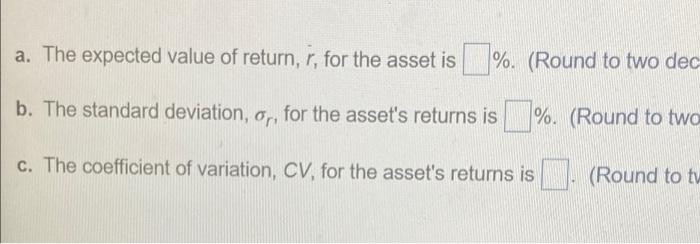

Integrative Expected return, standard deviation, and coefficient of variation Anast currently bong considered by Port de The probly dibution of expected returns for the in the following table a. Calculate the expected value of return for the asset b. Calculate the standard deviation for the asset's rotum c. Calculate the coefficient of variation CV, for the asset's return Data table a. The expected value ofrem for the assis (Round to b. The standard deviation for the assets returns (Round (Click on the icon here in order to copy the contents of the data to bolow into a spreadsheet PY Return 1 0.10 15005 2 0.15 0.00% 3 0.45 - 500 020 1000 5 0.10 -15.00 C. The coofficient of variation CV. for the sole rotumas Rou Integrative - Expected return, standard deviation, and coefficient of variation Anatot is currently being considered by Perth Industries. The probability darbution of expected return for us set is shown in the following table, a. Calculate the expected value ofretum. for the asset Data table b. Cite the standard deviation for the retums c. Calculate the coeficient of variation CV. for the se's returns Click on the conferiorder to copy the contents of the data to be into a spreadshot Return, a. The expected value of retur. for the Round to 015 000 b. The standard deviation for the asse's returns is Rour 0:45 5.000 c. The coefficient of variation CV for the assetsrotum in RO 0.10 -- 1500 PY 0.10 16.00 3 4 0:20 1000% j 1 2 3 4 5 Pr 0.10 0.15 0.45 0.20 0.10 Return, r 15.00% 0.00% - 5.00% - 10.00% - 15.00% a. The expected value of return, ', for the asset is %. (Round to two dec r ( b. The standard deviation, or, for the asset's returns is %. (Round to two . c. The coefficient of variation, CV, for the asset's returns is (Round to tu Integrative Expected return, standard deviation, and coefficient of variation Anast currently bong considered by Port de The probly dibution of expected returns for the in the following table a. Calculate the expected value of return for the asset b. Calculate the standard deviation for the asset's rotum c. Calculate the coefficient of variation CV, for the asset's return Data table a. The expected value ofrem for the assis (Round to b. The standard deviation for the assets returns (Round (Click on the icon here in order to copy the contents of the data to bolow into a spreadsheet PY Return 1 0.10 15005 2 0.15 0.00% 3 0.45 - 500 020 1000 5 0.10 -15.00 C. The coofficient of variation CV. for the sole rotumas Rou Integrative - Expected return, standard deviation, and coefficient of variation Anatot is currently being considered by Perth Industries. The probability darbution of expected return for us set is shown in the following table, a. Calculate the expected value ofretum. for the asset Data table b. Cite the standard deviation for the retums c. Calculate the coeficient of variation CV. for the se's returns Click on the conferiorder to copy the contents of the data to be into a spreadshot Return, a. The expected value of retur. for the Round to 015 000 b. The standard deviation for the asse's returns is Rour 0:45 5.000 c. The coefficient of variation CV for the assetsrotum in RO 0.10 -- 1500 PY 0.10 16.00 3 4 0:20 1000% j 1 2 3 4 5 Pr 0.10 0.15 0.45 0.20 0.10 Return, r 15.00% 0.00% - 5.00% - 10.00% - 15.00% a. The expected value of return, ', for the asset is %. (Round to two dec r ( b. The standard deviation, or, for the asset's returns is %. (Round to two . c. The coefficient of variation, CV, for the asset's returns is (Round to tu

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts