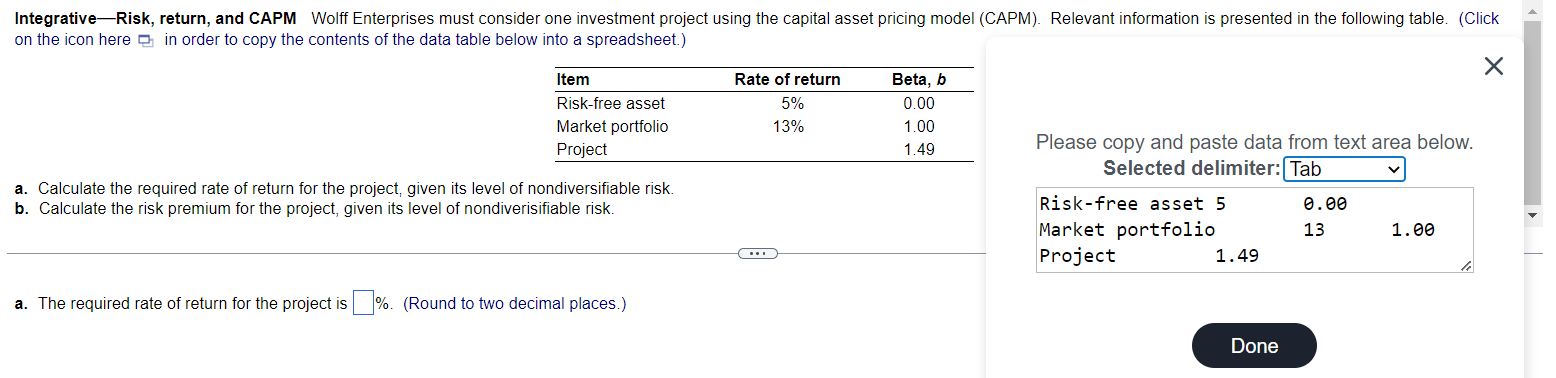

Question: Integrative Risk, return, and CAPM Wolff Enterprises must consider one investment project using the capital asset pricing model (CAPM). Relevant information is presented in

Integrative Risk, return, and CAPM Wolff Enterprises must consider one investment project using the capital asset pricing model (CAPM). Relevant information is presented in the following table. (Click on the icon here in order to copy the contents of the data table below into a spreadsheet.) Xx Item Risk-free asset Market portfolio Project a. Calculate the required rate of return for the project, given its level of nondiversifiable risk. b. Calculate the risk premium for the project, given its level of nondiverisifiable risk. a. The required rate of return for the project is%. (Round to two decimal places.) Rate of return 5% 13% ... Beta, b 0.00 1.00 1.49 Please copy and paste data from text area below. Selected delimiter: Tab Risk-free asset 5 Market portfolio Project 1.49 Done 0.00 13 1.00 le

Step by Step Solution

3.46 Rating (153 Votes )

There are 3 Steps involved in it

a RRf RmRf Here R is the required rate of return for the proj... View full answer

Get step-by-step solutions from verified subject matter experts