Question: Integrative Risk, return, and CAPM You collected the below information to create a portollo by investing 50% in SEC and the rest in the risk-free

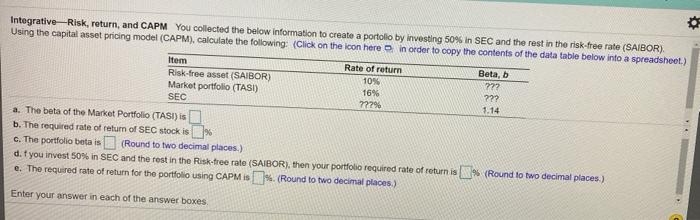

Integrative Risk, return, and CAPM You collected the below information to create a portollo by investing 50% in SEC and the rest in the risk-free rate (SAIBOR), Using the capital asset pricing model (CAPM), calculate the following: (Click on the icon here in order to copy the contents of the data table below into a spreadsheet.) Item Risk-free asset (SAIBOR) Market portfolio (TASI) Rate of return 10% 16% 772% SEC Beta, b 772 222 1.14 a. The beta of the Market Portfolio (TASI) is b. The required rate of return of SEC stock is C. The portfolio beta is (Round to two decimal places.) d. tyou invest 50% in SEC and the rest in the Risk-free rate (SAIBOR), then your portfolio required rate of return is % (Round to two decimal places.) e. The required rate of return for the portfolio using CAPM IS % (Round to two decimal places) Enter your answer in each of the answer boxes

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts