Question: Integrative-Expected return, standard deviation, and coefficient of variation Three assetsF, G, and H-are currently being considered by Perth Industries. The proba- bility distributions of expected

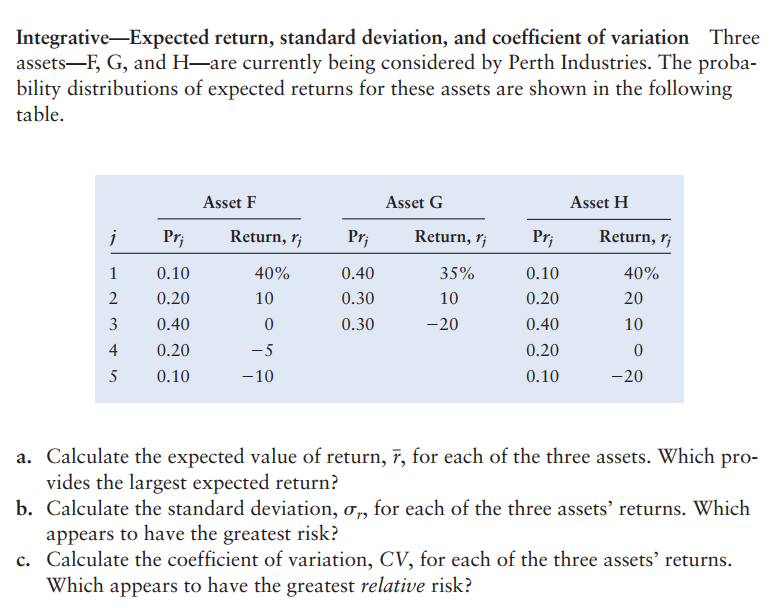

Integrative-Expected return, standard deviation, and coefficient of variation Three assetsF, G, and H-are currently being considered by Perth Industries. The proba- bility distributions of expected returns for these assets are shown in the following table. Asset F Asset G Asset H i Pr; Return, r; Pri Return, li Pr; Return, r; 1 2 0.10 0.20 0.40 40% 10 0.40 0.30 0.30 35% 10 -20 0 3 4 5 0.10 0.20 0.40 0.20 0.10 40% 20 10 0 -20 0.20 -5 0.10 -10 a. Calculate the expected value of return, i, for each of the three assets. Which pro- vides the largest expected return? b. Calculate the standard deviation, or, for each of the three assets' returns. Which appears to have the greatest risk? c. Calculate the coefficient of variation, CV, for each of the three assets' returns. Which appears to have the greatest relative risk

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts