Question: Integrative-Risk, return, and CAPM You collected the below information on Almarai. Using the capital asset pricing model (CAPM) calculate the the following. (Click on the

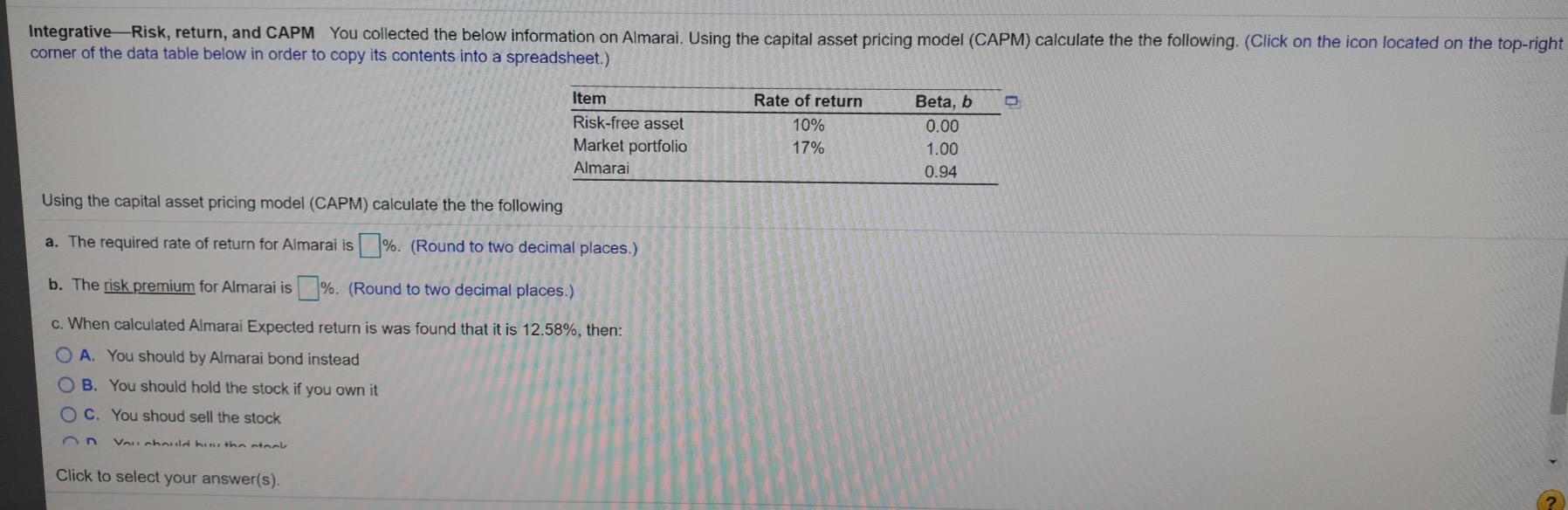

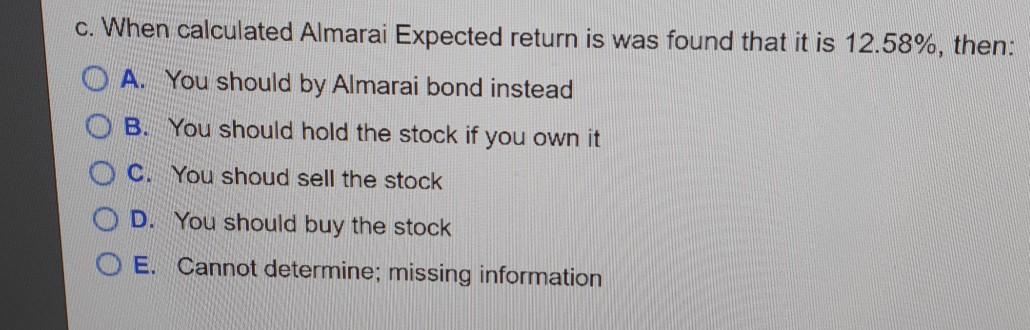

Integrative-Risk, return, and CAPM You collected the below information on Almarai. Using the capital asset pricing model (CAPM) calculate the the following. (Click on the icon located on the top-right corner of the data table below in order to copy its contents into a spreadsheet.) Item Risk-free asset Market portfolio Almarai Rate of return 10% 17% Beta, b 0.00 1.00 0.94 Using the capital asset pricing model (CAPM) calculate the the following a. The required rate of return for Almarai is %. (Round to two decimal places.) b. The risk premium for Almarai is %. (Round to two decimal places.) c. When calculated Almarai Expected return is was found that it is 12.58%, then: O A. You should by Almarai bond instead O B. You should hold the stock if you own it O C. You shoud sell the stock Valahnila hintha atnak Click to select your answer(s). c. When calculated Almarai Expected return is was found that it is 12.58%, then: O A. You should by Almarai bond instead B. You should hold the stock if you own it CYou shoud sell the stock D. You should buy the stock E. Cannot determine; missing information

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts