Question: Intel has determined its optimal capital structure, which is composed of the following sources and target market value proportions: Source of Capital Long-term debt

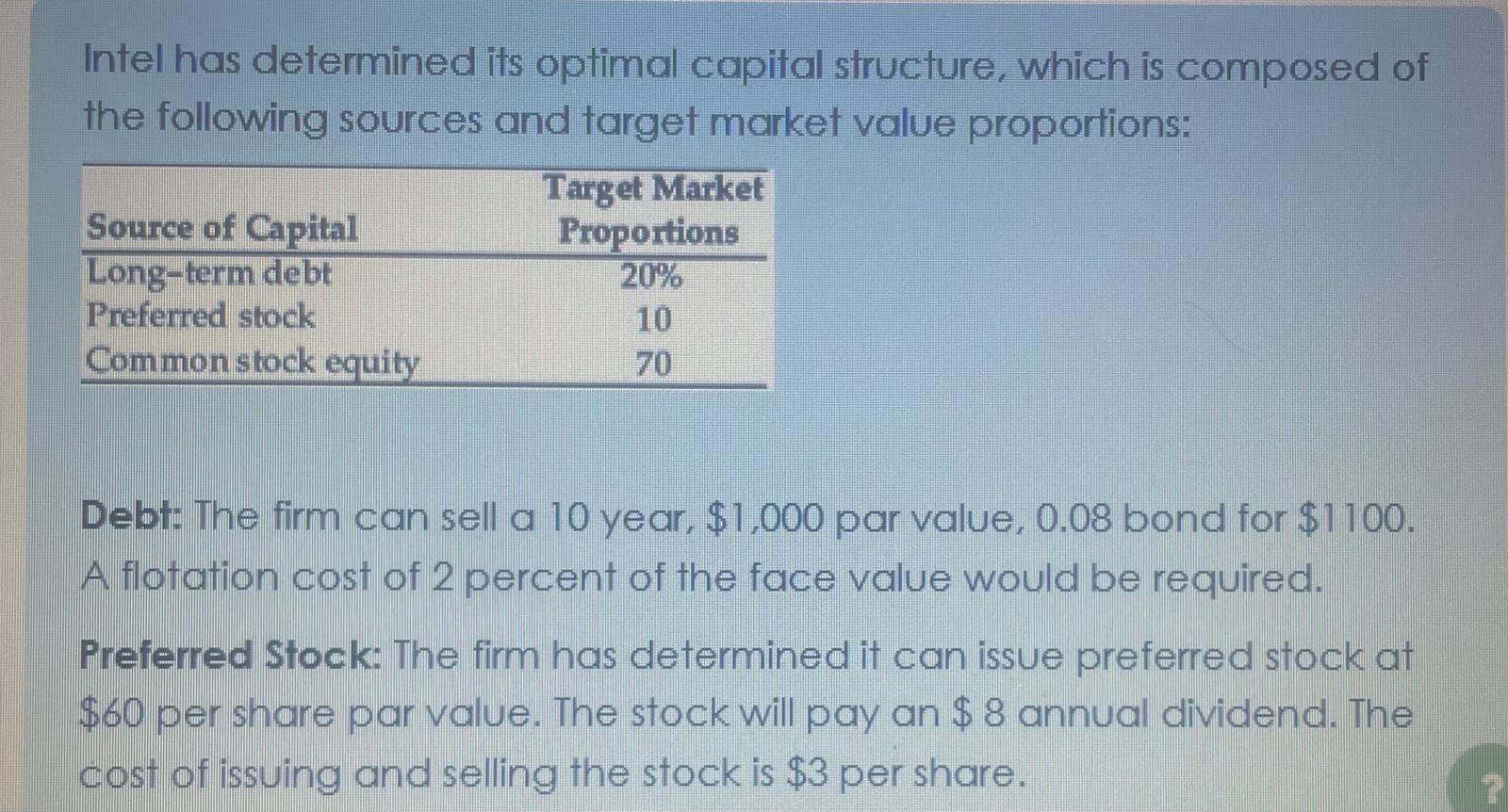

Intel has determined its optimal capital structure, which is composed of the following sources and target market value proportions: Source of Capital Long-term debt Preferred stock Common stock equity Target Market Proportions 20% 10 70 Debt: The firm can sell a 10 year, $1,000 par value, 0.08 bond for $1100. A flotation cost of 2 percent of the face value would be required. Preferred Stock: The firm has determined it can issue preferred stock at $60 per share par value. The stock will pay an $8 annual dividend. The cost of issuing and selling the stock is $3 per share.

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts