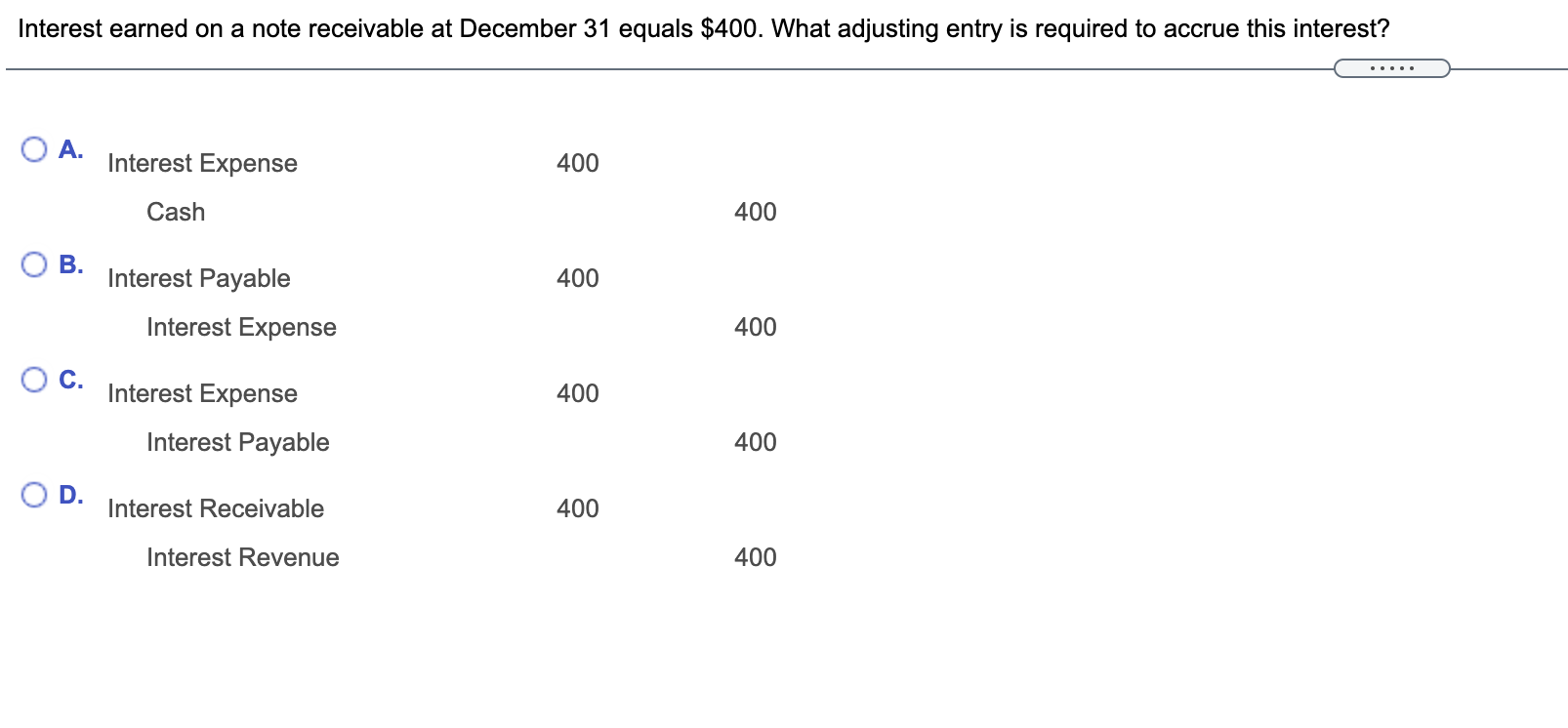

Question: Interest earned on a note receivable at December 31 equals $400. What adjusting entry is required to accrue this interest? O A. Interest Expense 400

Interest earned on a note receivable at December 31 equals $400. What adjusting entry is required to accrue this interest? O A. Interest Expense 400 Cash 400 B. 400 Interest Payable Interest Expense 400 OC. 400 Interest Expense Interest Payable 400 OD. Interest Receivable 400 Interest Revenue 400

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock