Question: Interest expense is often called a fixed expense because it usually does not vary due to short-term changes in sales or other operating activities. While

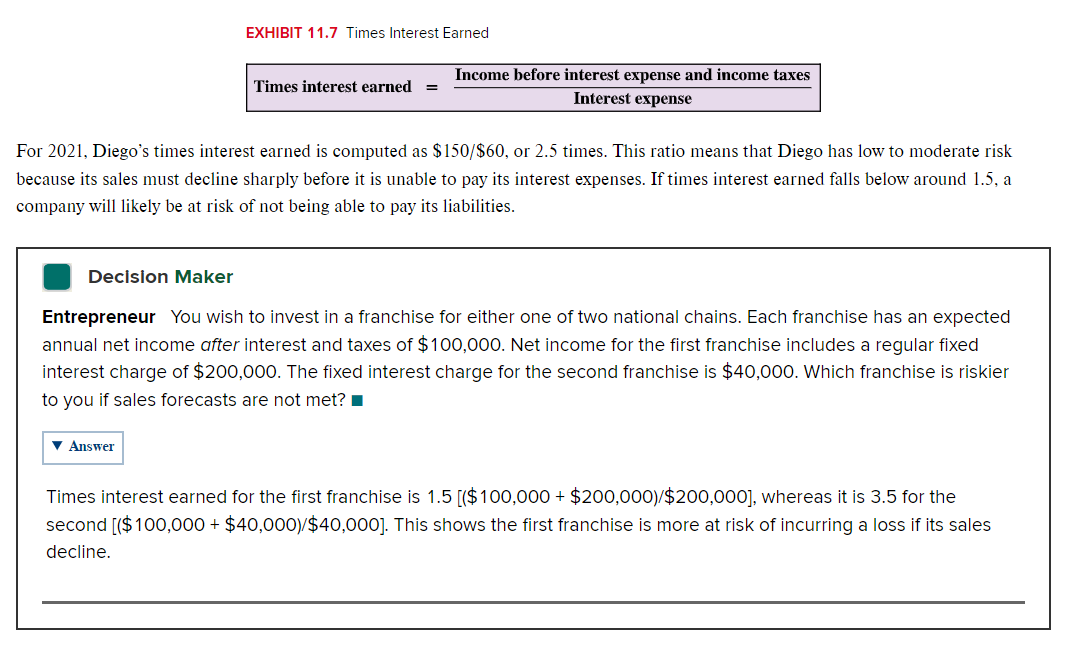

Interest expense is often called a fixed expense because it usually does not vary due to short-term changes in sales or other operating activities. While fixed expenses can be good when a company is growing, they create risk. The risk is that a company might be unable to pay fixed expenses if sales decline. Consider Diego Co.'s results for 2021 and two possible outcomes for year 2022 in Exhibit 11.6. Expenses excluding interest are expected to remain at 75% of sales. Expenses that change with sales volume are variable expenses. Interest expense is fixed at $60 per year. EXHIBIT 11.6 Actual and Projected Results Page404 The Sales Increase column of Exhibit 11.6 shows that Diego's net income increases by 83% to $165 if sales increase by 50% to $900. The Sales Decrease column shows that net income decreases by 83% if sales decline by 50%. These results show that the amount of fixed interest expense affects a company's risk of its ability to pay interest. One measure of "ability to pay" is the times interest earned ratio in Exhibit 11.7. For 2021, Diego's times interest earned is computed as $150/$60, or 2.5 times. This ratio means that Diego has low to moderate risk because its sales must decline sharply before it is unable to pay its interest expenses. If times interest earned falls below around 1.5, a company will likely be at risk of not being able to pay its liabilities. Decision Maker Entrepreneur You wish to invest in a franchise for either one of two national chains. Each franchise has an expected annual net income after interest and taxes of $100,000. Net income for the first franchise includes a regular fixed interest charge of $200,000. The fixed interest charge for the second franchise is $40,000. Which franchise is riskier to you if sales forecasts are not met? Times interest earned for the first franchise is 1.5[($100,000+$200,000)/$200,000], whereas it is 3.5 for the second [($100,000+$40,000)/$40,000]. This shows the first franchise is more at risk of incurring a loss if its sales decline

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts