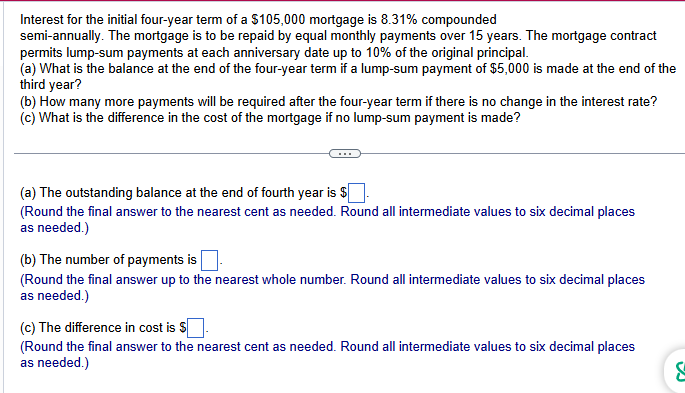

Question: Interest for the initial four - year term of a ( $ 1 0 5 , 0 0 0 ) mortgage is

Interest for the initial fouryear term of a $ mortgage is compounded semiannually. The mortgage is to be repaid by equal monthly payments over years. The mortgage contract permits lumpsum payments at each anniversary date up to of the original principal. a What is the balance at the end of the fouryear term if a lumpsum payment of $ is made at the end of the third year? b How many more payments will be required after the fouryear term if there is no change in the interest rate? c What is the difference in the cost of the mortgage if no lumpsum payment is made? a The outstanding balance at the end of fourth year is $ Round the final answer to the nearest cent as needed. Round all intermediate values to six decimal places as needed.b The number of payments is Round the final answer up to the nearest whole number. Round all intermediate values to six decimal places as needed.c The difference in cost is $ Round the final answer to the nearest cent as needed. Round all intermediate values to six decimal places as needed.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock