Question: Interest rate in this case is 5%. Any help would be greatly appreciated and please provide explanations to each step. I been trying to figure

Interest rate in this case is 5%.

Any help would be greatly appreciated and please provide explanations to each step. I been trying to figure it out for hours but I got nothing.

Thank you in advance!

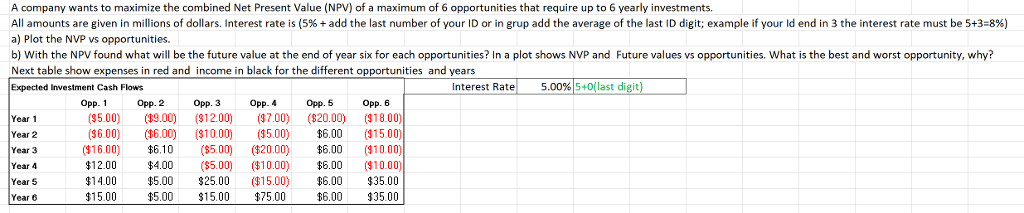

A company wants to maximize the combined Net Present Value (NPV) of a maximum of 6 opportunities that require up to 6 yearly investments All amounts are given in millions of dollars. Interest rate is 5% + add the last number of your ID or in grup add the average of the last ID digit, example if your ld end in 3 the interest rate must be 5+3-8%) a) Plot the NVP vs opportunities. b) With the NPV found what will be the future value at the end of year six for each opportunities? In a plot shows NVP and Future values vs opportunities. What is the best and worst opportunity, why? Next table show expenses in red and income in black for the different opportunities and years Expected Investment Cash Flows Interest Rate 5.00%5+0(last digit) Opp. 1 Opp. 2 Opp. 3 Opp.4 Opp. 5 Opp. 6 Year 1 Year 2 Year 3 Year 4 Year 5 Year 6 (35.00) 9.00) (12.00)7.00) ($20.00) 18.00) ($6.00) ($6.00) ($10.00) ($5.00) $6.00 ($1500) $16.00)$.10 ($5.00) ($20.00)$6.00 ($10.00) 1200 $4.00 ($5.00) ($10.00) $6.00 ($10.00) 1400 $5.00$25.00 ($15.00) $6.00 35.00 $6.00 $35.00 $15.00 $5.00 $15.00 $75.00

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts