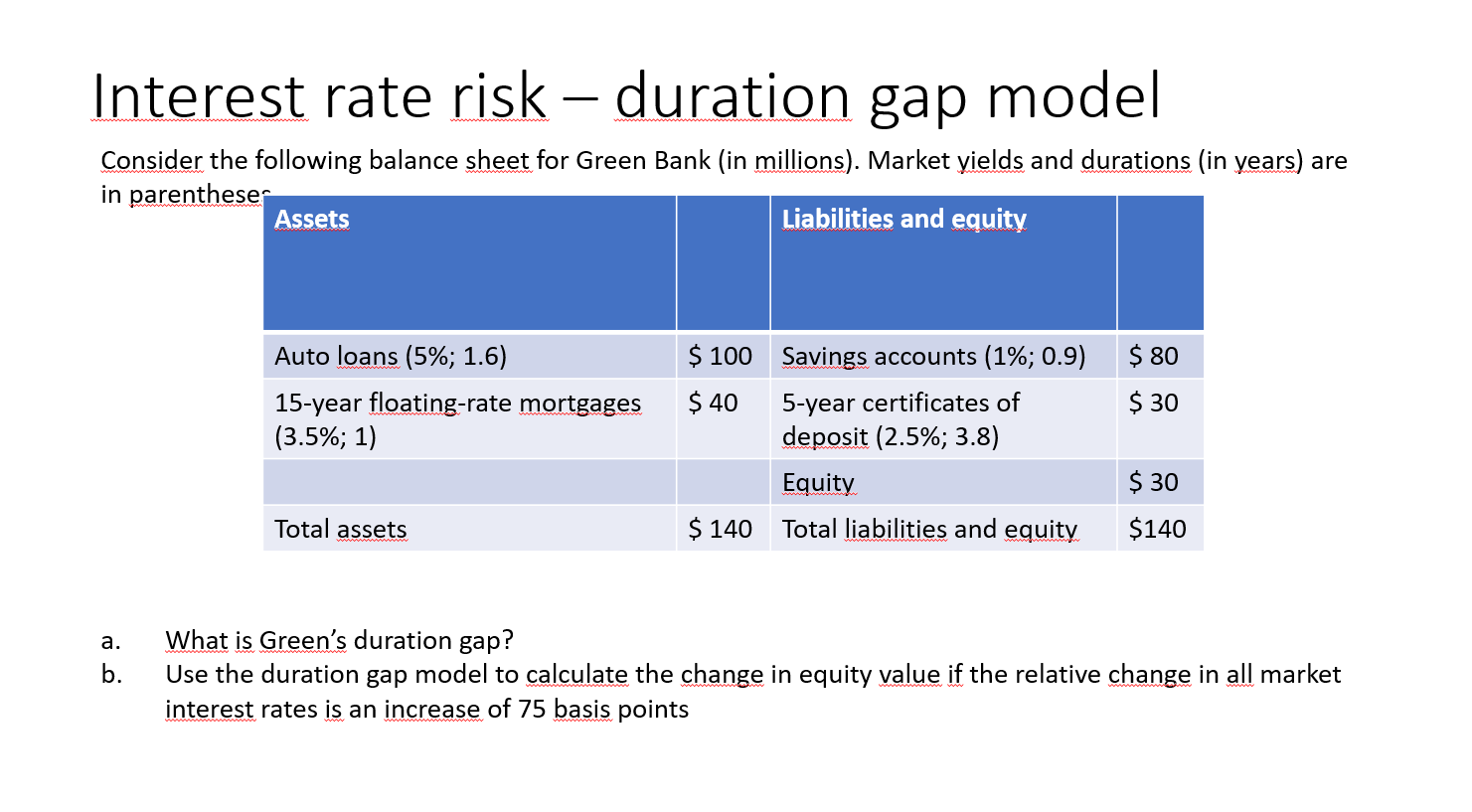

Question: Interest rate risk duration gap model - Consider the following balance sheet for Green Bank (in millions). Market yields and durations (in years) are

Interest rate risk duration gap model - Consider the following balance sheet for Green Bank (in millions). Market yields and durations (in years) are in parenthese Assets Liabilities and equity Auto loans (5%; 1.6) $ 100 Savings accounts (1%; 0.9) $ 80 15-year floating-rate mortgages (3.5%; 1) $ 40 5-year certificates of $ 30 deposit (2.5%; 3.8) Equity $ 30 Total assets $ 140 Total liabilities and equity $140 a. What is Green's duration gap? b. Use the duration gap model to calculate the change in equity value if the relative change in all market interest rates is an increase of 75 basis points

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts