Question: Interest rate risk-Excel $ Sign In DATA REVIEW VIEW FILE FORMULAS INSERT HOME PAGE LAYOUT Calibri 11 Cells Paste BLU- AA A. Alignment Number Conditional

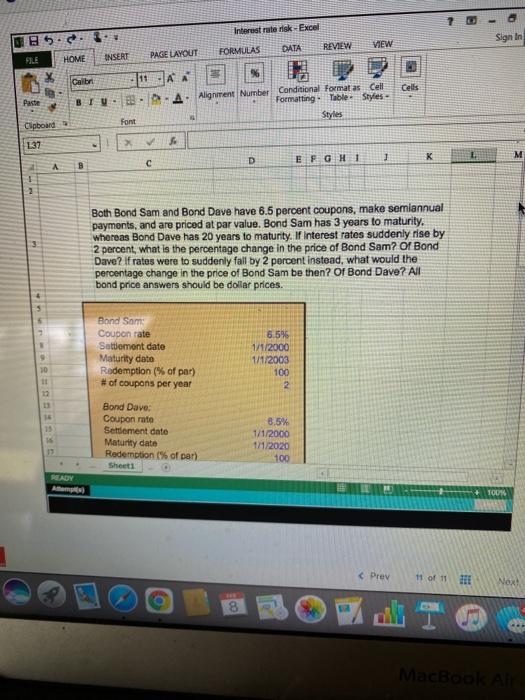

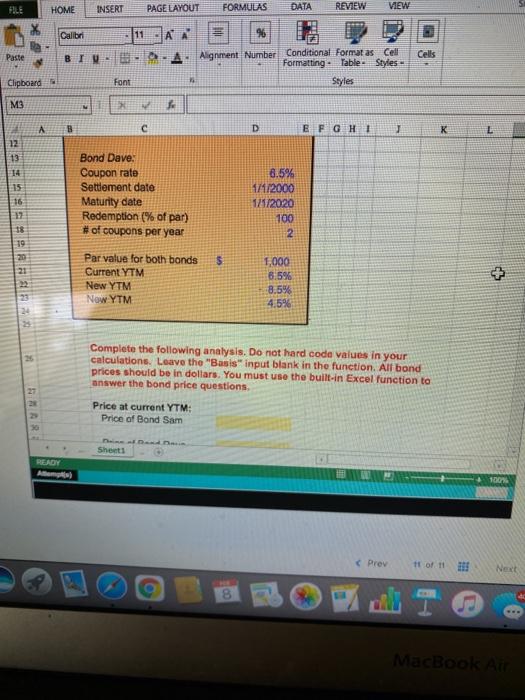

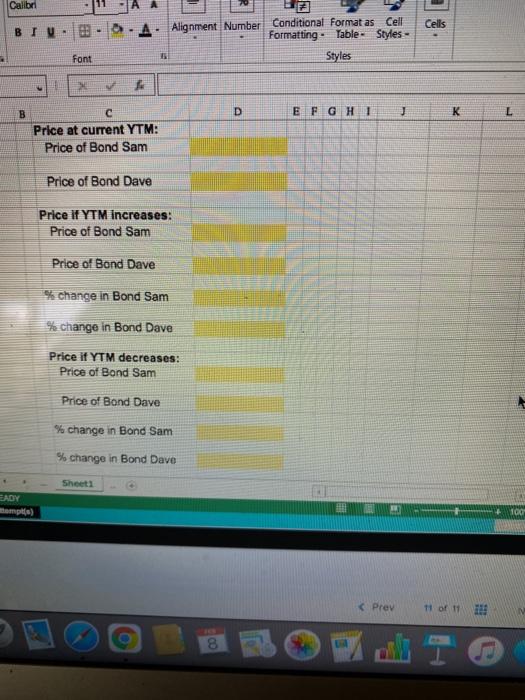

Interest rate risk-Excel $ Sign In DATA REVIEW VIEW FILE FORMULAS INSERT HOME PAGE LAYOUT Calibri 11 Cells Paste BLU- AA A. Alignment Number Conditional Format as Cell Formatting Table Styles - Styles font Clipboard L37 1 K M D E F G H 1 A B 2 Both Bond Sam and Bond Dave have 6.5 percent coupons, make semiannual payments, and are priced at par value. Bond Sam has 3 years to maturity. whereas Bond Dave has 20 years to maturity. If Interest rates suddenly rise by 2 percent, what is the percentage change in the price of Bond Sam? Of Bond Dave? If rates were to suddenly fall by 2 percent instead, what would the percentage change in the price of Bond Sam be then? Of Bond Dave? All bond price answers should be dollar prices. 9 10 11 Bond Sam Coupon rate Settlement date Maturity dato Redemption (% of par) # of coupons per year 6.5% 1/1/2000 1/1/2003 100 2 Bond Dave: Coupon rate Settlement date Maturity date Redemption (% of part Sheet1 8,5% 1/1/2000 1/1/2020 100 SEADY + TOD

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts